- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

The entries show on my side as imported from QuickBooks. I know you said you did not import QuickBooks, but had you last year? Perhaps that carried over to this year.

The estimated payments are not listed on your state return. The payments are listed on the MCTMT worksheet. The total tax paid is on IT-203 line 66.

When you open the NY state return section, you should see "You Just Finished Your New York Return"

Click UPDATE for "Credit and Other Taxes"

The program may ask about the START credit, continue

Scroll down to "Metropolitan Commuter Transportation Mobility Tax"

Continue to the "Your MCTMT Payments"

Do you want to work on the MCTMT? YES

Allocate the income on the next screen, but I don't think it will matter since your income is below the threshold

Continue to the "Your MCTMT Payments" screen

Your return shows the four payments all dated 2/15/2025

If they were not made, please delete or edit them on this screen

No estimated MCTMT payments results in a NY refund of 1,002 which is 301 less than the 1,303 it started at.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

To clarify, did you perhaps have a 2023 state refund of 301 applied to 2024?

Did you have 301 state withholding?

Any reason you sent an odd number of 1249 as an estimated payment?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

@KrisD15 Thank you.

- No state refund applied from 2023

- No tax state tax withholding, all NY income is 1099

- The $1249 is a the exact payment amount I made to NY State as an estimated payment for the 1st quarter of 2024

I'm stumped, I don't know where the extra 301 is coming from.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

Are you using TurboTax Desktop or Online?

Can you return and look at the Estimated Tax Payment Summary?

Federal

Deductions & Credits

Estimates and Other Taxes Paid

Estimates UPDATE or Start

State estimated taxes for 2024 UPDATE or Start

Is the 1,249 listed for the first quarter payment?

Click CONTINUE

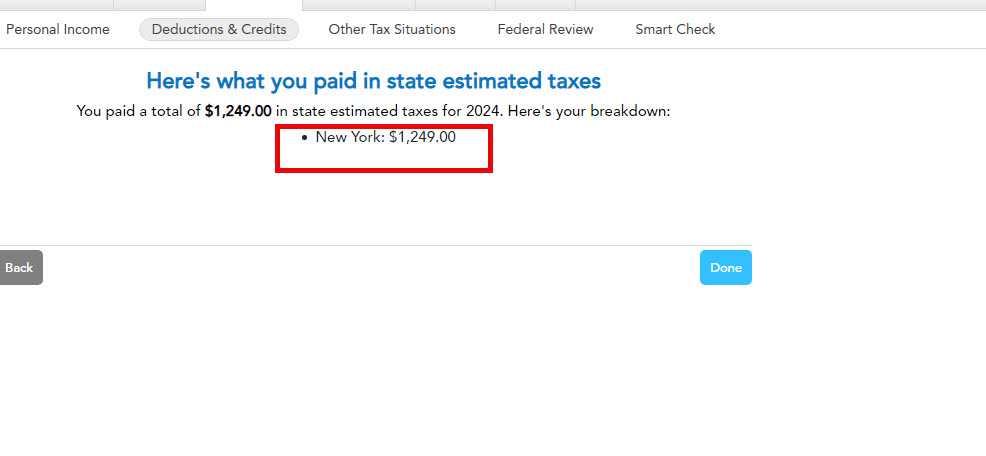

Does 1,249 show on the "Here's what you paid in state estimated taxes" screen?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

Would you care for us to look at a "sanitized copy" of the return?

If yes, we get a copy of the tax file with only numbers to look for the issue, there is no personal data transmitted.

You would follow the directions below and then enter the token number in the Thread with @KrisD15 in the text. I get an alert and look at the copy. No one outside of Intuit can open the file, and as I said, the file only contains numbers. No addresses or other personal identifying information.

"I would like to take a deeper look at this. However, I need a diagnostic file which is a copy of your tax return that has all of your personal information removed.

You can send one to us by following the directions below:

TurboTax Online:

Sign into your online account.

Locate the Tax Tools on the left-hand side of the screen.

A drop-down will appear. Select Tools

On the pop-up screen, click on “Share my file with agent.”

This will generate a message that a diagnostic file gets sanitized and transmitted to us.

Please provide the Token Number that was generated in the response.

TurboTax Desktop/Download Versions:

Open your return.

Click the Online tab in the black bar across the top of TurboTax and select “Send Tax File to Agent” *

This will generate a message that a diagnostic copy will be created. Click on OK and the tax file will be sanitized and transmitted to us.

Please provide the Token Number (including the dash) that was generated in the response.

*(If using a MAC, go to the menu at the top of the screen, select Help, then, “Send Tax File to Agent”)"

Thank you

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

@KrisD15 Sent agent copy: 1277684

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

Received, thank you.

It shows you paid $301 MCTMT Payments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

Thanks @KrisD15 can you tell me where this is entered on the website?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

Yes.

It was entered via QuickBooks

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

@KrisD15 Thanks, I meant what lines are you referring to on the tax return that equal $301. I didn't import anything from quickbooks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

The entries show on my side as imported from QuickBooks. I know you said you did not import QuickBooks, but had you last year? Perhaps that carried over to this year.

The estimated payments are not listed on your state return. The payments are listed on the MCTMT worksheet. The total tax paid is on IT-203 line 66.

When you open the NY state return section, you should see "You Just Finished Your New York Return"

Click UPDATE for "Credit and Other Taxes"

The program may ask about the START credit, continue

Scroll down to "Metropolitan Commuter Transportation Mobility Tax"

Continue to the "Your MCTMT Payments"

Do you want to work on the MCTMT? YES

Allocate the income on the next screen, but I don't think it will matter since your income is below the threshold

Continue to the "Your MCTMT Payments" screen

Your return shows the four payments all dated 2/15/2025

If they were not made, please delete or edit them on this screen

No estimated MCTMT payments results in a NY refund of 1,002 which is 301 less than the 1,303 it started at.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I entered an estimated tax payment on my 2024 NY State Taxes of $1249 but the NY Summary and tax return says $1550.

Thank you so much @KrisD15 , much appreciated!👍

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kiwi

Returning Member

dkatz71

New Member

Omar80

Level 3

black1761

Level 1

bill Pohl

Returning Member