- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

Upon review of your token, it appears you have not entered anything for Child and Dependent Care expenses in the federal interview section, but you do have amounts reflected under your W-2 Form, box 10 for Dependent care benefits. Therefore, you also need to complete the expense section of the program to rectify the state e-file error and file a complete Schedule X.

To do this, follow the steps in how do I get to the Child and Dependent Care Credit in TurboTax to enter the information for this credit. Proceed through the screens and enter the information as prompted.

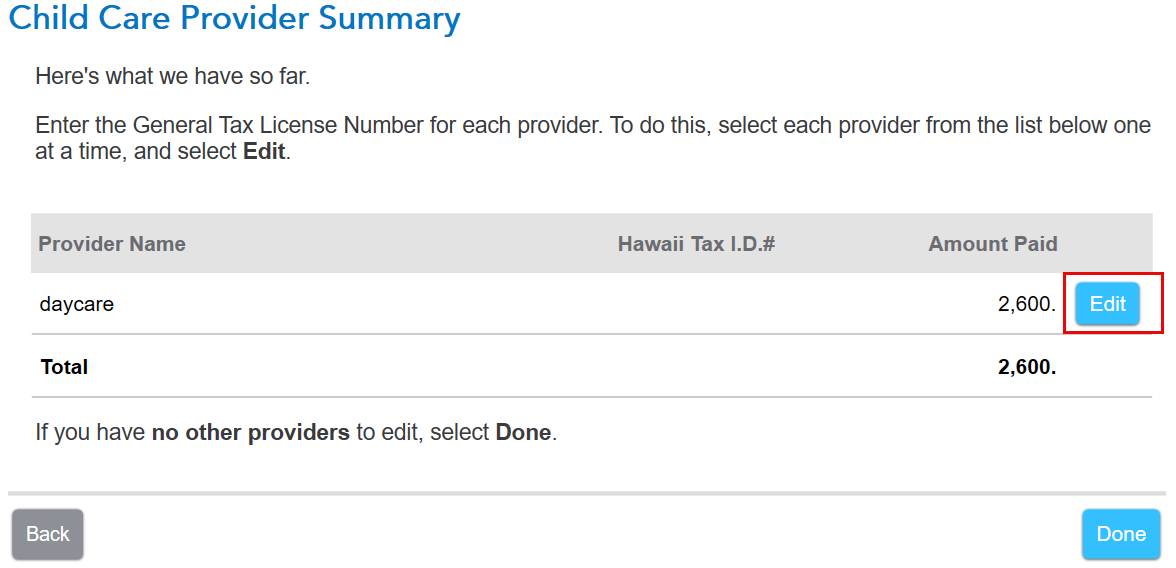

Once you have completed your entries, go to the state interview section again. Proceed through the screens. When you see the screen titled "Child Care Provider Summary," select edit.

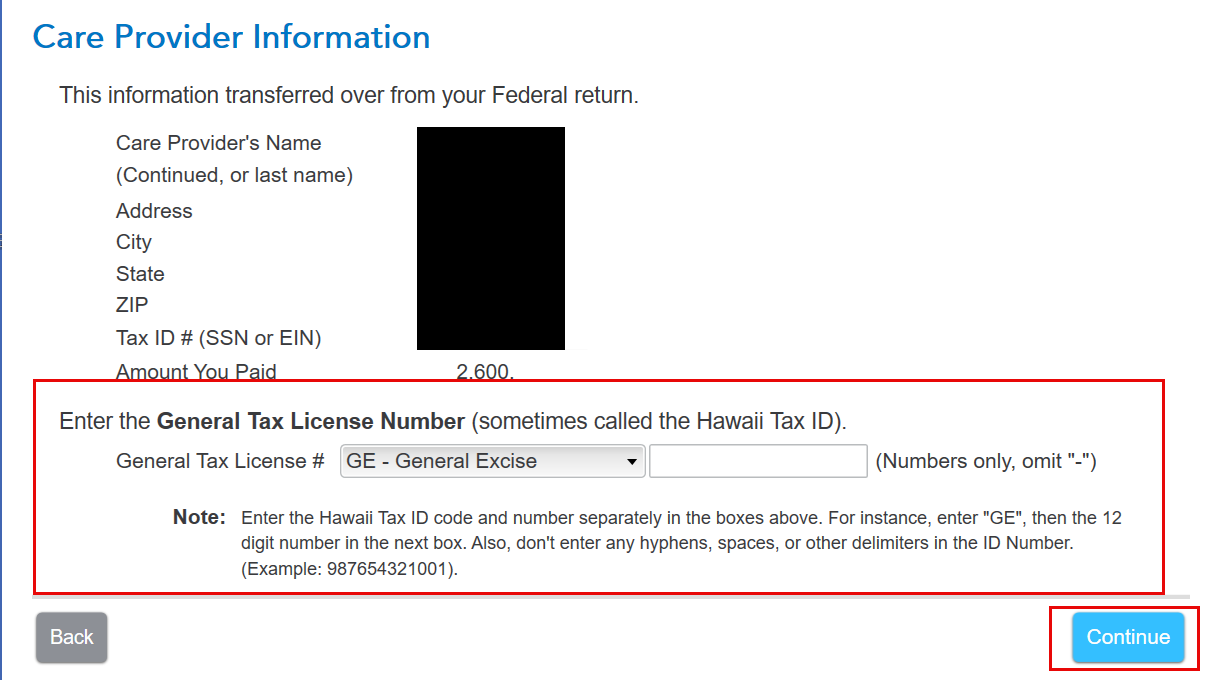

This will take you to a screen titled "Care Provider information." Please enter the General Tax License # as prompted on this screen and select continue.

Proceed through the remaining screens and answer the questions as prompted.

Once you have completed this and the rest of the state interview questions, the error message during the final review should go away and allow you to electronically file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

Thank you. That makes sense. However, the flexible spending account, from payroll deduction, was spread over the course of a year. So from July 1-December 31 2023; Jan 1-June 30, 2024. However, all dependent care funds were paid out of pocket, lump sump, in 2023. No spending was done in 2024. Any thoughts? Put $1.00?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

It depends.

IRS Publication 503 states that if you "pay for services before they are provided, you can count the prepaid expenses only in the year the care is received." Therefore, you would be able to include the expenses from January 1 - June 30, 2024 on your 2024 income tax return.

But if you claimed any of the 2024 expenses on your 2023 tax return, you may need to amend your prior year return as well to remove the expenses that were claimed in 2023 as they need to be reported on your 2024 tax return instead.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

Thanks. So the funds were for Preschool. The Preschool charged a penalty for paying monthly. So if you made two lump sum payments, you dont have the penalty. Thats what we did.

The 23-24 school year, one payment was made in July 2023 and another in December 2023. I was advised to put it on the 2023 returns since payments were made in 2023.

The dependent care funds, via a FSA, had no choice but to take out evenly (26 payments) from July 1-2023, June 30 2024. Therefore, the 2024 return shows half of dependent funds (Jan 1-June 30 2024).

Any advice as to what to do, moving forward? I did pay a total of $25 in 2024, due to fees.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

I submitted my form, token is

10 06 81 83 60-71663771

I had to insert spaces because the forum thought I was writing a phone number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

Unfortunately, I'm having issues retrieving the token number. If you'd like, try posting your token number again.

You can also refer to my reply to the prior poster on this thread and see if that might be your issue as well.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

Thank you. Are you able to relook at this and see how I can file the state return electronically?

Token:

9059978163775811-44244245

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

I think they need to make a fix to these forums, your own ticket numbers get flagged as phone numbers.

You have to take out all the spaces in this:

100 681 83 60-71663771

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

here's another attempt:

138

410

922

5

-34922213

I've also tried the other solution, but that doesn't apply to me. All of the fields are filled in. TurboTax isn't prompting me to fill in any missing information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

You will not be able to file electronically based upon the information you provided. As mentioned earlier, your best option is to amend your 2023 tax return to remove the amounts applicable to 2024 and utilize those expenses and correctly prepare your 2024 tax returns. As the deadline is closer, you can opt to extend your tax return, amend the 2023 tax returns, and then you will be able to electronically file your 2024 tax return incorporating the childcare expenses attributable to 2024.

Cableguy316, you also do not have anything entered for your Child and Dependent Care expenses. Please see my earlier post in this thread from April 7th for the steps you'll need to take to generate Schedule X correctly. If you have the expenses, then Schedule X will prompt you for more information and and if you meet the criteria, it will allow you to electronically file your Hawaii return.

Helpmedesktopuser, I've tried to download your diagnostic file and am not able to access it. But I suggest looking at my prior suggestions in this thread from April 7th and following the steps as this seems to be the issue on the diagnostic copies I have looked at. If you have a W-2 form with dependent care benefits in box 10, you also need to complete the Child and Dependent Care expenses section. This will then flow into your state return where you will need to answer questions to generate Schedule X.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

Thank you, I appreciate it.

1. In regards to amending: is that something I can do via TurboTax easily, get a Turbo Tax live agent, or find a tax rep? I paid 17,445 in Pre-K tuition last year, should I split the difference?

2. In regards to extension: is that something I can do via TurboTax easily, get a Turbo Tax live agent, or find a tax rep?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

1. We are glad to help. See How do I amend my federal tax return for a prior year? to get into last year's return. See also I need to amend my state return. You want to claim 2023 child care expenses in 2023 and the 2024 amount in 2024.

2. Extension:

- How do I file an IRS extension (Form 4868) in TurboTax Online?

- Do I need to file an extension for my personal state taxes?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

Hi, I'm looking for a solution as well. Using web version so it should be up to date. Tried removing Schedule X in forms but ends up generating when I enter information again such as State Tax ID.

Please help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

I forgot to include my token #

130 33 93

@JotikaT2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hawaii - "Returns with a Schedule X showing taxable benefits are not eligible for electronic filing"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jackkgan

Level 5

jbutlet950

New Member

tjmgator

New Member

Jmar45

New Member

Portland2416

New Member