- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Upon review of your token, it appears you have not entered anything for Child and Dependent Care expenses in the federal interview section, but you do have amounts reflected under your W-2 Form, box 10 for Dependent care benefits. Therefore, you also need to complete the expense section of the program to rectify the state e-file error and file a complete Schedule X.

To do this, follow the steps in how do I get to the Child and Dependent Care Credit in TurboTax to enter the information for this credit. Proceed through the screens and enter the information as prompted.

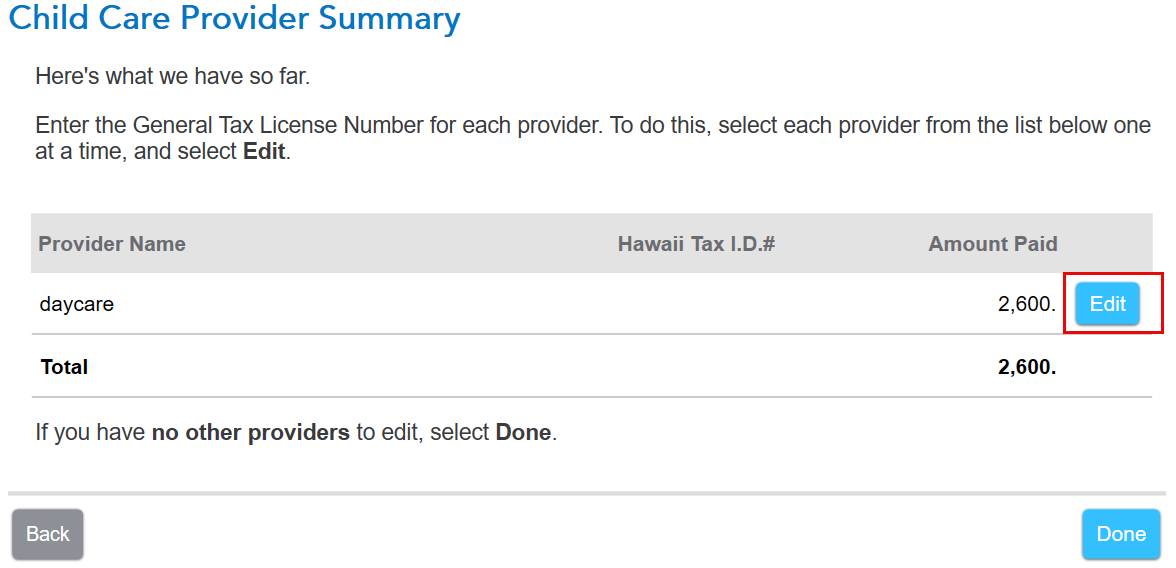

Once you have completed your entries, go to the state interview section again. Proceed through the screens. When you see the screen titled "Child Care Provider Summary," select edit.

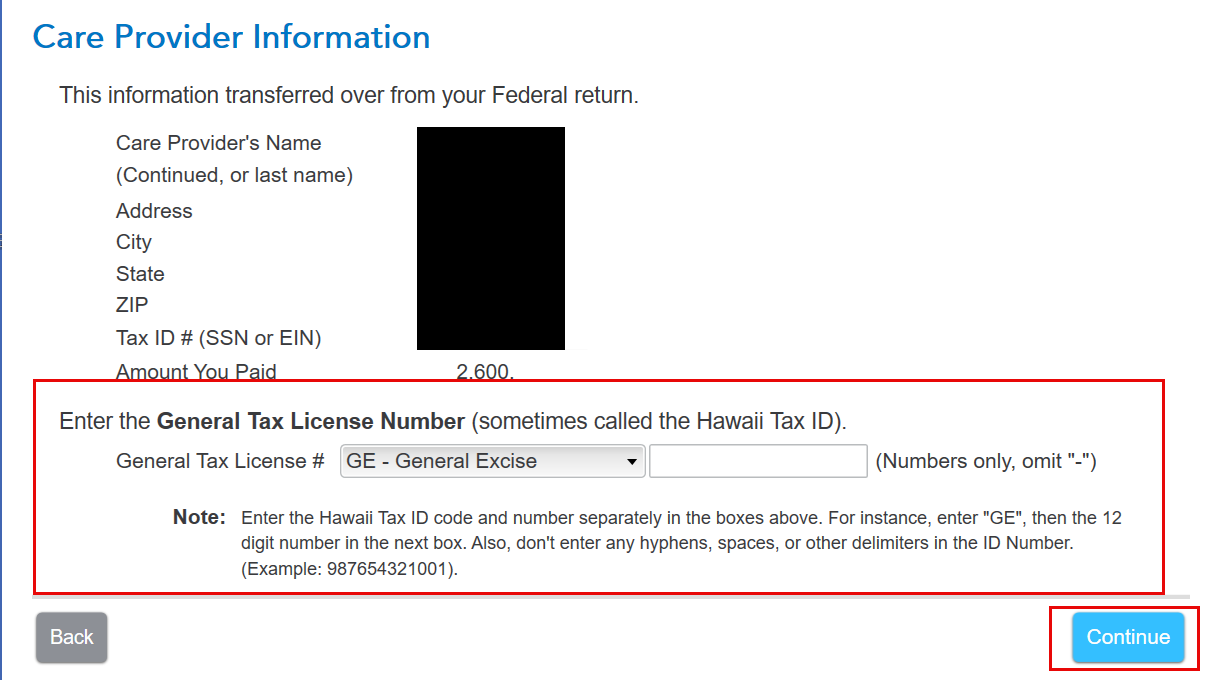

This will take you to a screen titled "Care Provider information." Please enter the General Tax License # as prompted on this screen and select continue.

Proceed through the remaining screens and answer the questions as prompted.

Once you have completed this and the rest of the state interview questions, the error message during the final review should go away and allow you to electronically file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"