- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Got 1099MISC for royalties from an investment in a company. I am neither self-employed or own property. How do I report this as just income with nothing else involved?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got 1099MISC for royalties from an investment in a company. I am neither self-employed or own property. How do I report this as just income with nothing else involved?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got 1099MISC for royalties from an investment in a company. I am neither self-employed or own property. How do I report this as just income with nothing else involved?

Here is how to enter this in TurboTax:

- Login and continue your return.

- Select Federal from the left side menu.

- On the Income & Expenses summary, look for Rental Properties and Royalties (Sch E), click Edit/ Add to the right.

What are you here to report?

Have more than one? You can start with any category. We'll add the rest later.

Rental property

Real estate leased or rented out to others

Royalty

Oil, gas, minerals or copyrights or patents

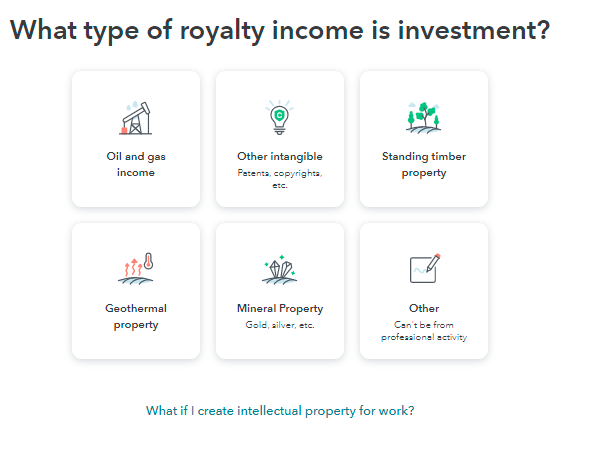

Add the name "Investment". If you click continue, the program says to enter your own address. Then you can choose the type.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got 1099MISC for royalties from an investment in a company. I am neither self-employed or own property. How do I report this as just income with nothing else involved?

Thank you. So under the royalty info, I just add a nickname for it, then put my own address as the "general info" address of the royalty? I'm not seeing anywhere specific where it tells you to do that. But I have labeled it as "other intangible".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got 1099MISC for royalties from an investment in a company. I am neither self-employed or own property. How do I report this as just income with nothing else involved?

Yes. For the Information on the royalty, you can write a detailed description or name it Royalty from Investment.

If reporting royalty income, the IRS instructions say address lines 1 and 2 can be left blank, but TurboTax may not let you continue without an address. If so, you can use the address of the company which pays your royalties (as shown on your 1099-MISC form) or you can use your own address.

Since the IRS is not expecting an address, you can choose between the two options listed above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17522839879

New Member

jhinstorff

New Member

rathna-gopu

New Member

psow

New Member

taberflyer

New Member