- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Form 8949

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949

Using TurboTax Business, I prepare Investment Income. When I enter the fields from my 1099-B related to "Short Term with cost basis reported to IRS", and I include "Accrued Market Discount", it seems that TurboTax adds the difference between Proceeds and Basis with the figure for "Accrued Market Discount", essentially counting the "Accrued Market Discount" twice when computing total income. Then, on the 8949 form, column 1f is blank (i.e. no code is provided), even when there is a figure in 1g. To summary, the "Accrued Market Discount" amount seems to be counted twice when determining total income and the "1f" column on the 8949 form is left blank. Both of these seem to be errors in TurboTax.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949

In which module in TurboTax Business are you working?

I did a quick test in the 1041 (trust/estate) module and the 8949 appeared to be correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949

I am not sure how to answer your question regarding "section", but if I look at the screen, I see that I am in Federal Taxes, Income, Edit Box A Sales. When I complete this section, including entering "Accrued Market Discount" and then look at the 8949 Form that is produced, I see column 1F is blank and there are amounts in column 1G. Also, at the bottom of the "Edit Box A Sales" screen, if I select "Continue" and I go to the "Summary for this Account" screen, the "Net Gain/Loss" figure includes the total for the columns labelled "1F" on the "Edit Box A Sales" screen. If on that screen, I compute the difference between "1d" and "1e", this seems to me to be what should be reported as income, but the figure on "Summary for this account" screen includes the "1g" value. All I actually earned from the transaction is the difference between selling price and cost, so to me, including "1g" is including more income than should be include.

Thanks for responding to my inquiry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949

What I meant by "module" was the type of return (e.g., 1041, 1065, 1120-S). I presume you are preparing a 1041 for an estate or trust.

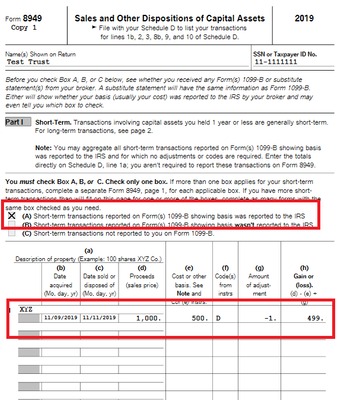

Below is a screenshot from a test return that I took of my test 8949 in Forms Mode. Perhaps you can compare that to what you are seeing on your 8949.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949

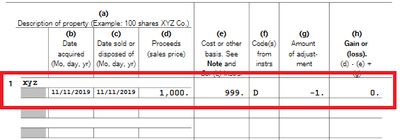

Below is a screenshot of the TurboTax entry screen. One of the entries that is causing a problem is line #2. As you can see, the sale was for $1,000.00 the cost basis was $998.52 and the accrued market discount was $1.48. On the 1099-B received from Merrill Lynch, this showed correctly as no gain. The second screen shot is for the 8949 that TurboTax generated and (I know it's hard to read) you can see for this entry (the second one in the table), TurboTax is showing a gain of $1. There are other places where entries with accrued market discount are similarly mishandled.

First screenshot

Sigh.......... I was not able to post the screenshots...

The first screenshot showed the boxes 1d, 1e, 1f, and 1g, with the following values: 1,000.00, 998.52, 1.48, 0.00

The equivalent line on the generated 8949 shows columns d, e, f, and h, with the following values: 1,000, 999, blank, blank, 1. The last column (h) indicates that profit of $1 was made on the transaction, when in fact there was no profit.

Sorry I could not post the screenshots. They really do show this problem much better than I can describe it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949

@edda wrote:The equivalent line on the generated 8949 shows columns d, e, f, and h, with the following values: 1,000, 999, blank, blank, 1. The last column (h) indicates that profit of $1 was made on the transaction, when in fact there was no profit.

So, you are seeing something different on Form 8949 than what appears in the screenshot below? I used your figures to generate the screenshot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949

Yes. I am seeing

1,000 999 blank blank 1.

where you are seeing

1,000 999 D -1 0.

Where you see a "D", I see a blank space. Where you see a -1, I see a blank space, and where you see a 0, I see a 1.

I have all the latest updates on TurboTax for Business, so I don't get it....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949

@edda wrote:I have all the latest updates on TurboTax for Business, so I don't get it....

Neither do I, but Support (link below) can provide further troubleshooting. Just so we are clear, you are preparing a Form 1041 for a trust or estate, correct?

https://ttlc.intuit.com/community/using-turbotax/help/what-is-the-turbotax-phone-number/00/25632

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949

That is correct. I am preparing a 1041 for a Trust.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949

FYI

I just now tried this same transaction (processing a 1099-B) using TurboTax Premier, instead of TurboTax Business. Premier processes it correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949

You have seen my results, so I have no idea what is occurring with your input (actually, output).

I cannot imagine why you would not see the same results with the same software working on the same type of return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949

I spoke with a TurboTax support person just now. They really did not have an explanation, but they asked me to delete the entries that were not being processed correctly and re-enter them. To make a long story short, that fixed my problem. I have no idea why they were incorrectly processed in the first place. The exact same software, the exact same keystrokes, etc. But now it is correct - mostly, anyway. The thing that is still incorrect is the following: On the "Summary for this Account" screen, under the "Net Gain/Loss" column heading, the figure is still wrong, and it does not match the figure on the 8949, which is right. I believe I have seen this before, where TurboTax screens sometimes show values that are different from what is on the IRS form. I have never reported the problem, and I've already had more "fun" with this than I want, so I think I am finished.

Thank you for taking the time to respond to my inquiry. I am generally not happy with the support response to "try it again", but this time it worked. I have also seen times when TurboTax, at the end where it supposedly checks everything, reports no problems, but then if you go back in to the file to do something that perhaps you forgot and then you re-run the "check everything", it finds something that was there earlier, and I wonder why it did not catch it before. All things considered, it is still better than doing it by hand, but it is not perfect.

Sigh...................

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

dsmith48302

New Member

GonaFishin

New Member

sandrawa

Level 2

cerega

Level 3

apandey1

New Member