I've got very small Sch C Income that has large carryover losses each year and Turbotax is calculating the correct net loss which includes the 2023 carryover loss.

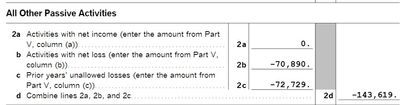

The issue is that on form 8582 it's showing the losses from 2024 on line 2b which include the 2023 carryover listed on 2C and adding those together on line 2d effective double-counting my carryover losses.

It seems this was an issue going year back that i never noticed in my previous year TT filings. I just found this community post from 2022 with the same issue that seems unresolved.

https://ttlc.intuit.com/community/taxes/discussion/bug-error-calculating-carry-over-loss-on-form-858...

How can i fix this so I can property file? This is also flowing down to my Massachusetts state return.