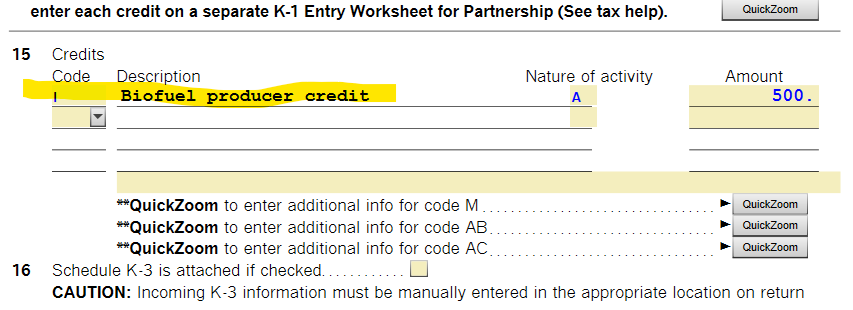

Form 3468 is used to report investment credits, which are credits businesses can receive for investing in certain types of property, such as energy equipment. It can stem from an entry on a schedule K-1, for instance on line 15 of a partnership schedule K-1:

I suggest you scrutinize your K-1 schedule to see if there are any credits listed and if so, read the supplemental information included with the schedule K-1 to see if that can provide you with the information you need to enter on form 3468.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"