- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- form 1099-K incorrect

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1099-K incorrect

PayPal sent me an incorrect 1099-K. They refuse to correct and state I must deal through a tax professional. I spoke to a support person and a supervisor at PayPal and got the same answer.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1099-K incorrect

If you have received a Form 1099-K which contains errors or has amounts that are not income and not self-employment, you should enter the Form 1099-K as it is received the Other Common Income section, so that it matches what was reported to the IRS.

If the form was for business or for sales of personal items, it will be entered elsewhere, so please give us details if this is the case.

In addition, make an adjustment to show the negative amount which should be subtracted.

For instance:

1099-K personal transactions $ -100

1099-K sale of personal items at loss $ -200

To enter this, go to:

- Wages and Income

- Scroll down to Less Common Income and select Show More

- Scroll down to the last entry and select Start or Review for Miscellaneous Income, 1099-A, 1099-C

- Scroll to the last entry, Other reportable income and click on Start

- Any Other Taxable Income? Select Yes

- Then enter 1099-K, the reason for the adjustment, and the amount, as below, and Continue

This adjustment entry will appear on the return on Form 1040, Schedule 1 Part II – Line 24z, Other Adjustments, which follows the directions from the IRS on their website. See Question 8 for an example.

It should show like this on your Schedule 1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1099-K incorrect

After testing the steps myself, everything appears to be working correctly. Just be sure to read the descriptions on the screen carefully and be aware that most of the choices you will make are at the bottom of the screen so you will need to keep scrolling to find the correct section.

The steps provided by experts TeresaM and ThomasM125 will work in TurboTax Online Self-Employed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1099-K incorrect

If you have received a Form 1099-K which contains errors or has amounts that are not income and not self-employment, you should enter the Form 1099-K as it is received the Other Common Income section, so that it matches what was reported to the IRS.

If the form was for business or for sales of personal items, it will be entered elsewhere, so please give us details if this is the case.

In addition, make an adjustment to show the negative amount which should be subtracted.

For instance:

1099-K personal transactions $ -100

1099-K sale of personal items at loss $ -200

To enter this, go to:

- Wages and Income

- Scroll down to Less Common Income and select Show More

- Scroll down to the last entry and select Start or Review for Miscellaneous Income, 1099-A, 1099-C

- Scroll to the last entry, Other reportable income and click on Start

- Any Other Taxable Income? Select Yes

- Then enter 1099-K, the reason for the adjustment, and the amount, as below, and Continue

This adjustment entry will appear on the return on Form 1040, Schedule 1 Part II – Line 24z, Other Adjustments, which follows the directions from the IRS on their website. See Question 8 for an example.

It should show like this on your Schedule 1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1099-K incorrect

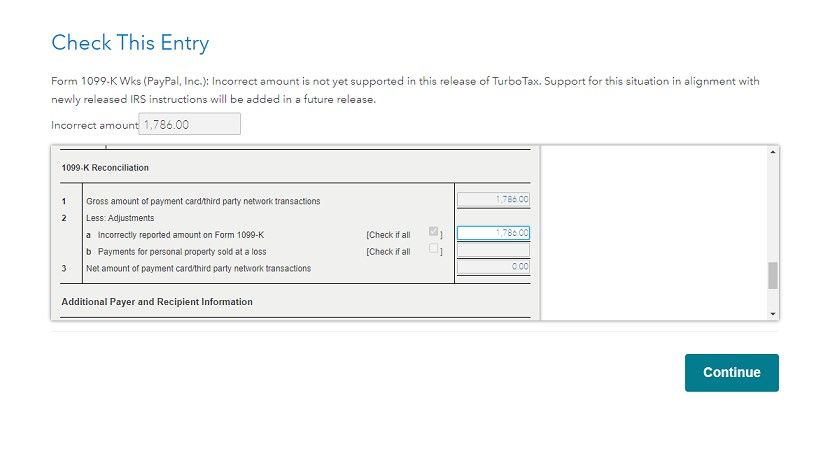

TurboTax cannot handle your solution currently. See this:

Further TurboTax support has no ETA for this. Therefore, I cannot file my taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1099-K incorrect

The solution offered by @TeresaM of entering a negative adjustment to income would be the correct solution. TurboTax may come up with a more expeditious way of entering it in the program, but the results will likely be the same. So, you can enter a negative adjustment to income to cancel out the income entered from your 1099-K as follows:

- Choose the Federal option on your left menu bar

- Choose Wages & Income

- Find Less Common Income in the list of income sources

- Use the Show More option to expand the choices and choose Miscellaneous Income, 1099-A, 1099-C

- Choose the Other Reportable Income option and find Other Taxable Income in that section

- Enter a description for your adjustment and the amount as a negative number

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1099-K incorrect

I have done exactly what both of you instructed.

You state:

- Choose the Federal option on your left menu bar

- Choose Wages & Income

- Find Less Common Income in the list of income sources

- Use the Show More option to expand the choices and choose Miscellaneous Income, 1099-A, 1099-C

- Choose the Other Reportable Income option and find Other Taxable Income in that section

- Enter a description for your adjustment and the amount as a negative number

I am using TurboTax Online Self-Employed.

Going to these does not work:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1099-K incorrect

After testing the steps myself, everything appears to be working correctly. Just be sure to read the descriptions on the screen carefully and be aware that most of the choices you will make are at the bottom of the screen so you will need to keep scrolling to find the correct section.

The steps provided by experts TeresaM and ThomasM125 will work in TurboTax Online Self-Employed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1099-K incorrect

I confirm this worked just fine.

Thank you very much.

Peter

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1099-K incorrect

Ok (user of 2023 desk Top deluxe TT) have the same situation to make an adjustment to a 1099 K I received for my 2023 tax liability. The payee to me in Jan 2023 used PayPal and listed the payment as a service (error by payee). Got the service fee taken off by Venmo, but because I live in Virginia, I received a PayPal 1099 K since the amount of $1,100 exceeded the $600 threshold.

I followed the directions from Teresa M to confirm receiving 1099K from PayPal. Then to other income to show the correction as 1099 K personal transaction -$1,100. Yes, this cleared out the tax liability, however this adjustment shows on Schedule 1 Part I-line Z and shows 0 entry on my 1040 line 8.

Curious why 2023 desk Top deluxe TT doesn’t show the adjustment on Schedule 1 Part II Line 24 Z as suggested by the IRS Notice FS-2023-27? No worries did TT Fed tax review and found no errors. In printing Schedule 1 Part I line Z says “See Stmt“and shows the following support statement

Additional Information From 2023 Federal Tax Return

Schedule 1: Additional Income and Adjustments to Income

Other Income Continuation Statement

Description Amount

Other Income from Form 1099-K 1,100.

1099 K personal transaction -1,100.

Total 0

Comments are welcome!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1099-K incorrect

This seems like it is working exactly as it should and providing you with exactly what you need in order to remove the income from your tax return while at the same time reporting it properly to the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Wildflower

New Member

PreparingMyTaxes

New Member

twnavy

New Member

fetalvero-meli13

New Member

leeanncladin

New Member