- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Foreign income. I don't have a W2 from employer, what form do i use to report income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

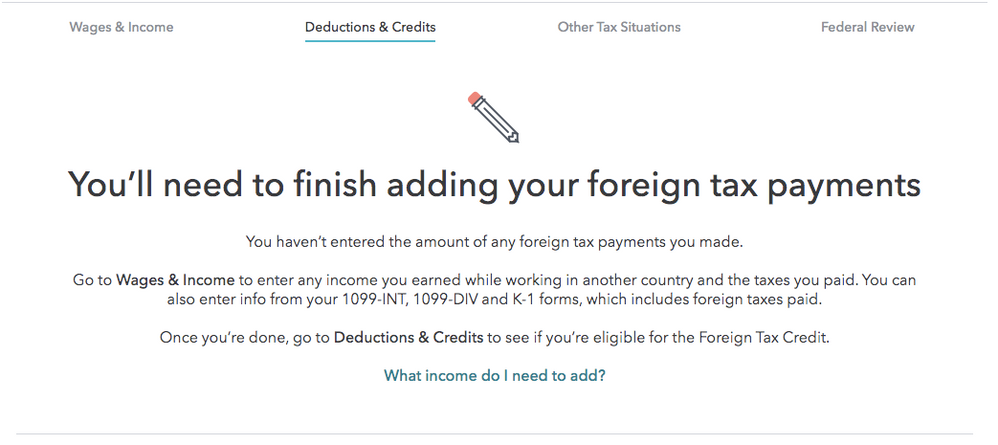

I don't have a W2 so I filled it in as other foreign income from a letter from my employer or whatever.

But then when I try to claim the foreign tax credit it says this!

I very clearly seem to have done my Income correctly (without W2) and even made adjustments to put the same amount in the second box for such income... :(

Help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

You would need to go through the foreign tax credit section to enter your foreign tax payment. Here are the steps:

- Open up your TurboTax account and select Pick up where you left off

- At the right upper corner, in the search box, type in "foreign tax credit" and Enter

- Select Jump to foreign tax credit

- Follow prompts

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

Hi! I searched for "foreign tax credit" and followed prompts; however, it takes me to "Dividend Income" and doesn't let me pass this step. I do not have dividend income, I just want to enter my employment income.

At this point, I'm considering entering my foreign income as self-employment income. Anyone have advice on this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

Hey guys... I need some help here please. Live and work in Europe and my one and only income I reported under FEI only. As soon as I put the same gross year income on my W-2 I owe $11k in federal taxes. Looking at my returns from the past two years I only ever had my FEI on my 2555 never on the W-2. Is this correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

Simply put: Can I just delete my W-2 completely? There isn't one anyways ... just monthly pay stubs. Employer is also named on 2555 FEIE. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

Yes, delete the W-2 completely. The follow these steps to enter your income from your own totals:

- Click on Federal in the menu on the left.

- Click on Wages & Income in the menu across the top or down the center. In some versions this may read Income & Expenses.

- Scroll down to Less Common Income and click on Show more (if you do not see this option, click on Show more income).

- Click Start (or Revisit) beside Foreign Earned Income and Exclusion.

- Answer Yes to Did you make any money outside the U.S.? and click Continue.

- Check the box A statement from my foreign employer (could be cash) and click Continue.

- Enter your income here and continue to follow the remaining prompts in this section to exclude the income and complete your Form 2555.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

Hello,

I have done exactly this, but the program will not let me e-file due to the fact that I don't have any income reported on the W2 section, even when I have deleted the W2 since I don't have a W2. And if I were to mail in my Form 2555, as TurboTax later told me I had to (since I couldn't qualify to e-file), how then do I attach it to a Form 1040 that the IRS requires if I don't have a w2?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

What if I live in the US, was paid from a company abroad (have no foreign tax credits), but don't have a W2/1099/paystub from my foreign employer? Should I put it under W2 income? Can the IRS "reject" it or something?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

Hi there, I use www.xe.com/currencyconverter - click on View full USD to EUR chart - from there you can select how many years to see on chart. You can then see what the exchange rate was on the last day of the calendar year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

Hi,

I'm in a similar situation and wondering if you were able to find a solution for this.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

Hi! I have a question.

I am a retired central government pensioner from India and I receive pension monthly. Where in the form IRS 1040 SR I have to report and what to do if I don't have any supporting form as 1099 or W2.

This is the first time and I am 75 years old. I am filing jointly with my wife.

Can anyone please reply?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

That's okay,

To enter foreign pension in TurboTax online program, you will need to create a substitute form 1099-R.

Within your Personal Tax section, Under Retirement Plans, select the IRA, 401(k), Pension Plans (1099-R).

To file a substituted 1099-R:

-

Wages & Income

-

IRA, 401(k), Pension Plan Withdrawals (1099-R)

-

Did you get a 1099-R in 2021? Yes

-

Get ready to be impressed - Continue

-

Select Change how I enter my form

-

Type it Myself

-

Continue the interview from here. Enter the appropriate information.

-

In most cases, Box 7 is code 7

-

There will be a question Do any of these situations apply to you?

-

Select I need to file a substitute 1099-R

-

Continue through the interview

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

Hello: I work as a consultant for a foreign (EU) corporation. They pay me monthly against an invoice: it is all income paid to me in the US. I am paying quarterly estimated taxes. I won't get a 1099 from them: should I request an end of year statement from them, and do I need to submit it with my 2022 return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

All total worldwide income MUST be reported and since you are self employed it goes on a Sch C even if you get no tax reporting form.

If you are new to being self employed, are not incorporated or in a partnership and are acting as your own bookkeeper and tax preparer you need to get educated ....

If you have net self employment income of $400 or more you have to file a schedule C in your personal 1040 return for self employment business income. You may get a 1099-NEC for some of your income but you need to report all your income. So you need to keep your own good records. Here is some reading material……

IRS information on Self Employment….

http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Self-Employed-Individuals-Tax-Center

Publication 334, Tax Guide for Small Business

http://www.irs.gov/pub/irs-pdf/p334.pdf

Publication 535 Business Expenses

http://www.irs.gov/pub/irs-pdf/p535.pdf

Home Office Expenses … Business Use of the Home

https://www.irs.gov/businesses/small-businesses-self-employed/home-office-deduction

https://www.irs.gov/pub/irs-pdf/p587.pdf

Publication 463 Travel, Gift, and Car Expenses

https://www.irs.gov/pub/irs-pdf/p463.pdf

Publication 946 … Depreciation

https://www.irs.gov/pub/irs-pdf/p946.pdf

There is also QuickBooks Self Employment bundle you can check out which includes one Turbo Tax Self Employed return and will help you keep up in your bookkeeping all year along with calculating the estimated payments needed ....

http://quickbooks.intuit.com/self-employed

Self Employment tax (Scheduled SE) is generated if a person has $400 or more of net profit from self-employment on Schedule C. You pay 15.3% for 2017 SE tax on 92.35% of your Net Profit greater than $400. The 15.3% self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. So you get social security credit for it when you retire. You do get to take off the 50% ER portion of the SE tax as an adjustment on line 27 of the 1040. The SE tax is already included in your tax due or reduced your refund. It is on the 1040 line 57. The SE tax is in addition to your regular income tax on the net profit.

PAYING ESTIMATES

For SE self employment tax - if you have a net profit (after expenses) of $400 or more you will pay 15.3% for 2017 SE Tax on 92.35% of your net profit in addition to your regular income tax on it. So if you have other income like W2 income your extra business income might put you into a higher tax bracket.

You must make quarterly estimated tax payments for the current tax year (or next year) if both of the following apply:

- 1. You expect to owe at least $1,000 in tax for the current tax year, after subtracting your withholding and credits.

- 2. You expect your withholding and credits to be less than the smaller of:

90% of the tax to be shown on your current year’s tax return, or

100% of the tax shown on your prior year’s tax return. (Your prior year tax return must cover all 12 months.)

To prepare estimates for next year, You can just type W4 in the search box at the top of your return , click on Find. Then Click on Jump To and it will take you to the estimated tax payments section. Say no to changing your W-4 and the next screen will start the estimated taxes section.

OR Go to….

Federal Taxes or Personal (H&B version)

Other Tax Situations

Other Tax Forms

Form W-4 and Estimated Taxes - Click the Start or Update button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign income. I don't have a W2 from employer, what form do i use to report income?

I have the same situation. Did you find out if you just use the w2 way or did you use another form? Thanks for any help.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

yingmin

Level 1

user17549282037

New Member

Propeller2127

New Member

VAer

Level 4

Naren_Realtor

New Member