in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Filing Tax for Employment Claim - Do I need to report Attorney fee in my taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Tax for Employment Claim - Do I need to report Attorney fee in my taxes?

Hello Experts,

I am preparing taxes for a family member. He lost his job in 2021 and filed a claim with his employer for wrongful termination. They were able to resolve all disputes without litigation after mediation in 2022. Employer finally paid $100,000 (the “Settlement Amount”). Lawyer had contingency fee as 40% of Settlement Amount

As per agreement, Employer paid amount in 3 checks.

- Check 1 - $30,000.00 payable to Employee. W-2 was issued to Employee

- Check 2 - $30,000.00 payable to Employee. 1099-Misc was issued to Employee

- Check 3 - $40,000.00 payable to Attorney. Employer was supposed to issue 1099 Form.

Question

- For check 3, do we need to report this in our Taxes or Attorney will do it in his taxes?

- If yes, how should we report it? 1099-Misc?

- Can we deduct $40,000 somehow as a lawyer fees?

- Shouldn’t this ideally be reported by Lawyer since my family member never got that money?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Tax for Employment Claim - Do I need to report Attorney fee in my taxes?

As per agreement, Employer paid amount in 3 checks.

- Check 1 - $30,000.00 payable to Employee. W-2 was issued to Employee entered on return as wages

- Check 2 - $30,000.00 payable to Employee. 1099-Misc was issued to Employee entered on return as other income Sch 1

- Check 3 - $40,000.00 payable to Attorney. Employer was supposed to issue 1099 Form. NOT entered on employee return unless a 1099 was issued to the employee ... the 1099 should have been issued to the attorney.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Tax for Employment Claim - Do I need to report Attorney fee in my taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Tax for Employment Claim - Do I need to report Attorney fee in my taxes?

Hello Experts,

any help on this question will be highly appreciated. 🙏

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Tax for Employment Claim - Do I need to report Attorney fee in my taxes?

You do not need to report it, but my opinion is that you should claim the $40,000 as an itemed deduction. This is a gray area however I cannot imagine an IRS agent denying that deduction. Others may have different response.

But if you are going to report it as a deduction, then you need to report it as income. This was income even though it went to the attorney. This would be worth consulting a tax attorney to explore your options and best course of action.

Your attorney will be responsible to pay the tax on the $40,000 that they received.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Tax for Employment Claim - Do I need to report Attorney fee in my taxes?

As per agreement, Employer paid amount in 3 checks.

- Check 1 - $30,000.00 payable to Employee. W-2 was issued to Employee entered on return as wages

- Check 2 - $30,000.00 payable to Employee. 1099-Misc was issued to Employee entered on return as other income Sch 1

- Check 3 - $40,000.00 payable to Attorney. Employer was supposed to issue 1099 Form. NOT entered on employee return unless a 1099 was issued to the employee ... the 1099 should have been issued to the attorney.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Tax for Employment Claim - Do I need to report Attorney fee in my taxes?

hi @Critter-3 . Thank you very much for your response.

Yes, no 1099 was issued to Employee for Check -3.

so I assume based on your reply, we don’t need to do anything in our Tax return for Check-3?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Tax for Employment Claim - Do I need to report Attorney fee in my taxes?

Correct ... it was paid to the attorney directly and it goes on the attorney's return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Tax for Employment Claim - Do I need to report Attorney fee in my taxes?

Hi @Critter-3 , I need another help.

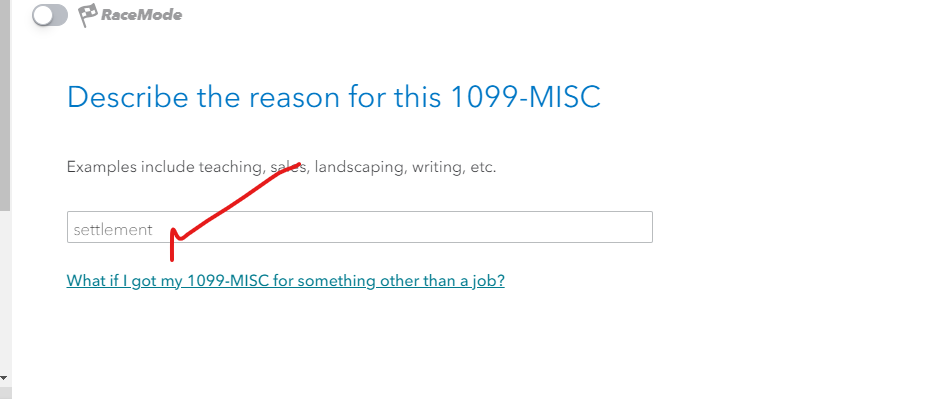

When I enter details for Check -3 in 1099-MISC. It asks for question "Does one of these uncommon situations apply?"

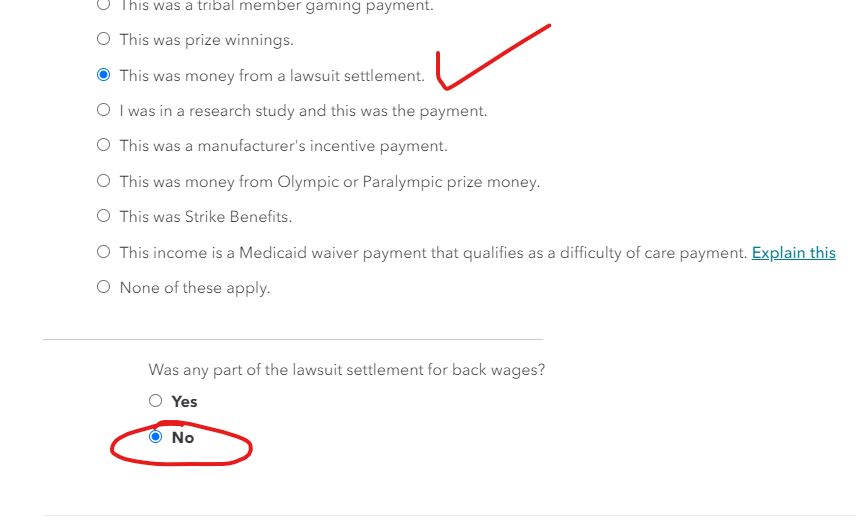

Should I select "this money was from lawsuit settlement"? My family member didn't filed a lawsuit in the court. It was just a claim to employer.

If, I mark this transaction from lawsuit settlement, its give me another question "Was any part of the lawsuit settlement for back wages"? DO I need to mark this Yes or No?

If I "mark No", then during Smart Check its asking me to still fill in amount details for lawsuite settlement for back wages.

If I mark "Yes", and add Check 1 amount then it adds more taxes.

We think Check 1which is reported in W-2 is already getting taxed.

I am bit confused why during smart check it forces me to enter amount details for Check 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Tax for Employment Claim - Do I need to report Attorney fee in my taxes?

Since you are entering the W-2 for the back wages you will NOT enter that info again in the 1099-misc section.

As for the 1099 entry ... I don't see where you are having issues ... delete the 1099 and try again ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Tax for Employment Claim - Do I need to report Attorney fee in my taxes?

Thanks @Critter-3 , Your suggestion worked. Deleted the form and added again. "Smart Check" works fine now.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Vermillionnnnn

Returning Member

rosasanc8

New Member

karissarosenquist0066

New Member

eviemeadows5

New Member

brian-cropp

Level 1