- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Filing for a deceased person whose 2023 taxable income is shown on line 15 as $ 5,443, but lines 16 and 24 show $ 0 tax due. This looks incorrect to me?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing for a deceased person whose 2023 taxable income is shown on line 15 as $ 5,443, but lines 16 and 24 show $ 0 tax due. This looks incorrect to me?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing for a deceased person whose 2023 taxable income is shown on line 15 as $ 5,443, but lines 16 and 24 show $ 0 tax due. This looks incorrect to me?

One possibility is that the income consisted of capital gain income (line 7 of form 1040) and qualified dividend income (line 3a). If the individual filed as a single filer, and the taxable income was less than $44,625 in 2023, the tax rate would be $0 on the portion of income represented by qualified dividends and net capital gain income. In that case, you would have taxable income but no income tax.

To view your form 1040 and schedule 1 to 3:

- Choose Tax Tools from your left menu bar in TurboTax Online

- Choose Tools

- Choose View Tax Summary

- See the Preview my 1040 option in the left menu bar and click on it

- Choose the Back option in the left menu bar when you are done

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing for a deceased person whose 2023 taxable income is shown on line 15 as $ 5,443, but lines 16 and 24 show $ 0 tax due. This looks incorrect to me?

Thank you Thomas, very helpful, and I think you may have identified the issue?

About half the AGI is ordinary-dividend income but the balance is pension, SS, small interest and small LT capital loss. I thought the dividends might be a factor but there's still that other income that I assume should be taxable. Three confusions: 1) Turbotax lacks transparency on how the standard deduction affects various income types, 2) the SS income on line 6a shows about $ 5,000 but line 6b, the taxable amount is $ 0, and 3) given his low taxable income of $ 5,443 I thought perhaps it might be the EIC, but the math doesn't seem to work there, as he had no kids.

I'm working on my PC and not online, and the 1040 worksheet doesn't answer these confusions. Any further suggestions?

Again, appreciate your reply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing for a deceased person whose 2023 taxable income is shown on line 15 as $ 5,443, but lines 16 and 24 show $ 0 tax due. This looks incorrect to me?

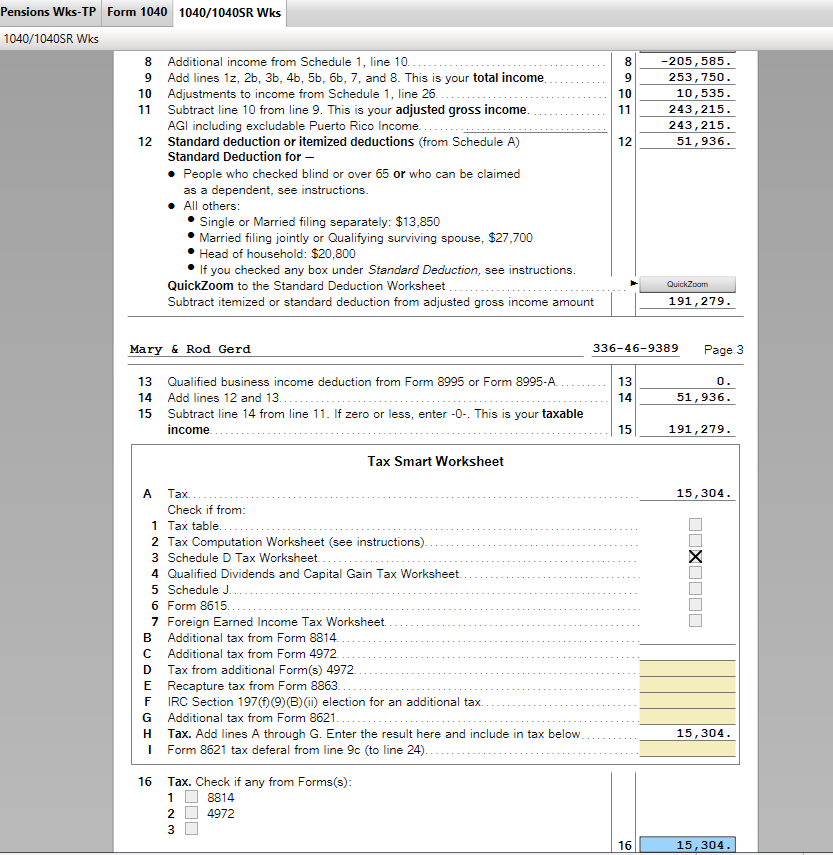

Since we can't see your return in this forum, and you are using TurboTax Desktop, go to FORMS in the upper right.

'Open Form' 1040, and scroll down to Line 16, Tax.

Click on the field, and a magnifying glass will pop up. Click on that, to be taken to the worksheet where Tax amount is calculated.

There is also a Schedule D Tax Worksheet in your list of forms you can review.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing for a deceased person whose 2023 taxable income is shown on line 15 as $ 5,443, but lines 16 and 24 show $ 0 tax due. This looks incorrect to me?

Thanks Marilyn. Your guidance was accurate but I already knew how to do that, and TT's calculation is still not transparent. I'm going to file trusting TT has done it correctly, but still not clear why the tax on ~ $ 5,000 taxable income is $ 0. Perhaps it's the EIC, though that is questionable given low income and no kids. Appreciate your input, thanks.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wesaabs4

New Member

edmarqu

Level 2

k8fitz07

New Member

kritter-k

Level 3

danielab

New Member