- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Filing 2020 tax in 2022 with TurboTax download software

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing 2020 tax in 2022 with TurboTax download software

I did not fill 2020 tax last year, so I bought a download version and filled out all forms today. At first the software told me that I cannot use e-filing because it is too late. I wanted to see what would happen if I chose e-filing so I clicked on it. I got to the end without any issues, and now the "check e-file status" section shows that IRS has accepted my return. However, I found it strange because:

1. I didn't get any emails from IRS saying that the return was accepted.

2. I downloaded Form 1040, and for "Federal Return Acceptance Date" it shows 06/13/2021. I have no idea where this date came from because I am certain that I did not fill last year.

3. Technically I think I cannot use e-filing anymore for 2020.

Could this be a possible technical error with TurboTax? Did someone else fill on my behave on 6/13/2021? I checked with the track refund function on IRS and they have no information available.

Please help me confirm what is happening to my 2020 return. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing 2020 tax in 2022 with TurboTax download software

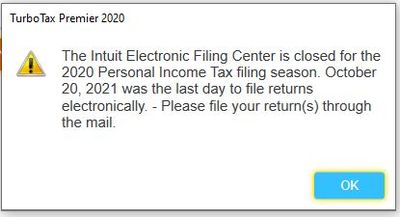

E-filing of a 2020 tax return using TurboTax was closed after 10/20/2021. The 2020 tax return can only be printed and mailed.

What you are seeing must be an internal software bug since nothing can be e-filed.

I am using a 2020 TurboTax Premier desktop edition for Windows. Tried e-filing a 2020 tax return and the software refused to e-file the return. In the File section of the program right after clicking on Transmit my returns now this window is presented -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing 2020 tax in 2022 with TurboTax download software

Thank you. I remember seeing the same message but the e-filing status page was "accepted". I will just ignore the the e-filing status and mail-in instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing 2020 tax in 2022 with TurboTax download software

How do you run/use the software after you download it? I can not figure it out. There are gazillions of files. Please advise!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing 2020 tax in 2022 with TurboTax download software

Glad to see this question and reply.

I came with the same question because I also got that confusing behavior in Desktop - "e-filing is closed for the season" followed by "Choose E-File! It's the best!" .

I'll make sure to mail ~

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing 2020 tax in 2022 with TurboTax download software

@meAtTBT Yes----e-filing is permanently closed for all tax years except for 2021 returns. Your past year return can only be filed by mail.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS/state received the return.

Federal and state returns must be in separate envelopes and they are mailed to different addresses. Read the mailing instructions that print with your tax return carefully so you mail them to the right addresses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing 2020 tax in 2022 with TurboTax download software

@meAtTBT - assume it'll take a good six months to process a paper return (maybe longer); the IRS is quite backlogged on paper returns

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

yibanksproperties

New Member

tbduvall

Level 4

5LG8-6WT4-K8DY-KQQK

New Member

evltal

Returning Member

N7777

Returning Member