in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Federasl Information worksheet spouse dependent marked no but TTAX error check says form 8889-S linen 3A1 family should not checked

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federasl Information worksheet spouse dependent marked no but TTAX error check says form 8889-S linen 3A1 family should not checked

Running TTAX desktop. Error check provided error" Form 8889-S Line 3A1 Family should not be checked. you indicated on the federal information worksheet that spouse could be claimed as a dependent of another...

I find the Federal information worksheet and spouse is NOT listed as a dependent of another - which mean the error message is WRONG.

Also looked at From 8889-S and there is no Line 3A1

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federasl Information worksheet spouse dependent marked no but TTAX error check says form 8889-S linen 3A1 family should not checked

So you looked at the following:

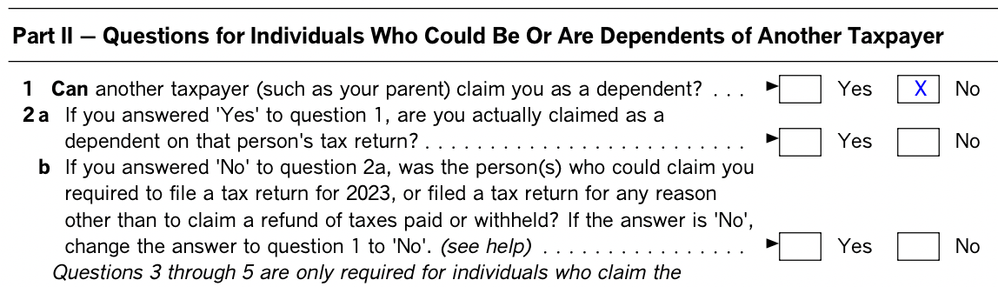

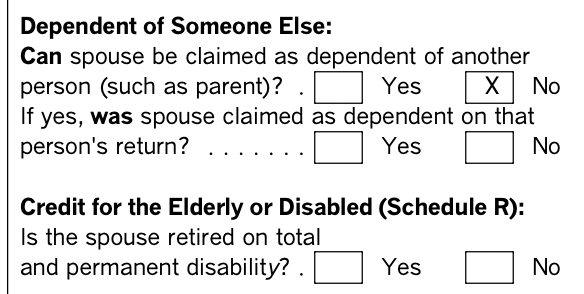

And on Part II, line one, is marked as NO. This is the spouse's Personal Worksheet on my test return (all info is made up). So your spouse's worksheet is marked the same way?

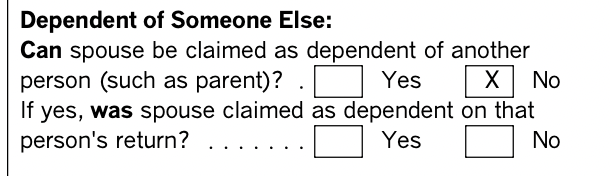

In the My Info/Personal Info section, you'll see

Is this unchecked for your spouse?

If you are still having this issue, I wonder if you checked this box by accident in the process of initially enter your spouse's data. If so, I would suggest deleting your spouse and re-entering your spouse.

We do millions of returns here, and I don't recall seeing a case in which this error message was produced incorrectly.

Oh, here is Line 3A1:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federasl Information worksheet spouse dependent marked no but TTAX error check says form 8889-S linen 3A1 family should not checked

Thank you for your reply.

I notice in your screen shots that "Marital Status" is shown as "Single" - does this make a different. We were married, so "single" would be incorrect and does not seem right because then there would be married filing separately. I will assume that this does not matter as you are merely trying to help with the screen shots. This field , "Martial Status" is set at "Married in my TTAX return

On my return, on the Personal Wks (Spouse name), Part II, line 1 the box is checked as "NO"

On the Federal Information Worksheet Part I ("Personal Information") "Dependent of Someone Else, the NO box is checked for the line "Can spouse be claimed as a dependent of another person (such as a parent")

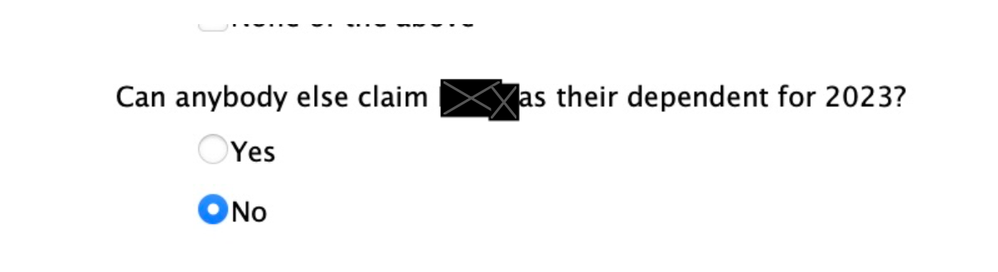

You directed my attention to "In the My Info/Personal Info section, you'll see". I did not find a form for this, so I went back through the Easy Step Personal Info Summary for my spouse. I did not change anything. I reconfirmed all of the answers (kept choosing "Continue" after reviewing the information) in the Easy Step Personal Information workflow. I note that the Easy Step query about spouse claimed as a dependent also has the NO box checked.

I have not been able to find a section that looks exactly like the image you displayed.

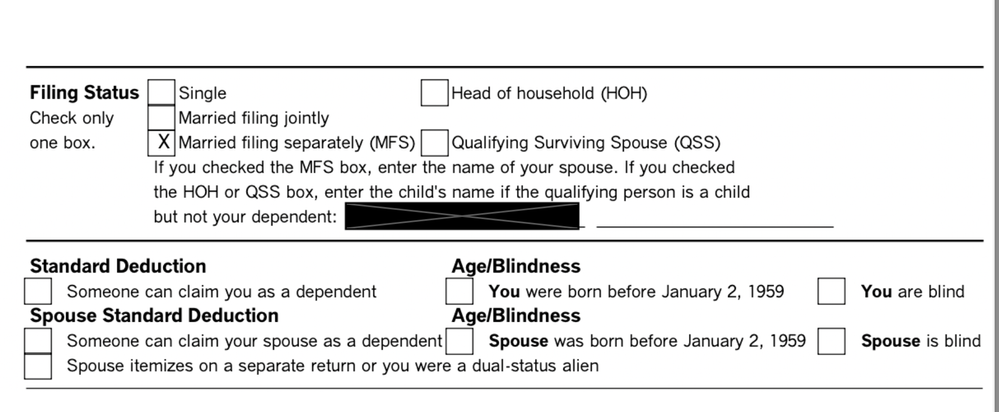

I also looked at the 1040 form itself.

- Filing Status is listed as "Married filing Separately"

- Under "Spouse Standard deduction" the Box is NOT checked for "Someone can claim your spouse as a dependent"

I respect your comment: "We do millions of returns here, and I don't recall seeing a case in which this error message was produced incorrectly." However, I have combed through the forms and data in TTAX --with your guidance-- and I have not been able to find any place where my spouse is listed as a dependent.

The error message says ". . . . You indicated on the Federal Information Wks the your spouse could be claimed as a dependent of another . . ." This is an untrue statement, as when I look at the Federal Informaiton Worksheet The NO box is checked for the line "Can spouse be claimed as a dependent of another person (such as a parent")

I appreciate the time you took to provide a detailed answer, but the error remains. Is there some hidden place in TTAX where this is set that we have not yet searched?

I will try to figure out how to delete my spouse and and then put her back in TTAX, I hope this does not mean I need to start over.

If you have any further suggestions, please let me know. I appreciate your assistance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federasl Information worksheet spouse dependent marked no but TTAX error check says form 8889-S linen 3A1 family should not checked

Go to MY INFO section of your return and delete all of your spouse's information. Then log out of your return to save the change. Log back in and reenter the information. Be sure to check she cannot be a dependent of someone else.

Let us know if this helps.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federasl Information worksheet spouse dependent marked no but TTAX error check says form 8889-S linen 3A1 family should not checked

Hi There - I am running into the same issue and tried your recommended steps. This didn't work. Do you have any other recommendations?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federasl Information worksheet spouse dependent marked no but TTAX error check says form 8889-S linen 3A1 family should not checked

So, do you have the exact same error message? Are you filing Married Filing Separately?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

taxanaut

Level 3

CA99

New Member

MojoMom777

Level 3

in Education

whydoineedtodothis

New Member

quik_66-netzero-

New Member