- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thank you for your reply.

I notice in your screen shots that "Marital Status" is shown as "Single" - does this make a different. We were married, so "single" would be incorrect and does not seem right because then there would be married filing separately. I will assume that this does not matter as you are merely trying to help with the screen shots. This field , "Martial Status" is set at "Married in my TTAX return

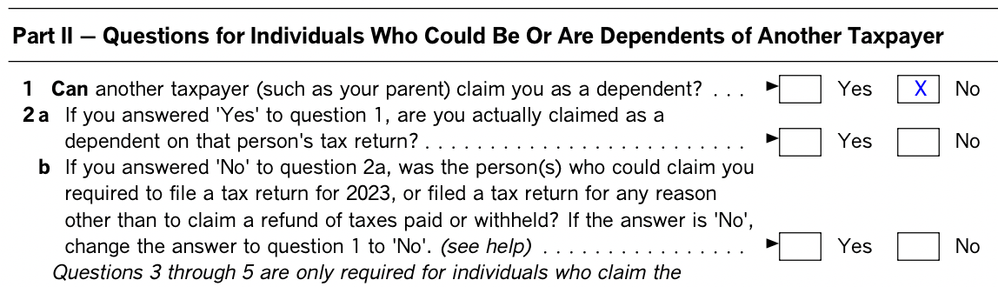

On my return, on the Personal Wks (Spouse name), Part II, line 1 the box is checked as "NO"

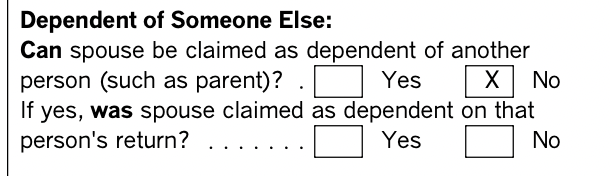

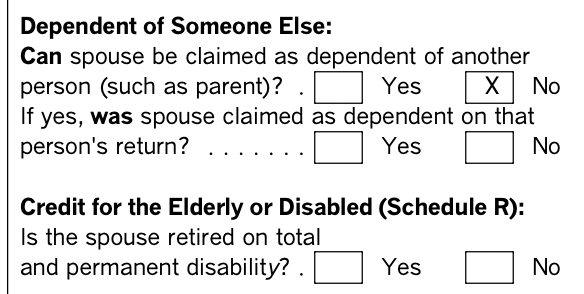

On the Federal Information Worksheet Part I ("Personal Information") "Dependent of Someone Else, the NO box is checked for the line "Can spouse be claimed as a dependent of another person (such as a parent")

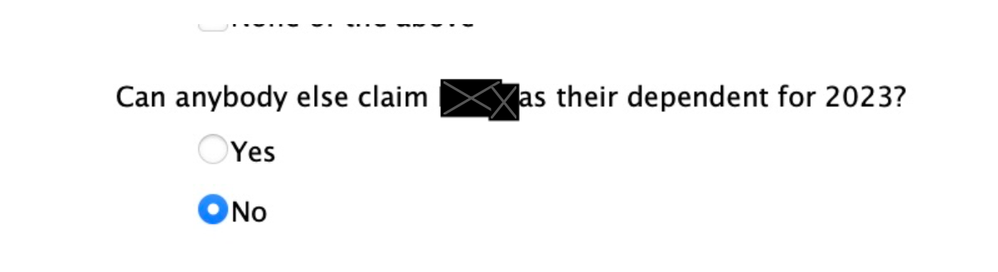

You directed my attention to "In the My Info/Personal Info section, you'll see". I did not find a form for this, so I went back through the Easy Step Personal Info Summary for my spouse. I did not change anything. I reconfirmed all of the answers (kept choosing "Continue" after reviewing the information) in the Easy Step Personal Information workflow. I note that the Easy Step query about spouse claimed as a dependent also has the NO box checked.

I have not been able to find a section that looks exactly like the image you displayed.

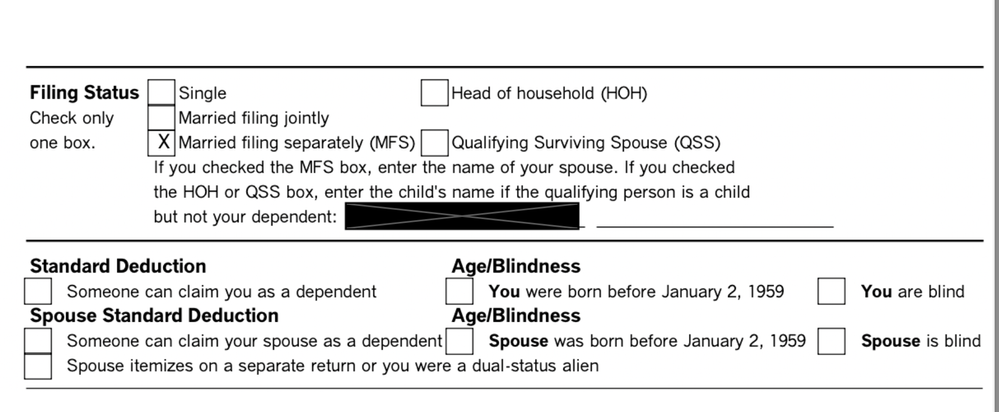

I also looked at the 1040 form itself.

- Filing Status is listed as "Married filing Separately"

- Under "Spouse Standard deduction" the Box is NOT checked for "Someone can claim your spouse as a dependent"

I respect your comment: "We do millions of returns here, and I don't recall seeing a case in which this error message was produced incorrectly." However, I have combed through the forms and data in TTAX --with your guidance-- and I have not been able to find any place where my spouse is listed as a dependent.

The error message says ". . . . You indicated on the Federal Information Wks the your spouse could be claimed as a dependent of another . . ." This is an untrue statement, as when I look at the Federal Informaiton Worksheet The NO box is checked for the line "Can spouse be claimed as a dependent of another person (such as a parent")

I appreciate the time you took to provide a detailed answer, but the error remains. Is there some hidden place in TTAX where this is set that we have not yet searched?

I will try to figure out how to delete my spouse and and then put her back in TTAX, I hope this does not mean I need to start over.

If you have any further suggestions, please let me know. I appreciate your assistance.