- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Extra W2 Over Reports Income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Extra W2 Over Reports Income

The company I worked for sent me two W2’s. I had an actual income of $36,500 that is on one W2. . The other W2 is for $19,100, money that I was not paid. I added all my paystubs, my total income was $36,500. Employer ID #’s are the same on both. Ive asked for a correction, the company tells me I need to just file the correct one, and forgot about the other $19,100 income they reported for me. They paid federal, soc sec, & medicare taxes on both the W2s. What should I do now??

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Extra W2 Over Reports Income

Just file the correct one. They may have printed one incorrectly (but go ahead and save the erroneous one). I doubt that they actually PAID all the tax matches on that one anyway.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Extra W2 Over Reports Income

Wouldn’t I get flagged for not reporting my full income. The company went from processing our payroll in house that year, to outsourcing it to an independent company.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Extra W2 Over Reports Income

They are correct. You would simply just need to use the correct one to file.

The one that is not correct you should completely disregard.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Extra W2 Over Reports Income

Sorry to be dense on the matter. But isn’t it already reported? They paid taxes into accounts in my name, like social security, on both the W2s. Does the IRS see both W2s? Doesn’t this put me into a higher tax bracket?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Extra W2 Over Reports Income

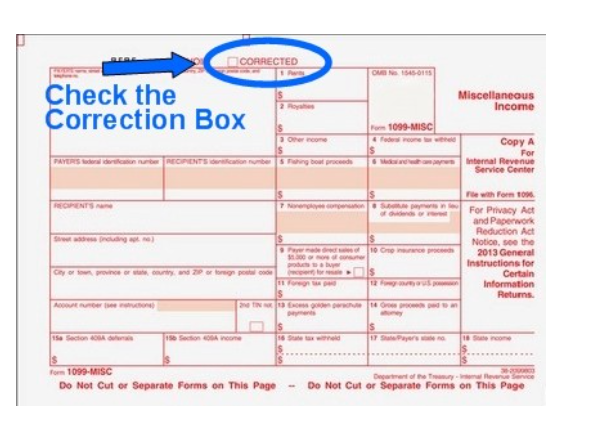

Yes, you should only file the W-2 form that is correct. Is the Corrected box checked at the top of the W-2 form?

If yes, use that one and think no more about it.

If the Corrected box is not checked, you should get your employer to make sure that both forms were not filed with the Social Security Administration, or you may get an IRS letter later.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Extra W2 Over Reports Income

Just because the second W2 was printed and given to you doesn't mean the form was transmitted to the Social Security Administration, the IRS, or that the taxes were paid on it.

Sometimes payroll providers will issue a W-2, discover it is wrong and correct it. That is why I suggest checking for the Correction indicator at the top of the form.

If the form that matches your income has the Corrected box checked, that means the payroll processor corrected it, and unless they are completely incompetent, they filed it as a correction, not as an addition to the other form. in other words the correction replaces the first form.

You should be concerned about the matter, because there is a possibility that both forms were filed and that could be a problem for you. Your employer needs to look into this for you and make sure that it was handled properly.

That being said, the mere fact of that second form exists doesn't mean that you have the to claim the extra income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Extra W2 Over Reports Income

Thank you for the thorough answers! Im new to doing my own taxes and trying to muddle my way through. The forms Ive received are formatted different than the pic you postes, but I have looked and there is no CORRECTED box on these forms at all. As for the incompetence level at the place, well, they aren’t impressing me. I waited two weeks + to be told not to worry about it, with no further explanation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Extra W2 Over Reports Income

There is no good answer since an employer has the responsibility to report your W-2 correctly.

Perhaps you should ask co-workers if they have the same issue and contact an IRS Tax Advocate for help before filing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17712841822

New Member

Tomzee

Level 2

dancerfrog

Level 1

thomas_callahan

Level 1

droppedfries

New Member