If you entered a Form 1099-R for the return of excess contributions plus earnings, then you will get the "Explain the Return of Contribution" screen in the follow-up screens. Please see these steps:

- Click "Federal Taxes" on the top and select "Wages & Income"

- Click "I'll choose what to work on"

- Scroll down and click "Start/Edit" next to "IRA, 401(k), Pension Plan (1099-R)"

- On the "Your 1099-R Entries" screen click "continue" (after you have entered all Form 1099-R)

- Continue through the questions until the "Explain the Return of Contribution" screen.

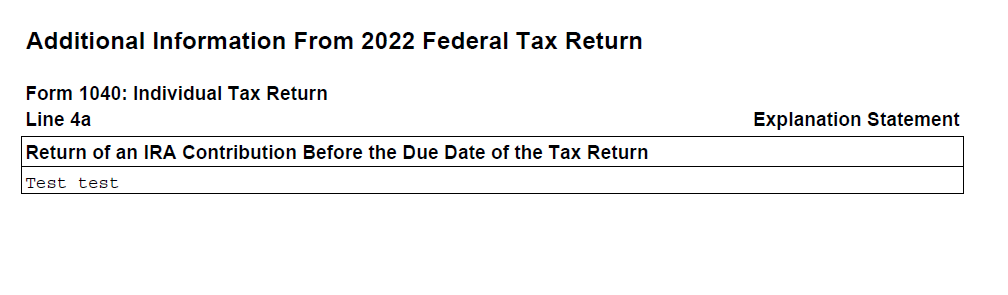

When you review the Federal Forms in the Print Center you need to look for "Additional Information From 2022 Federal Tax Return" and it should say "Form 1040: Individual Tax Return

Line 4a Explanation Statement":

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"