- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Error Message: Effective date of S corp election is later than beginning date of tax year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message: Effective date of S corp election is later than beginning date of tax year

I am having to late file my 2018 S Corp return but I get the error message "You have entered an S corp effective date that is later than the first of the year". It was my first year and the business did not start until 10/5/2018. Turbotax will not let me efile with this error and my state requires efile. The help instructions mention a 'short year' return but turbotax only appears to allow calendar or fiscal year. Please advise...thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message: Effective date of S corp election is later than beginning date of tax year

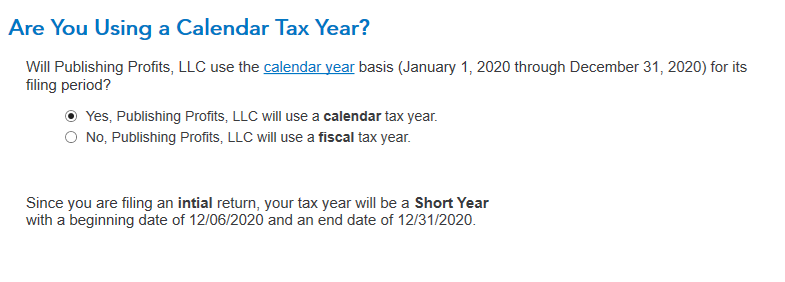

You need to select that your corporation did not use a calendar year (first) in the Business Info>>About Your Business section of the program.

The next screen should give you the choice between a fiscal year and a short year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message: Effective date of S corp election is later than beginning date of tax year

You need to select that your corporation did not use a calendar year (first) in the Business Info>>About Your Business section of the program.

The next screen should give you the choice between a fiscal year and a short year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message: Effective date of S corp election is later than beginning date of tax year

Thanks. I was finally able to do it from the Form method but not the interview method in 2018.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message: Effective date of S corp election is later than beginning date of tax year

I am running into the same issue, but I am doing it for 2020 taxes. I keep getting the same error, but I dont have the option to select "short year" and it says that is what Turbotax is using.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message: Effective date of S corp election is later than beginning date of tax year

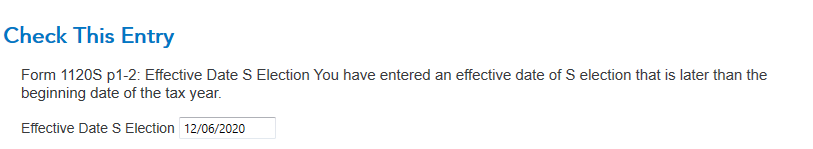

This is the error it produces. It tells me I cannot use this date, because it is after the start of the year. When I change it to 1/1/2020, it says I cannot use that date because that is before I incorporated. I cannot file my K-1 without passing this obstacle.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message: Effective date of S corp election is later than beginning date of tax year

Never mind. I see how the original poster fixed it and I managed to do it also in the Forms tab. A future enhancement may be to have Turbotax automatically fill in the forms like how it says it will.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bluepig2020

Level 2

2Pups

Returning Member

big toes

Level 2

twbusby

Level 2

drcgeri

Level 2