- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Error in state (CA) return for head of HH status. My ex claims child one and I claim other. State return error listing other child not living 50% with me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in state (CA) return for head of HH status. My ex claims child one and I claim other. State return error listing other child not living 50% with me.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in state (CA) return for head of HH status. My ex claims child one and I claim other. State return error listing other child not living 50% with me.

Did the child physically live with you more than half the year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in state (CA) return for head of HH status. My ex claims child one and I claim other. State return error listing other child not living 50% with me.

One child (Bob) lived w/ me more than half the year (my dependent), the other (Mary) lived with my Ex more than half the year (her dependent). But my state return wants me to "fix" Mary so she lives w/ me more than half the year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in state (CA) return for head of HH status. My ex claims child one and I claim other. State return error listing other child not living 50% with me.

If Mary did not live with you more than half the year then why is she on your tax return at all, unless your Ex gave you a 8332 form to release the dependent and child tax credit to you and the Ex is claiming the other credits?

If not then go to the personal information section, dependent, and totally delete Mary from your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in state (CA) return for head of HH status. My ex claims child one and I claim other. State return error listing other child not living 50% with me.

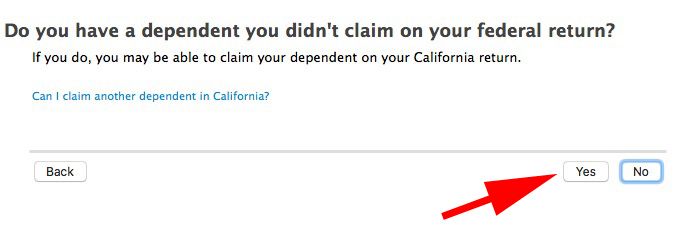

Because I get some credit for her for my state return, even though she's not a dependent. I originally did not list her and added her later as part of my state return. I feel like that may be why I'm getting an error, but I don't know how to fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in state (CA) return for head of HH status. My ex claims child one and I claim other. State return error listing other child not living 50% with me.

@davegphd wrote:

Because I get some credit for her for my state return, even though she's not a dependent. I originally did not list her and added her later as part of my state return. I feel like that may be why I'm getting an error, but I don't know how to fix it.

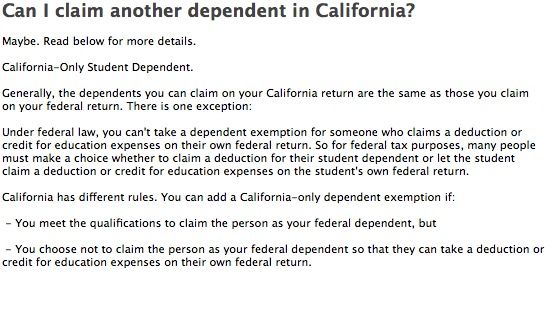

That was incorrect. The "California only student dependent" only applies to a child that is a student in college and claims their own educational credits on their own tax return. You cannot claim that student on your Federal return but CA allows you to. That would not apply to a 16 year or younger child.

Remove that from your CA return and enter the child in the Federal Dependent section. If your ex has released the dependent to you, otherwise there is nothing that you can claim.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in state (CA) return for head of HH status. My ex claims child one and I claim other. State return error listing other child not living 50% with me.

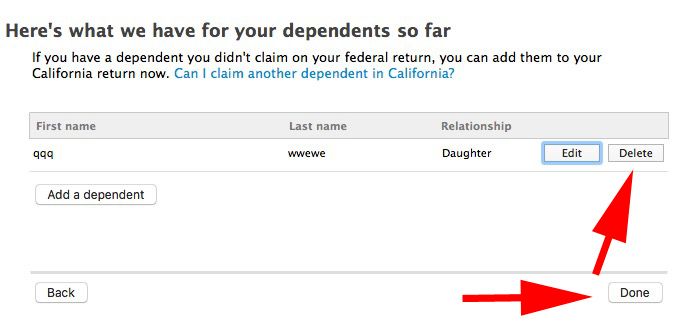

To see what impact removing Mary would have on my return, I deleted her. But the error still shows in my state return (that is, Mary appear and the program wants me to increase how long she lived with me... even though I don't have Mary in my return at all!). Got to be a bug in the software...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in state (CA) return for head of HH status. My ex claims child one and I claim other. State return error listing other child not living 50% with me.

@davegphd wrote:

To see what impact removing Mary would have on my return, I deleted her. But the error still shows in my state return (that is, Mary appear and the program wants me to increase how long she lived with me... even though I don't have Mary in my return at all!). Got to be a bug in the software...

Delete from CA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in state (CA) return for head of HH status. My ex claims child one and I claim other. State return error listing other child not living 50% with me.

Got it! Thank you!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

martha

New Member

ak2airy

New Member

1120-F

Level 2

1120-F

Level 2

eszczepanik

New Member