- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@davegphd wrote:

Because I get some credit for her for my state return, even though she's not a dependent. I originally did not list her and added her later as part of my state return. I feel like that may be why I'm getting an error, but I don't know how to fix it.

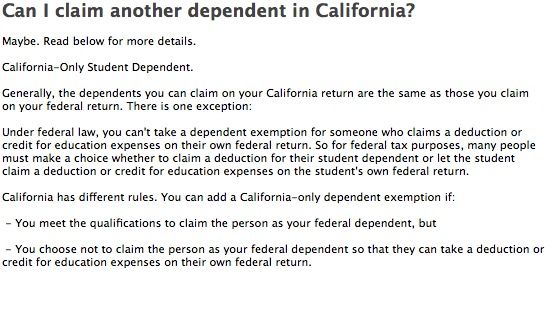

That was incorrect. The "California only student dependent" only applies to a child that is a student in college and claims their own educational credits on their own tax return. You cannot claim that student on your Federal return but CA allows you to. That would not apply to a 16 year or younger child.

Remove that from your CA return and enter the child in the Federal Dependent section. If your ex has released the dependent to you, otherwise there is nothing that you can claim.

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

April 18, 2020

8:28 PM