- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Entering points for a rental property purchase

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering points for a rental property purchase

Hello! I tried to enter points on rental but it is not calculating.

Here's what I did:

Add asset

Amortizable intangibles

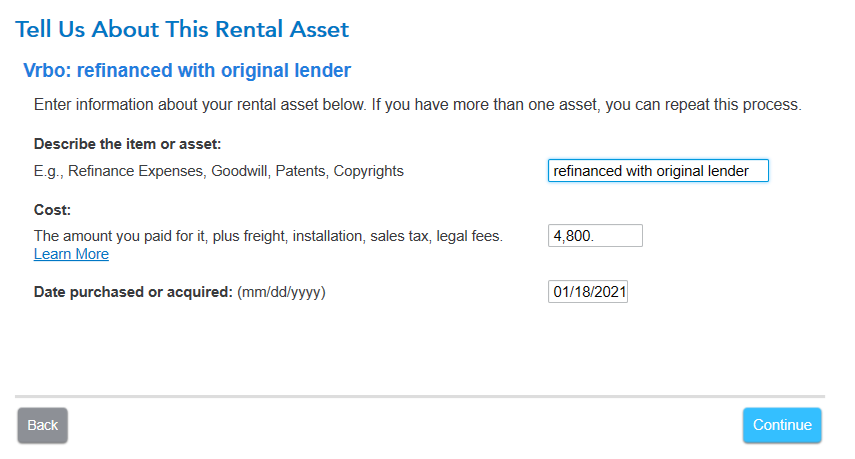

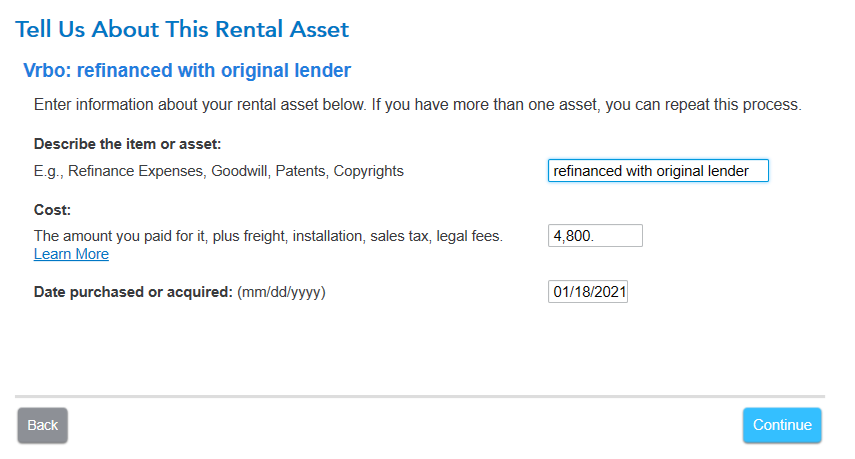

Described asset - added cost and closing date of loan

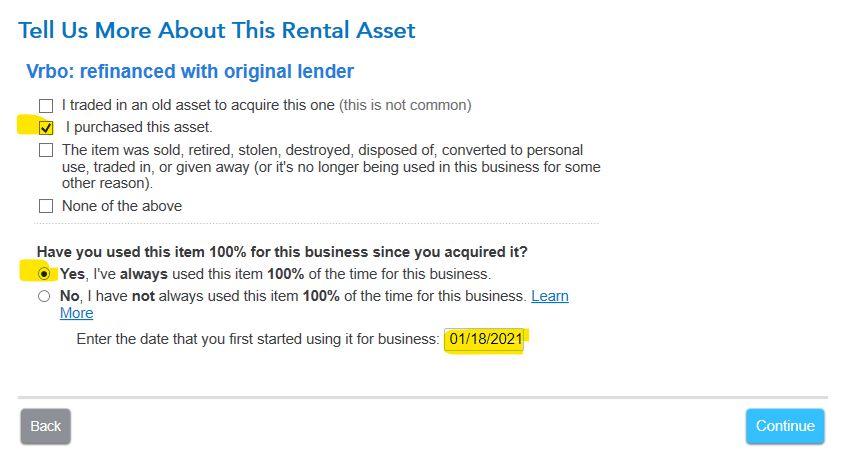

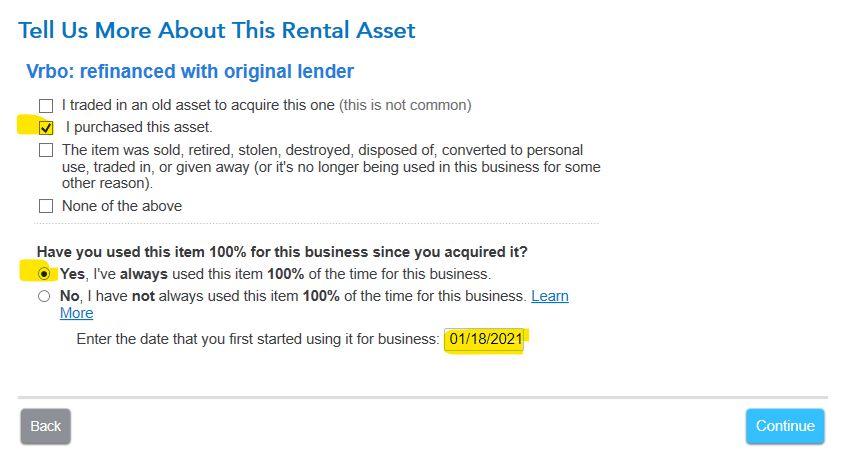

Selected purchased new asset

Clicked used for 100% of business and entered closing date of loan

Selected code section 163:Loan fees

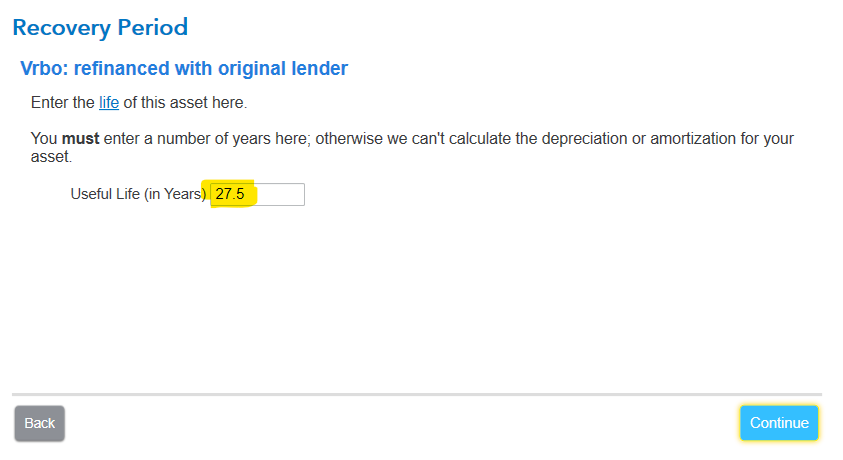

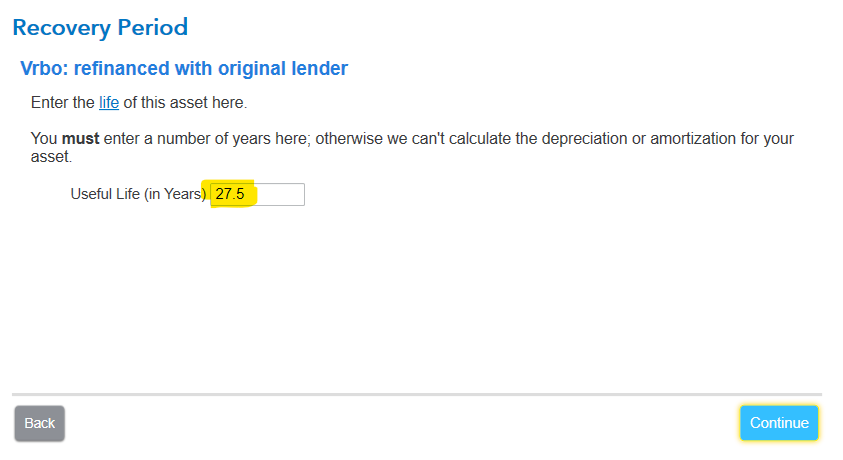

Entered in useful life of 30 years

Asked if I wanted to take special depreciation allowance (clicked no because I don't think it applies)

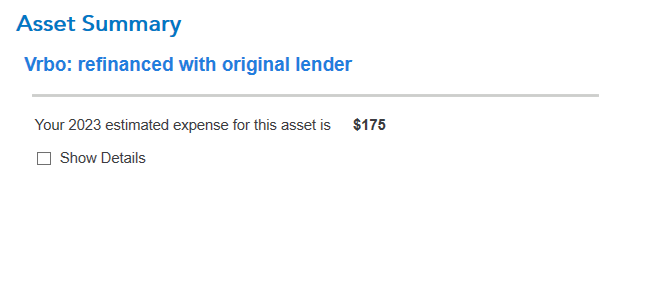

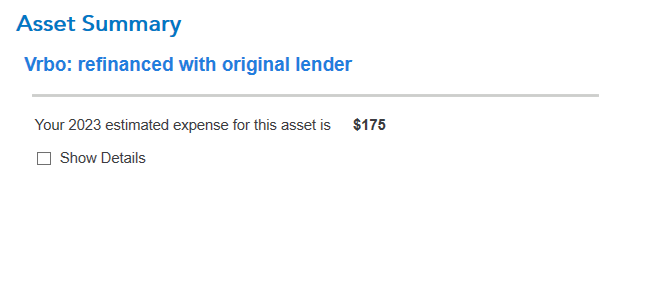

Calculates $0 for the amortization

Can you please let me know what I did wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering points for a rental property purchase

When you refinance with the same lender, you are required to amortize the points. Otherwise, the points are deductible for purchase and refinance.

I am following your steps and can only tell one mistake so far (rental is 27.5 years for mortgage), here are mine:

You must mark purchased as well as enter your date

Sec 163 loan fees is correct

depreciation allowance, no is good and then asset summary

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering points for a rental property purchase

When you refinance with the same lender, you are required to amortize the points. Otherwise, the points are deductible for purchase and refinance.

I am following your steps and can only tell one mistake so far (rental is 27.5 years for mortgage), here are mine:

You must mark purchased as well as enter your date

Sec 163 loan fees is correct

depreciation allowance, no is good and then asset summary

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering points for a rental property purchase

Thank you for the detailed reply! I closed out the program, deleted that asset I was working on, and created a new asset and all worked! I wonder if I somehow messed something up when I went to look at the individual forms. Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering points for a rental property purchase

The program wouldn't have asked about Special Depreciation for points, so chances are it was in the wrong place the first time.

Thank you for choosing TurboTax

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

elliott1917

New Member

jackkgan

Level 5

stvbreed

New Member

supecoadventures

New Member

vanessamariahunter

New Member