- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- enter mortage interest and property tax for rent out a room

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

enter mortage interest and property tax for rent out a room

I rent out a room in my primary property this year. Assume it is 20% of my entire house. I also live here.

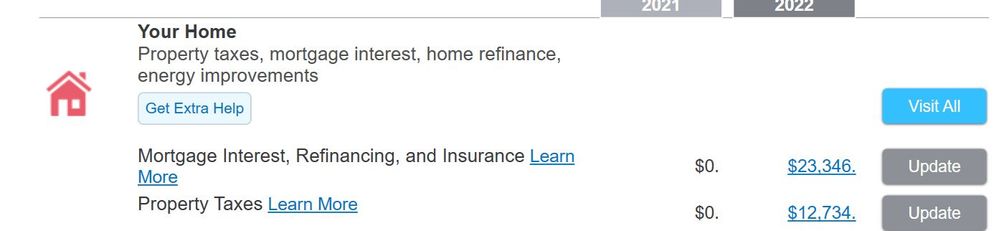

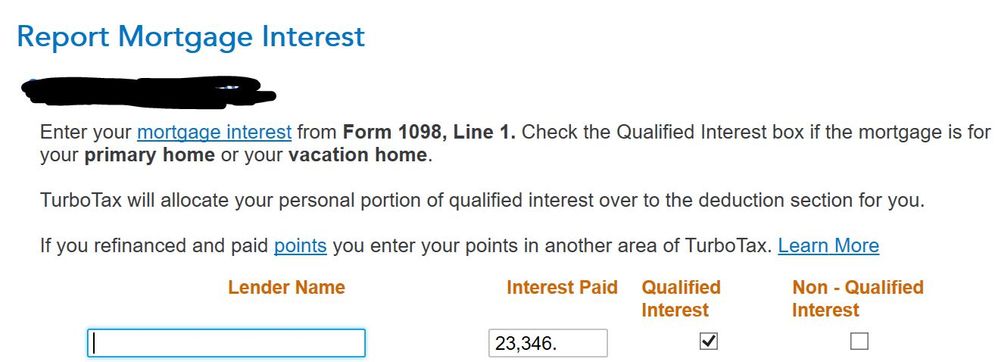

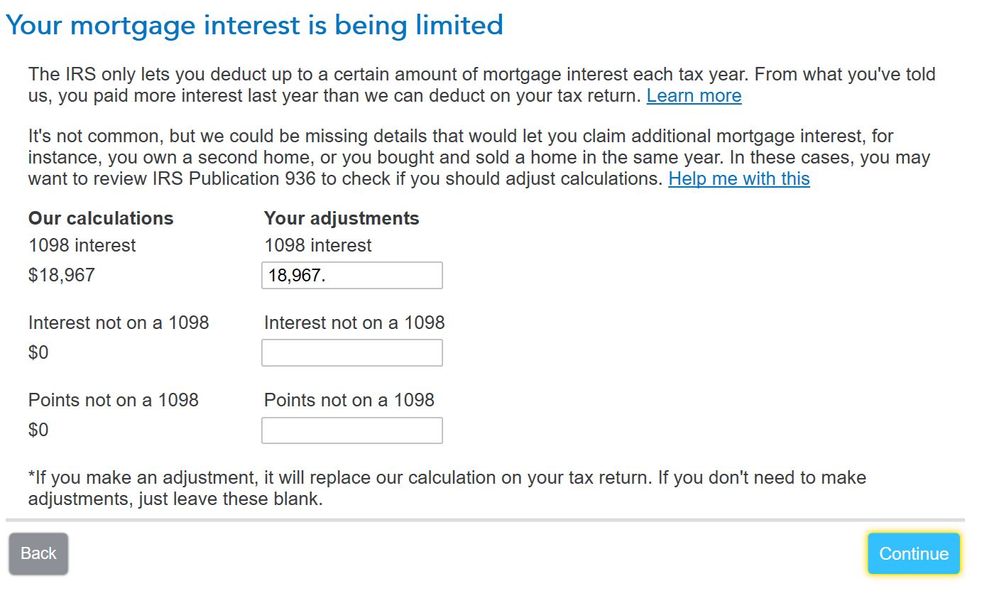

My interest payment is around 23000, but due to limit of using interest of 750000 in loan, the calculation by turbo tax is 19000 for 1098 interest. Should I split this 19000 manually across the property tax in rental (20%) and in the Deduction & Credits (80%)? TurboTax says it will automatically allocate it for me, but after I enter the entire amount (23000) in the rental, it does not show up in the Deduction & Credits. Or can I just do not enter anything inside the rental, but put them in the Deduction & Credits?

Besides, for the property tax, should I also use the similar calculation and split? Property tax seems to have a limit of 10000.

Deduction & Credits

Deduction & Credits Rental info in Schedule E in Wages & Income

Rental info in Schedule E in Wages & Income

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

enter mortage interest and property tax for rent out a room

Unfortunately, TurboTax does not support the calculation for the mortgage interest limitation when you rent a portion of your home. You will need to manually adjust the interest deduction amount on the Tax and Interest Deduction Worksheet for Schedule A, Form 8829 and/or the Schedule E Worksheet if you are subject to limitations. Refer to IRS Publication 936 for help if necessary.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

enter mortage interest and property tax for rent out a room

Thanks very much for the reply! Do you mean I need the money shown in the following picture, and manually split it based on the rental area of my house into schedule A and E?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

enter mortage interest and property tax for rent out a room

Yes, you will need to manually allocate the mortgage interest and property taxes between the rental on Schedule E, and your itemized deductions on Schedule A.

Please see Renting Part of Property in IRS Publication 527 for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ramseym

New Member

DallasHoosFan

New Member

eric6688

Level 2

user17523314011

Returning Member

eric6688

Level 2