- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

enter mortage interest and property tax for rent out a room

I rent out a room in my primary property this year. Assume it is 20% of my entire house. I also live here.

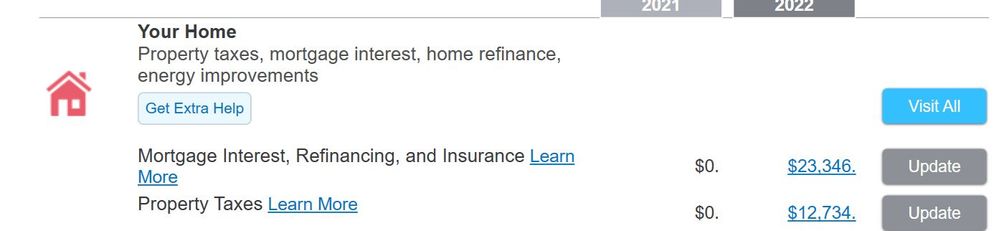

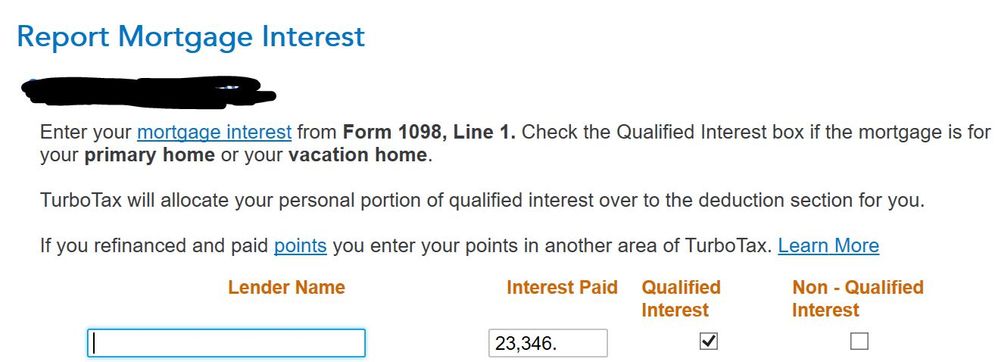

My interest payment is around 23000, but due to limit of using interest of 750000 in loan, the calculation by turbo tax is 19000 for 1098 interest. Should I split this 19000 manually across the property tax in rental (20%) and in the Deduction & Credits (80%)? TurboTax says it will automatically allocate it for me, but after I enter the entire amount (23000) in the rental, it does not show up in the Deduction & Credits. Or can I just do not enter anything inside the rental, but put them in the Deduction & Credits?

Besides, for the property tax, should I also use the similar calculation and split? Property tax seems to have a limit of 10000.

Deduction & Credits

Deduction & Credits Rental info in Schedule E in Wages & Income

Rental info in Schedule E in Wages & Income