- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Energy Transfer Partner K-1 questions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

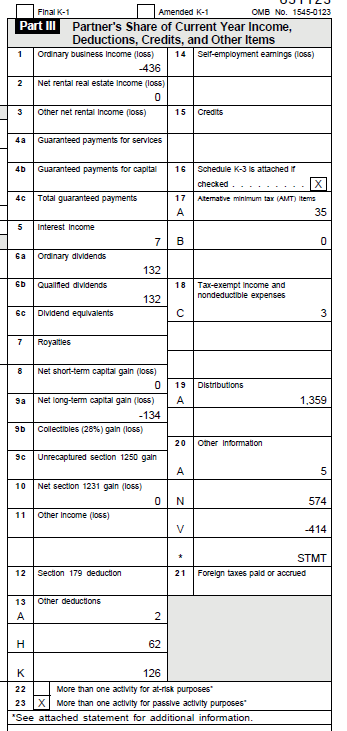

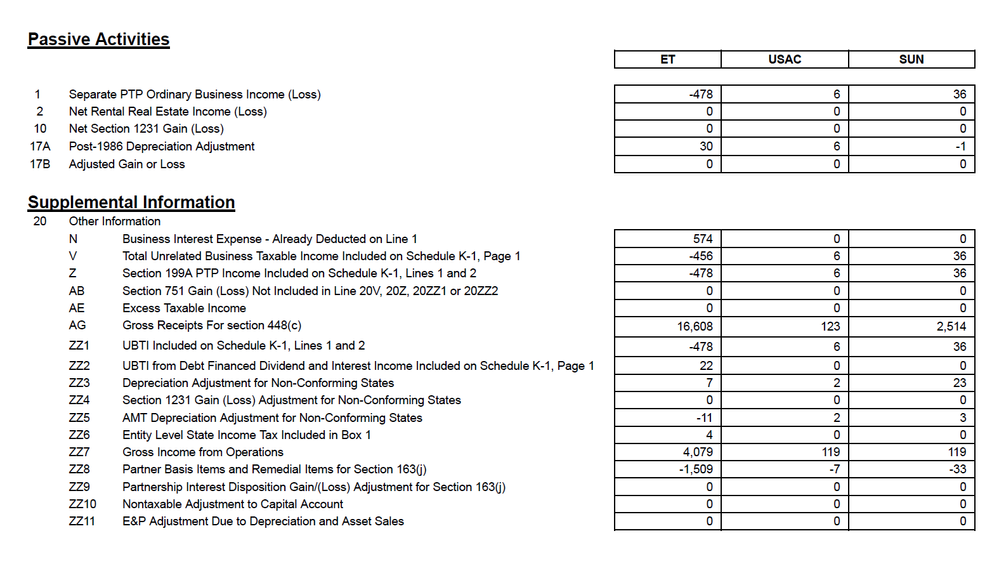

I've owned Energy Transfer Partners for several years now. Energy Transfer owns positions in two other MLPs, USA Compression Partners (USAC) and SUN (Sunoco LP). Sunoco reported income in Box 1 and Box 2 in the past. The Energy Transfer Partners K-1 contained one table that consolidated the overall data, plus a separate table where it broke out the data for the other MLPs. Based on input from this forum, I created four K-1 entries for Energy Transfer: ET, USAC, SUN Box 1 and SUN Box 2 (Real estate).

This year, Energy Transfer broke the data up separately. There is still the consolidated K-1, but the breakdown for the other MPLs doesn't show values for all of the sections on the main K-1.

I think the appropriate way to handle this is to fill in the data for the USAC, SUN Box 1, and SUN Box 2 first. Any items on the main K-1 that aren't attributed to USAC or SUN gets attributed to ET. This year, the SUN Box 2 is zero, so there is nothing to report. I also assume I still need to enter a K-1 into Turbotax for Sun BOX 2 with $0 for all entries. In general, I need to report it such that the totals end up matching the main table.

The K-1 called the separate breakout a "Schedule of Separate Passive Activities". All three are PTPs (Publicly Traded Partnerships) and there are limitations on passive activity losses. I don't fully understand how that works.

If anyone is familiar with Energy Transfer Partners, can you weigh in on whether I'm entering this data correctly? I have copied the two tables in the images below.

Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

most line dont matter which k-1 becuase they are not business items so you can put th amounts on the ET K-1

here are the boxes where it doesn't matter:

5 (interest income) ,6a(dividend income) ,6b Qualified dividends),9a Long-term capital gain 13A (cash contributions), 13H (investment interest expense), 13K Excess business interest expense - good luck with this because TurboTax does not handle this item nor the form. If the partnership reports EBIE to the partner, the partner is required to file Form 8990. See the Instructions for Form 8990 for additional information.

For tax years beginning after 2017, the partner’s basis in its partnership interest at the end of the tax year is reduced (but not below zero) by the amount of excess business interest allocated to the partner for the tax year, even if the partner isn't allowed a deduction for the allocated excess business interest in the year of the basis reduction. If the partner disposes of a partnership interest in which the basis has been reduced before all of the allocated excess business interest was used, the partner increases its basis immediately before the sale for the amount not yet deducted.

13C (nondeductible expenses), 19A (distributions)

since each is treated as a separate entity you are entitled to a QBI deduction for the SUN's QBI (20% of 36)

nothing for USAC since no QBI, Nothing for ET since a loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

The breakout for SUN 2023 DOES include a 'net rental real estate income (loss). Line 2: minus 2, a loss. This is odd, that the screenshot above does not. On my K-1, ET does as well, line 2, a gain of 1. USAC has none. How is it possible for one K-1, as above, to show no line 2 for SUN and another to show a loss? Any input very greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

I suspect you have more money invested in ET than I do. My guess is that for some columns, the amount rounds down to $0. If I had double the money invested, there might be a small dollar value there.

I assume your comment : "The breakout for SUN 2023 DOES include a 'net rental real estate income (loss). Line 2: minus 2, a loss." is referring to your K-1, not mine.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

@Mike9241 I searched Turbotax for Form 8990, couldn't find it. I take the standard deduction, so is Form 8990 required? If so, where do I find it? And if Form 8990 is not resident in Turbotax, how do I adjust my returns so that any changes due to 13K are reported?

Thanks,

Mike

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

Were you able to resolve your issue here or are you still needing guidance?

Make sure you have ran all updates.

If using TurboTax Online: Clear your cache and cookies. See this FAQ, for your particular browser.

If using TurboTax Desktop: Please see this FAQ.

If you still are not able to solve this, please call TurboTax Customer service. Here is a link: Turbo Tax Customer Service

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

I don't have all of the answers yet.

As best I can tell, Form 8990 is not in the Premier version that I have. The dollar amount of 13K is $126. I take the standard deduction. From what I have found in other discussions, the 13K amount could result in a tax deduction if I itemize. Since I don't itemize, it won't make any difference.

Do I have to report Form 8990 if I don't itemize on my taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

Yes, you do need to file a 8990 regardless on whether you itemize or not. Since you have an excess business expense of $126, you need to file Form 8990. Please read the instructions for Form 8990 and read under the heading on Who Must File.

You may view this entire paragraph to see if you qualify for the exceptions that are listed there.

Form 8990 is not supported in the individual version of Turbo tax but here is download form to download and include in your return. You won't be able to efile this return but , you will need to print and mail your return, along with this form, in accordance with the printing and mailing instructions you will be given when you are ready to file the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

@DaveF1006 , I have briefly looked at form 8990, I think I must file it. In general, will filing this form change my taxes? If so, it is an increase or decrease in what I owe. Since I have to wait on the K-3, I will file an extension.

Thanks,

Mike

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

Hi guys, read through all this...super helpful! We also have ET stock for 2023 and had a few more questions hoping to get clarity on. Thanks in advance!!

1. This is our first year with a K-1 form Energy Transfers, and read the the threads. I believe I need to enter them as 4 separate K-1s (ET box 1, USAC box 1, SUN box 1, and SUN box 2). I also read the thread where it talks about which items in Part III have no effect. But is it ok to enter box 18, and box 19 in all the K-1s or just the main ET K-1? Also it does not breakout A in box 20, does that get entered in all 4 as well?

2. In addition, I'm unsure how to breakout Sunoco because it has ordinary business income and net rental real estate income. Do I just duplicate all the breakouts except box 1 and box 2?

3. When it comes to Part II, I just wanted to check I enter all sections in all 4 K-1s or just the main ET K-1? Specifically partners share of profit, loss, and capital, partners share of liability, and partners capital account analysis.

4. Lastly, this K-1 does have business interest. It totals $577, do we need to fill out form 8990 or is that optional if we decide deducting the interest expense is not worth the manual hassle on TT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

Form 8990 is used to calculate the amount of business interest expense you can deduct and the amount to carry forward to the next year. Your business interest expense of $126 will reduce the amount of your taxable income by $126 thus will reduce the amount you owe slightly but not significantly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

To clarify, how many K-1's did you receive? Was it one or four separate?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

We received one K-1 from ET. In that package, it lists 3 PTPs (ET, USA Compression Partners, Sunoco) in the Schedule of Separate Passive Activities.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

For ET, we receive a single K-1 from Energy Transfer. Energy Transfer owns states in SUN and USAC. One of those reports amounts on both Line 1 and Line 2.

The community said we should treat this as if we received four different K-1s, because ET could sell off one or both of these assets. Also, TT tells you to enter separate K-1s if an entity has amounts in both Box 1 and Box 2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

You are correct. A single IRS K-1 may require multiple K-1 entries in TurboTax.

In both TurboTax Online Premium and TurboTax Desktop Premier, at the screen Choose Type of Activity, select This K-1 reports amounts in more than one of boxes 1, 2, and 3.

The instructions read:

Since your K-1 reports amounts in more than one of boxes 1, 2, or 3, the partnership/LLC is involved in more than one type of activity. You should treat each activity separately in TurboTax.

Enter the business activity amount, box 1, on one K-1

Enter real estate rental activity amount, box 2, on another K-1

Enter other rental activity amount, box 3, on a third K-1.

In addition, you would be able to enter two business activity amounts, box 1, that is reported on one K-1. Hopefully, your attachments will provide all of the additional information that you need including EIN numbers, if necessary.

You may find that individual section 199A information is reported for each business activity. The entries on the K-1 are reported on two K-1 entries into the TurboTax software.

Original K-1 EIN 1 EIN 2

Box 1 $1,000 = $500 $500

Box 4 $100 = $75 $25

Box 5a $200 = $150 $50

Box 5b $100 = $75 $25

W-2 wages $50,000 = $25,000 $25,000

UBIA $100,000 = $50,000 $50,000

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Nem2

New Member

VAer

Level 4

Tax_Lego

Returning Member

MojoMom777

Level 3

bubbawizard

Level 1