- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Transfer Partner K-1 questions

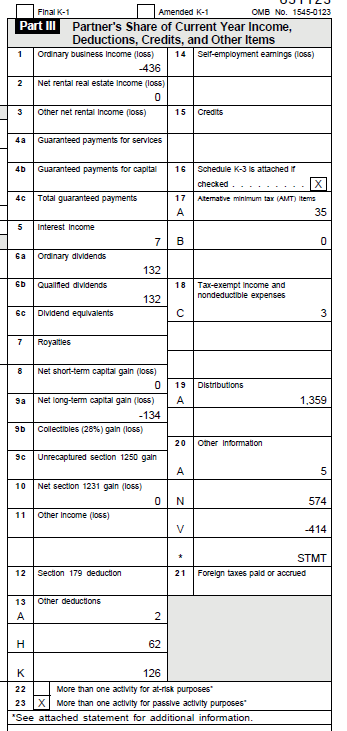

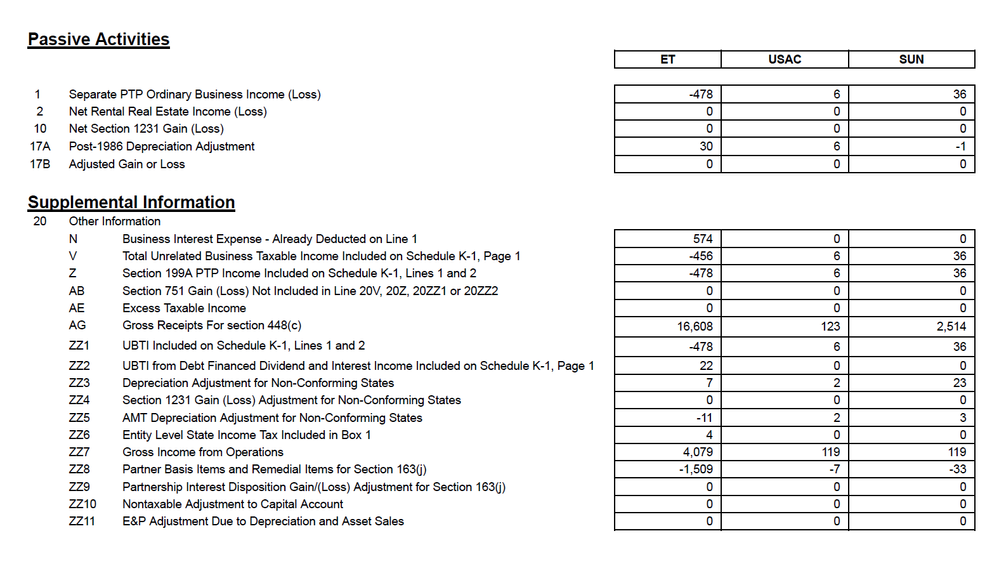

I've owned Energy Transfer Partners for several years now. Energy Transfer owns positions in two other MLPs, USA Compression Partners (USAC) and SUN (Sunoco LP). Sunoco reported income in Box 1 and Box 2 in the past. The Energy Transfer Partners K-1 contained one table that consolidated the overall data, plus a separate table where it broke out the data for the other MLPs. Based on input from this forum, I created four K-1 entries for Energy Transfer: ET, USAC, SUN Box 1 and SUN Box 2 (Real estate).

This year, Energy Transfer broke the data up separately. There is still the consolidated K-1, but the breakdown for the other MPLs doesn't show values for all of the sections on the main K-1.

I think the appropriate way to handle this is to fill in the data for the USAC, SUN Box 1, and SUN Box 2 first. Any items on the main K-1 that aren't attributed to USAC or SUN gets attributed to ET. This year, the SUN Box 2 is zero, so there is nothing to report. I also assume I still need to enter a K-1 into Turbotax for Sun BOX 2 with $0 for all entries. In general, I need to report it such that the totals end up matching the main table.

The K-1 called the separate breakout a "Schedule of Separate Passive Activities". All three are PTPs (Publicly Traded Partnerships) and there are limitations on passive activity losses. I don't fully understand how that works.

If anyone is familiar with Energy Transfer Partners, can you weigh in on whether I'm entering this data correctly? I have copied the two tables in the images below.

Thanks.