- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Does your program take into account?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does your program take into account?

Does your program take into account that President Trump signed the massive COVID relief bill into law, which included a work-around: a “lookback rule” that allows filers to use either their 2019 or 2020 income for tax purposes. In regards to the EIC Tax Credit. or has T/T been updated to account for this in filing?

The earned income tax credit is a refundable tax credit for low- and moderate-income workers. (For 2020, the earned income tax credit ranges from $538 to $6,660, depending on income and number of children.) To qualify for either the EITC or Child Tax Credit, you need earned income. Unemployment benefits are not considered earned income, but they are taxable. So a taxpayer with a big chunk of income from unemployment and little “earned” income could face a sizable tax bill and little in the way of credits to offset it.

The earned income tax credit is a refundable tax credit for low- and moderate-income workers. (For 2020, the earned income tax credit ranges from $538 to $6,660, depending on income and number of children.) To qualify for either the EITC or Child Tax Credit, you need earned income. Unemployment benefits are not considered earned income, but they are taxable. So a taxpayer with a big chunk of income from unemployment and little “earned” income could face a sizable tax bill and little in the way of credits to offset it.

Topics:

posted

February 13, 2021

11:21 AM

last updated

February 13, 2021

11:21 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does your program take into account?

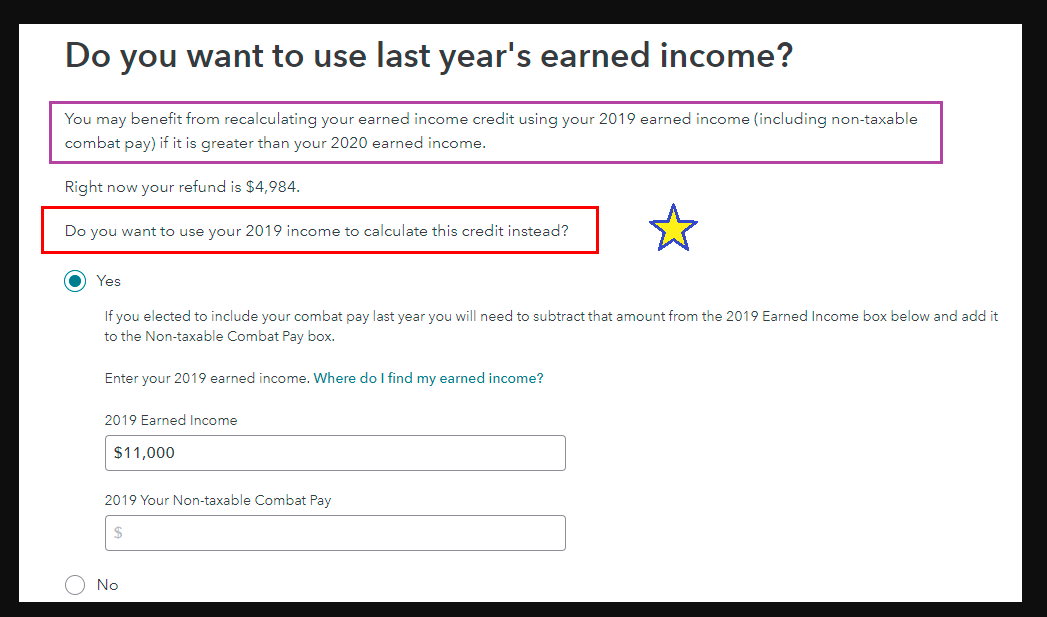

You can use your 2019 earned income to claim the EIC for 2020. TurboTax has been updated to allow the "look back rule".

Here are the steps to follow:

- Sign into your TurboTax account > Select Search at the top right

- Type earned income tax credit

Select Jump to earned income tax credit

If you qualify for the EITC, you will see a screen that asks if you want to use 2019 earned income and select yes to use 2019 earned income to have TurboTax calculate the 2020 EIC.

February 15, 2021

1:05 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dcgelectriccorp

New Member

Omar80

Level 3

chinyoung

New Member

sacap

Level 2

PCD21

Level 3