- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Do I need to purchase TurboTax Desktop to allow me do the cost segregation analysis form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to purchase TurboTax Desktop to allow me do the cost segregation analysis form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to purchase TurboTax Desktop to allow me do the cost segregation analysis form?

No, you can use TurboTax Online, but the cost segregation analysis isn't a tax form that you can fill out in any program.

It's a method of accelerating depreciation deductions by breaking down depreciable property into its smallest components and depreciating them individually.

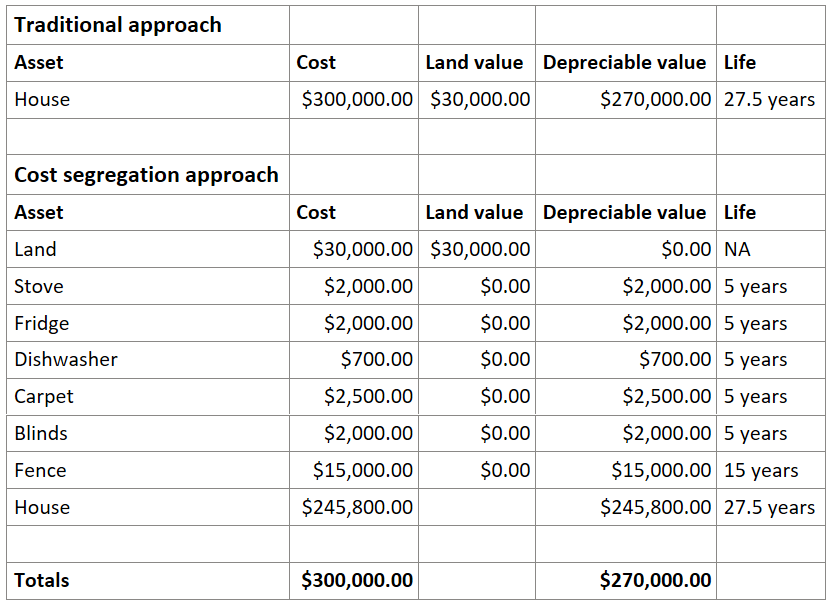

For example, if you buy a house to rent out, normally you would list the entire property as a single asset depreciable over 27.5 years.

In the cost segregation method, you would list the different components as separate assets and assign a portion of the total cost to each component. See the spread sheet below for an example.

If you want to do this, you need to create a spreadsheet similar to the one below and make sure your totals add up to the amount you paid for the entire property. Then you enter each asset separately in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dtjamieson

Level 1

flin92

New Member

11486

Level 2

likesky1010

Level 3

bne4632

Level 1