- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Do I need to divide qualified dividends if married filing separately and dividing ordinary dividends?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to divide qualified dividends if married filing separately and dividing ordinary dividends?

In Turbotax, there is an "I need to adjust these dividends" function for adjusting overall dividend amount but there is no step in the workflow that adjusts the amount of qualified dividends. However, in form mode, I notice that Box 1b includes an "adjusted qualified dividends" line. Is there a way to get to that line? Do we need to manually adjust qualified dividends if dividing ordinary dividends?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to divide qualified dividends if married filing separately and dividing ordinary dividends?

TurboTax will adjust your qualified dividends for you when you make an adjustment for ordinary dividends. There is no need to make a second adjustment.

You can make a manual adjustment in Forms mode. Tap Form 1099-DIV to change the amounts in Box 1b.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to divide qualified dividends if married filing separately and dividing ordinary dividends?

TurboTax will adjust your qualified dividends for you when you make an adjustment for ordinary dividends. There is no need to make a second adjustment.

You can make a manual adjustment in Forms mode. Tap Form 1099-DIV to change the amounts in Box 1b.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to divide qualified dividends if married filing separately and dividing ordinary dividends?

Thank you!

Do other consolidated 1099 numbers, eg foreign tax paid, also get divided the same as total ordinary dividends division?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to divide qualified dividends if married filing separately and dividing ordinary dividends?

TurboTax will ask you to enter the amount of foreign tax paid. It does not split this automatically.

The other numbers split.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to divide qualified dividends if married filing separately and dividing ordinary dividends?

What if I have a joint stock account with my girlfriend, but includes only my Soc. Sec. #?

The dividend portion is split evenly by Turbotax, but what about the income or loss?

We have a $4700 loss to be split evenly.

Suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to divide qualified dividends if married filing separately and dividing ordinary dividends?

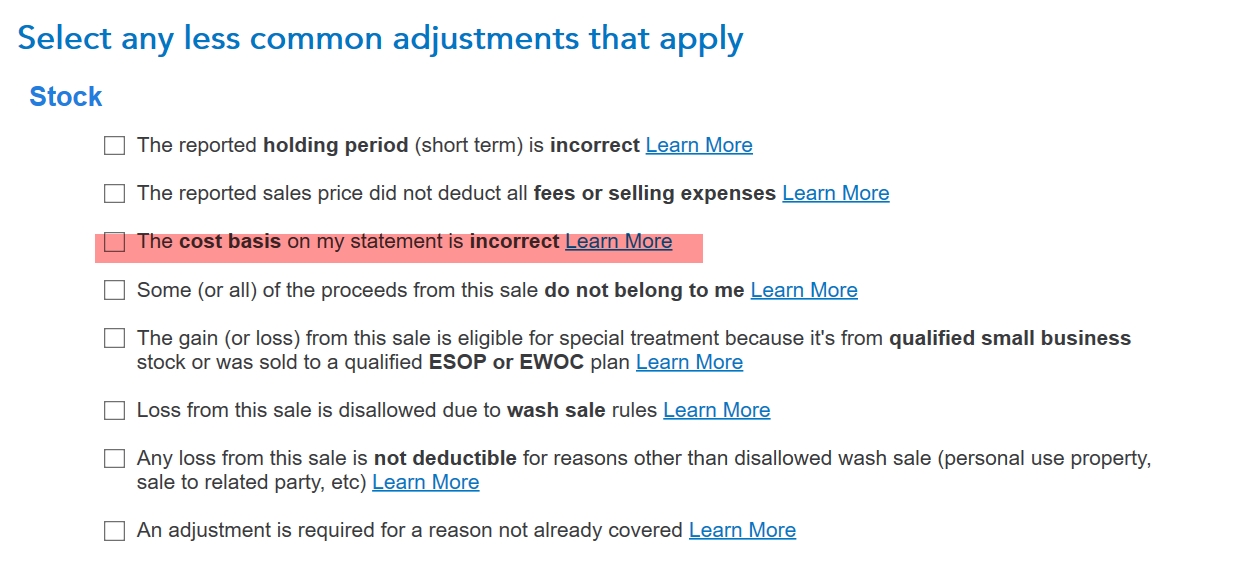

The person whose social security number is listed on the form 1099-B needs to report the full amount of the sales proceeds and cost basis listed on the form, but then adjust the cost basis to reflect their share of the loss. You will see an option for this after your enter your sales proceeds and cost listed on the form 1099-B as follows:

The other person who did not receive the form 1099-B would enter the investment sales without a 1099-B entry, and list their share of the proceeds and cost basis.

The other person who did not receive the form 1099-B would enter the investment sales without a 1099-B entry, and list their share of the proceeds and cost basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

claire-hamilton-aufhammer

New Member

blankfam

Level 2

dlz887

Returning Member

sierrahiker

Level 2

abcxyz13

New Member