- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

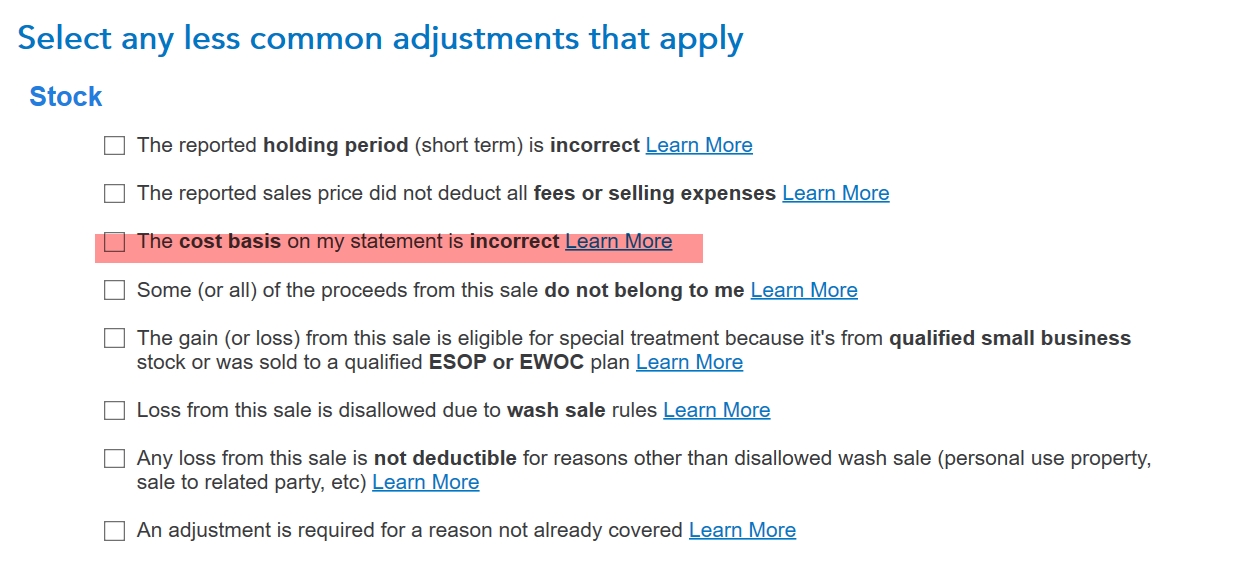

The person whose social security number is listed on the form 1099-B needs to report the full amount of the sales proceeds and cost basis listed on the form, but then adjust the cost basis to reflect their share of the loss. You will see an option for this after your enter your sales proceeds and cost listed on the form 1099-B as follows:

The other person who did not receive the form 1099-B would enter the investment sales without a 1099-B entry, and list their share of the proceeds and cost basis.

The other person who did not receive the form 1099-B would enter the investment sales without a 1099-B entry, and list their share of the proceeds and cost basis.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 8, 2022

5:09 PM

1,009 Views