- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Disability Pay

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability Pay

My wife received disability payments in 2021, reported on a 1099-misc. The amount was reported on line 14, as parsonage exclusion. How is this entered into turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability Pay

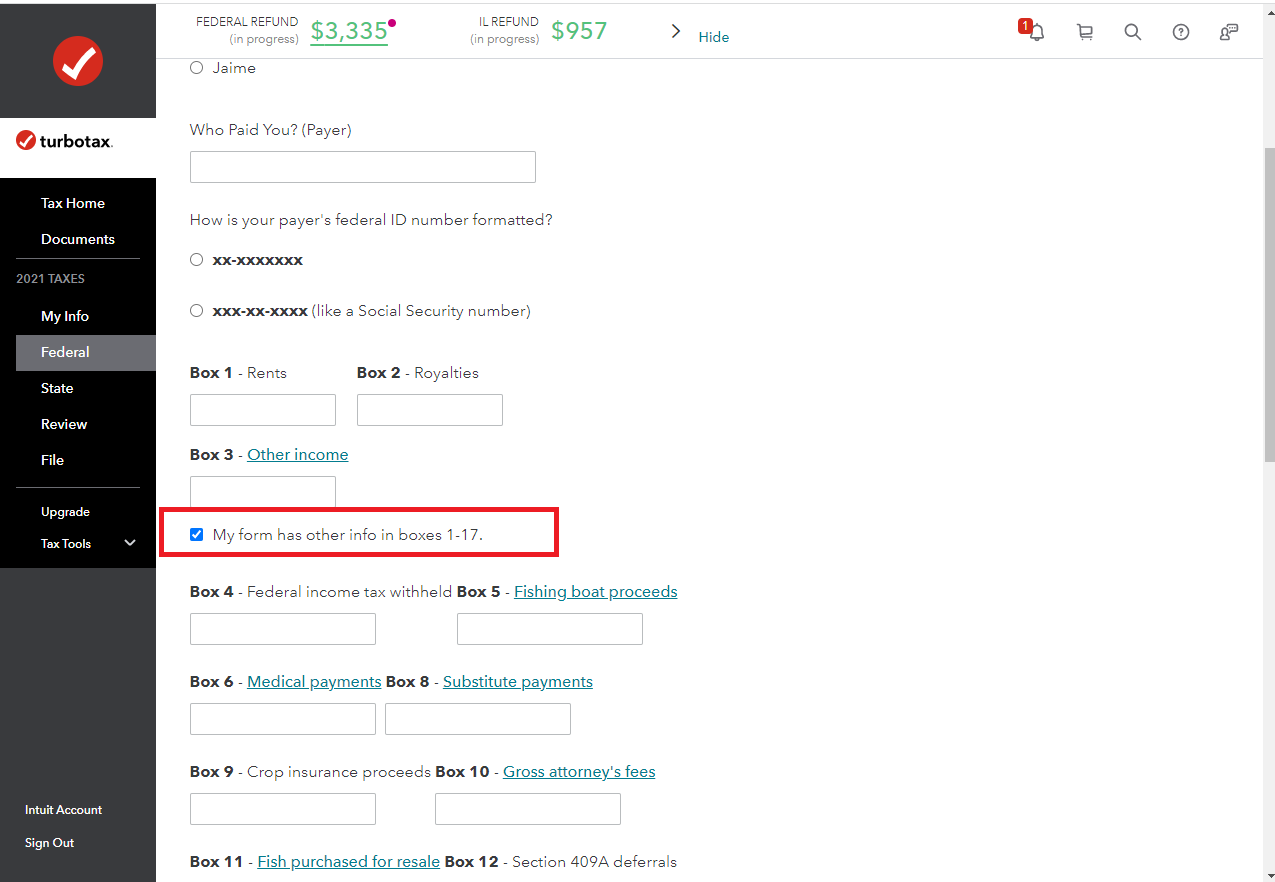

In TurboTax, when you enter your wife's 1099-MISC, check the box My form has other info in boxes 1-17. Scroll down to Box 14, Nonqual deferred comp. For instructions on how to enter the 1099-MISC, click here.

- Per IRS Form 1099-MISC instructions, Box 14 Shows income as a nonemployee under an Nonqualified Deferred Compensation (NQDC) plan that does not meet the requirements of section 409A. Any amount included in box 12 that is currently taxable is also included in this box. Report this amount as income on your tax return. This income is also subject to a substantial additional tax to be reported on Form 1040, 1040-SR, or 1040-NR.

- Please see the following TurboTax FAQ Is disability income taxable?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability Pay

My apologies - this disability pay was reported on a W2 rather than a 1099. The amount is reported in box 14, as a household furnishings exclusion for a pastor. It is not reported in box 1, which is blank. I am wondering, if part of this amount is taxable to us under IRS guidelines, how to get that entered into TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability Pay

Disability compensation may or may not be taxable. It sounds like it was misreported as parsonage allowance, which normally is not taxable, but you should report it by reference to what it was even if it was reported wrong.

Disability compensation is typically taxable if provided by your employer as opposed to from an insurance company to whom you have paid premiums for the coverage.

To report the benefits as taxable, you can enter it as Other Income by following these steps in TurboTax:

Go to the Income and Expenses section of TurboTax

- Choose Less Common Income

- Choose Miscellaneous Income, 1099-A, 1099-C

- Choose Other reportable Income

Enter a description for the income and the amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Dan S9

Level 1

JeanA_2009

Level 1

VJR-M

Level 1

zcrush86

New Member

gingmoe001

New Member