- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Depreciation and Amortization

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation and Amortization

I purchased capital equipment in third quarter of 2020, 7 years Propoerty MQ Method: 200 DB I received a

$3, 411 Deduction. I am working on 2021 taxes. I purchased new equipment in 2021 which I listed: When asked if I wanted to take this annual election I opted YES.

My Question is I don't see anywhere where I get the next 6 years of depreciation for future taxes On the equipment purchased in 2020. Also, I am paying every month on this equipment which is around $18,000 a year...I am writing off the interest on this equipment but can I expense the annual cost. Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation and Amortization

if you are paying $18K per year or so on the financing the principal amount you are financing is part of the depreciable cost and depreciation should have started in the year the equipment was put into service so it seems that 2020 and 2021 were reported incorrectly. see a tax pro becuase this needs to be corrected. you can not expense the principal payments as they are paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation and Amortization

Thanks for replying but I don't think you understood the question. Thanks anyway

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation and Amortization

If you transferred 2020 into 2021 the depreciation should be be automatically calculated each year. Are you doing a personal return with Schedule C or a separate Business return?

For Schedule C the depreciation is on form 4562 and goes to Schedule C line 13.

4562 is a summary of current depreciation and doesn't list the individual items. If you are using the Desktop program you can get the Asset Life History.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation and Amortization

Oh you are doing a 2021 return? Then you have to be using the Desktop installed program. Did you start by transferring the .tax2020 file? If not or you didn't use Turbo Tax for 2020 you will need to enter the 2020 Asset manually and enter the prior deprecation taken.

Using the Desktop program you can get an Asset Life History worksheet but you have to do it in Forms Mode, click Forms in the upper right (upper left for Mac) You can't get detailed worksheet showing all the assets but you can get the Asset Life History on each one. It doesn't print out with your return or save in the pdf. So you have to print each Asset Life History individually.

Scroll down the list of forms in your return to a Asset Entry or Asset Worksheet and open it. Then down on line 14 is a QuickZoom button to Asset Life History, Click on that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation and Amortization

Thanks you got it! Yes you are right on. That's why it didn't transfer to the new year tax and I couldn't find were to put it. will try it now....I thought I had lost my mind.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation and Amortization

so volvogirl - still a little confused. Do I go into the 2021 program and enter the asset (from 2020) into the space with all the 2020 data? Then in the asset entry form I will see a 2020 life history? Sorry still a little confused. I am not very well versed with any of this...I am like a first grader I need exact step by step approach Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation and Amortization

So you didn't transfer from your 2020 return? I'm not sure how it works. But you add it as a new asset in the step by step interview with the 2020 date you bought it. It should ask how much depreciation was already taken.

What version are you using? The Home & Business version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation and Amortization

Yes Home and Business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation and Amortization

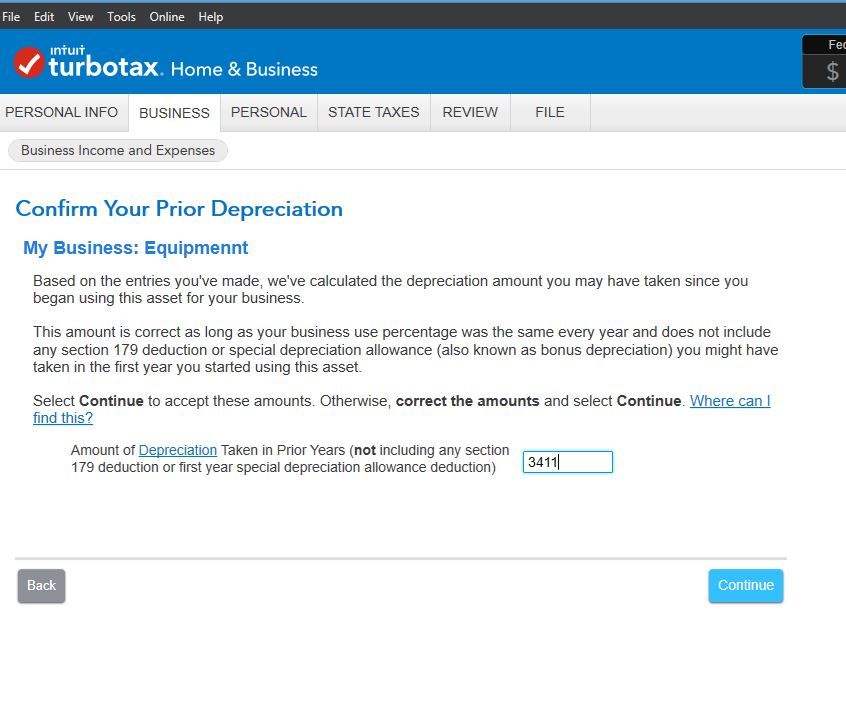

Ok I opened my 2021 Home & Business program. Just add it as a new asset with the cost and date, fill out the screens and you will come to the attached screen

Go to Business tab- then Continue

Choose Jump to Full List -or I'll choose what I work on

Then…..

Business Income and Expenses - Click the Start or Update button

Then click EDIT by the business name and the next screen should be a list of topics,

Business Profile, Income, Inventory/Cost of Goods Sold, Expenses, Assets, and Final Details last.

Click Start or Update by Business Assets

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

maureenjasie

New Member

Numbertwo

Returning Member

Reacher237

Level 1

mikell228

Level 1

paulbgoodman

New Member