- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- depreciated rental assets

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciated rental assets

i am using TT Premier. I took a rental out of service in 2018 and repaired it during 2019 and did not take any depreciation. i ended up selling rental property in 2020. Will, 1) TT will pick up my depreciation data from 2018 or will i have to renter depreciation data manually; and 2) IRS assume I took depreciation for 2019 even though I took it our of service?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciated rental assets

Your answer depends on whether your rental property is still in the rental section of TurboTax and what you did in TurboTax in 2019.

Check your 2019 tax return for a Schedule E for the property.

TurboTax will automatically calculate depreciation so if you had the rental listed in TurboTax in 2019 you may have filed a return with no rental income or expenses except depreciation, unless you told TurboTax you took the rental out of service.

TurboTax will calculate 2020 deprecation as well.

If that’s what happened, you can amend your 2019 return.

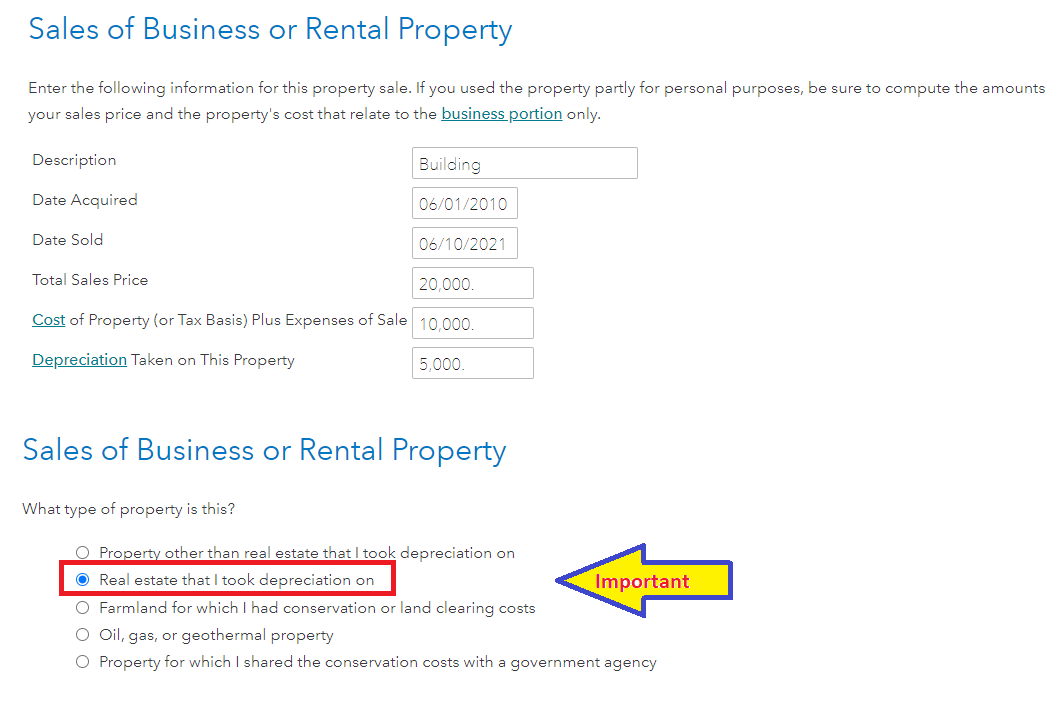

If you removed the rental in 2019 from TurboTax you can enter the disposition under Sale of Business Property. You can also delete the rental from 2020 if it’s still there and do the same thing since it was not used as a rental since 2018. Use the total deprecation (accumulated and amount claimed for 2018) from your 2018 return.

- Click on Federal in the left column

- Wages & Income at the top

- Scroll down to Other Business Situations

- Select Sale of Business Property

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciated rental assets

I took it out of service on 1/1/2020 and sold it on 3/4/2021. I wouldn't complete it under Sale of Business Property but rather sale of second home, correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciated rental assets

No, you would report it under Sale of Business Property in TurboTax. Follow the instructions provided by our awesome Tax Expert @ErnieS0. You must find the depreciation used on the rental property from the time it was rented until you removed it from service (1/1/2020). The depreciation must be recaptured whether or not it was available for rent in 2019 - through the sale date in 2021.

- Click on Federal in the left column

- Wages & Income at the top

- Scroll down to Other Business Situations

- Select Sale of Business Property

Be prepared with the sales price, sales expenses, cost (add the improvements cost), depreciation used through 2018 (& 2019 if you used that on your tax return in 2019) and the date acquired and sold.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciated rental assets

thank you. for my better understanding, is there a situation where I would sell it as a second home instead of a sale of a business property?

also, can i add allowable closing costs to my cost basis for both when I purchased the home as well as when I sold it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciated rental assets

If you had changed the rental to personal use, it could now be a second home this year, but you would still have had to report that transaction the year you turned the rental into personal use. It would have been like "selling" the rental to yourself, so you would not get any benefit by doing that. You would have still been charged with "Depreciation Recapture".

Some closing costs, when purchased, are added to the basis, (which would have been included with the depreciation basis of the rental) and selling closing costs are subtracted from the selling proceeds you received from the sale.

Here is some more information:

"You can reduce your selling price by the amount of the closing costs paid. Lower selling price produces a lower profit, which in turn lowers your tax bill. .

The following is a list of closing costs that can be deducted from your sales price assuming you paid them.

Attorney fees in connection with obtaining property

-

- Commissions

- State stamp taxes and transfer taxes

- Tax service fees

- Title policy fees or title insurance

- Miscellaneous abstracts of title, surveys, recording of deed"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciated rental assets

uh oh...closing costs, when purchased, were not added to the basis, (which would have been included with the depreciation basis of the rental)...can i still add those closing costs to my cost basis for selling the house?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciated rental assets

How long was it a rental?

The basis of the property is listed when the property becomes a rental.

Depreciation starts on the property when it becomes a rental and is depreciated over 27.5 years.

Depreciation does not stop when the property is "Idle" only when it is retired from service.

When you sell the property, unless you sell for less than the remaining value, you'll have a gain and/or depreciation recapture.

So if the property was purchased for 100,000 and depreciated down to 60,000, anything over 60,000 up to 100,000 is depreciation recapture and anything over 100,000 is a gain.

Depreciation is taxed at income rate, gain is taxed as Capital Gain.

If you try to add to the basis now, you'll need to add the additional depreciation for that additional basis when you report the sale. That most likely means additional depreciation recapture.

According to the IRS:

"Retired From Service

You stop depreciating property when you retire it from service, even if you haven’t fully recovered its cost or other basis. You retire property from service when you permanently withdraw it from use in a trade or business or from use in the production of income because of any of the following events.

-

You sell or exchange the property.

-

You convert the property to personal use.

-

You abandon the property.

-

The property is destroyed."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciated rental assets

it was a rental from 2010 thru 2019. it sat there empty (i worked on it) for a year 2020. i did not try to rent it as i was working on it although rather slowly. i finally sold it in 2021. for the 2020 tax year i told TT that "I converted this property from a rental to personal use in 2020" and I dated the conversion date 1/1/2020 (although i did not live in it one day, therfore I thought I was treating it as a 2nd home instead of a rental). as a result for 2020 my depreciation amount was $432 whereas my depreciation amount for 2019 (when I was still renting it out) was $8109.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

alvin4

New Member

melillojf65

New Member

iqayyum68

New Member

flin92

New Member