- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

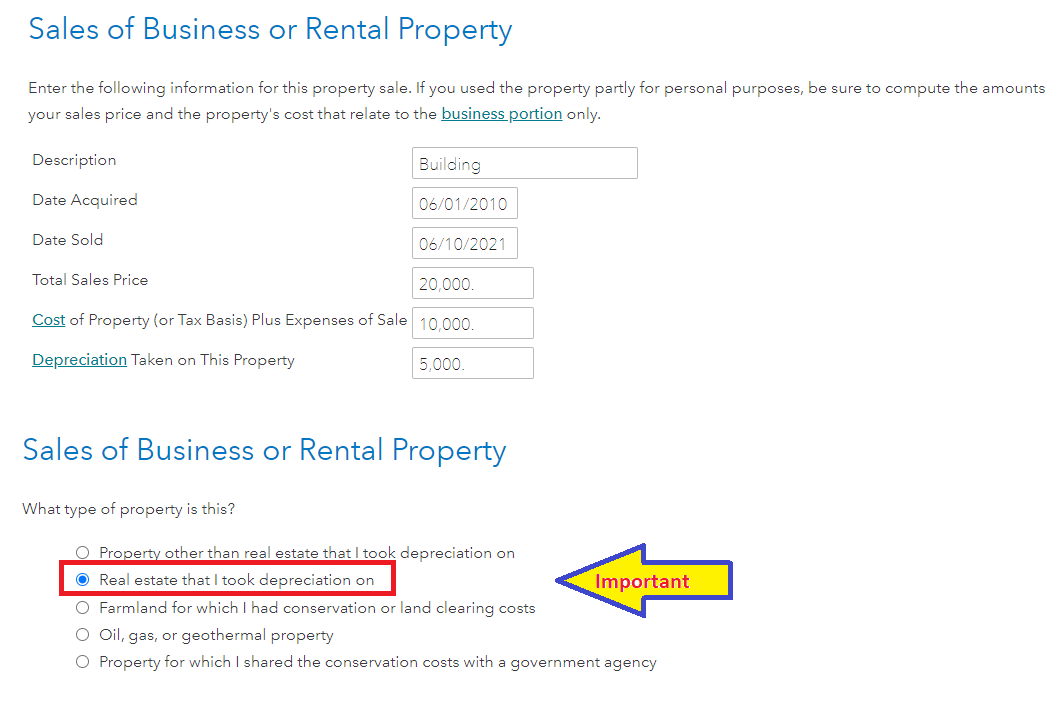

No, you would report it under Sale of Business Property in TurboTax. Follow the instructions provided by our awesome Tax Expert @ErnieS0. You must find the depreciation used on the rental property from the time it was rented until you removed it from service (1/1/2020). The depreciation must be recaptured whether or not it was available for rent in 2019 - through the sale date in 2021.

- Click on Federal in the left column

- Wages & Income at the top

- Scroll down to Other Business Situations

- Select Sale of Business Property

Be prepared with the sales price, sales expenses, cost (add the improvements cost), depreciation used through 2018 (& 2019 if you used that on your tax return in 2019) and the date acquired and sold.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 11, 2022

1:58 PM