- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Dependent Care FSA reimbursements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care FSA reimbursements

If I contributed $3000 to my FSA in 2022 but my sitter didn't provide me with my receipt until 2023 and that's when I got my reimbursement. How do I properly report that? Do I say that December 31, 2022 the account had $3000 even though I used it all thanks to the grace period so my claim was for 2022 and I'm now thoroughly confused.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care FSA reimbursements

When you received your receipt is irrelevant. What is important is that the money in your FSA was used for expenses in 2022.

You will enter your expenses incurred for 2022 dependent care on your return.

[edited 2.9.23 | 4:55am]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care FSA reimbursements

Just so I understand. I can indicate that $3,000 was in my account on December 31, 2022 and also claim that I used all of those funds for 2022 expenses? I just don't want to look like I'm contradicting myself and make a mess of things.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care FSA reimbursements

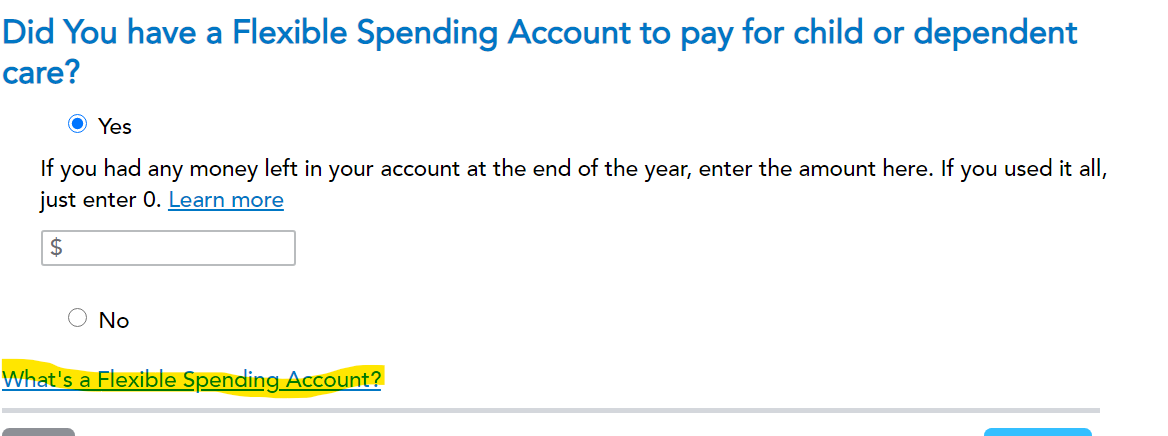

Where are you being asked to indicate how much was in your account as of December 31, 2022? I'm not finding that question when I enter a test scenario.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care FSA reimbursements

In the walk-through for Personal Income it asks if I had a Flexible Spending Account and when selecting yes an additional question but now reading the explanation of the type of answer that would typically be given it says to not include money that you expect to be reimbursed so I will indicate 0 since the full amount was reimbursed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent Care FSA reimbursements

You are correct to enter 0 if you were reimbursed for the entire amount that was in your Flexible Spending Account (FSA). If you select What is a flexible Spending Account?, it will explain the amount that should be entered in the box.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mybtrinh

New Member

jenshinto

New Member

zabe2057

Returning Member

mommycarebare

New Member

AmeriKiwijp

New Member