- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Contributions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributions

I've entered all my cash contributions but the total amount which is on Schedule A is shaded in pink indicating, I guess, that something is still missing. But what?

We are itemizing as our total deductions exceed the minimum standard deduction.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributions

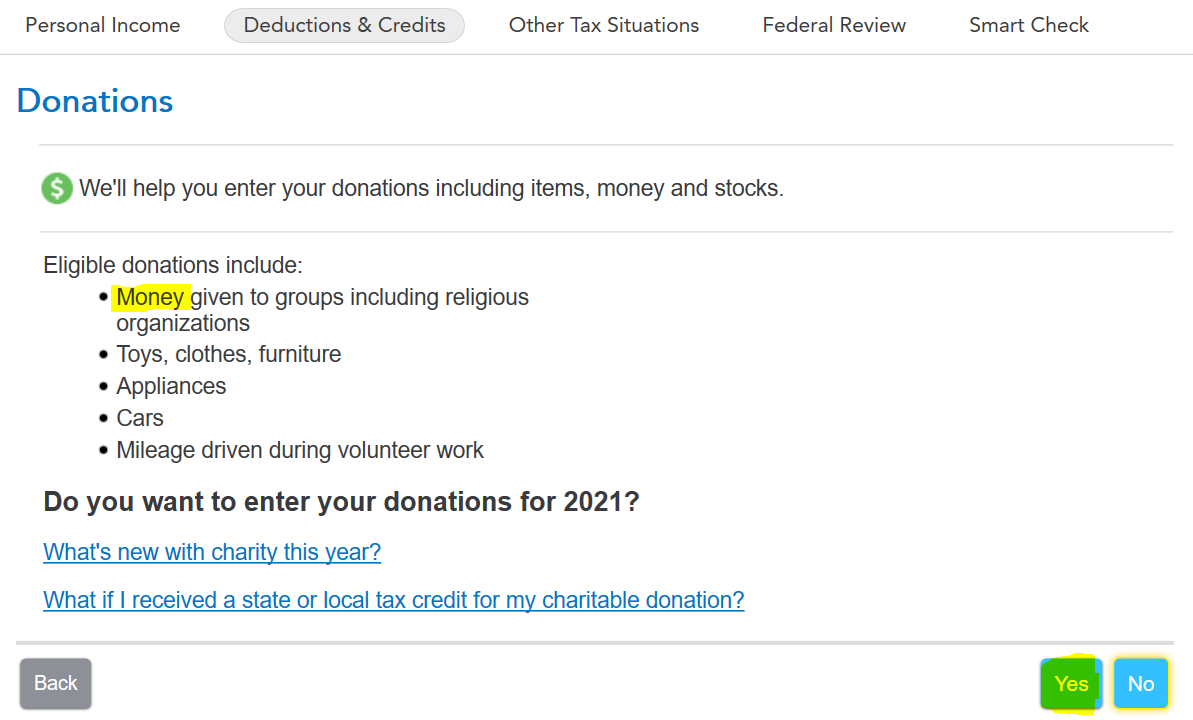

Go through the interview to enter your charitable donations. If you are trying to enter directly on Schedule A, you are probably getting an error due to a missing charity profile (TurboTax needs to know information about the organization you gave cash to).

In the search box, search for donations and use the Jump to donations link to go through the interview and enter the details of all of your donations, cash or property. TurboTax will put all the information on Schedule A and calculate your deduction.

Can I deduct donations to charity?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributions

I used the step-by-step method to enter all donations, including a couple of in-kind donations and some mileage. The total on Sch A is still pink.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributions

You are in TurboTax Desktop. Go to Forms and select Schedule A.

Right-click one of the pink entries and select Data Source.

A box will appear that tells you the source of the entry.

Even if there are no error messages, it will tell you the source of the entry. That is where you go to review, correct or delete and re-enter the data.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributions

OK. I see the source of the error. The total on the worksheet was different from the Total on Schedule A. But how do I get them to agree? I tried changing the total on Sch. A to agree with the worksheet (adjusting for the rounding) but the amount on Sch. A remained pink. Shouldn't the worksheet total automatically forward to Schedule A?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributions

Yes, worksheet entries should transfer to Schedule A.

You could Delete Schedule A in Forms mode, and make changes on the worksheet (or in the step-by-step entries) to re-generate a correct Schedule A.

Since we can't see your return in this forum, if this doesn't resolve your issue, feel free to post again and we'll try to help.

Click this link for more info on Schedule A.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

W16VA

Level 2

jedelman10

New Member

crazyforpizza

New Member

pkliphon

Returning Member

dianalnorton

New Member