in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Colorado Charitable Contribution substraction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado Charitable Contribution substraction

I e-filed my Colorado State Taxes with Tubo Tax for the 2022 tax season. My total charitable contributions subtraction was greater than $5,000, so I understand I am to submit documentation confirming my contributions, but turbo tax did not provide any way for me to attach the documentation to my e-filing. How do i submit this documentation?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Colorado Charitable Contribution substraction

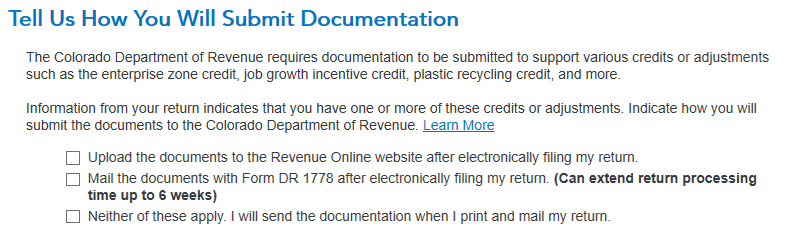

At the screen Tell Us How You Will Submit Documentation under the Colorado state income tax return, you see three options.

- You may upload the documents to the Colorado Department of Revenue website,

- You may mail the documents with Form DR 1778 after electronically filing the tax return, or

- You may attach the documents to your paper-filed tax return.

See here.

Colorado Department of Revenue Income 48: Charitable Contribution Subtraction states:

Documentation

Submit this documentation when you file your return using the E-Filer Attachment function of Revenue Online, or attach the documentation to your paper Colorado income tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

IY

Level 2

bobjohnson25

New Member

av8rhb

New Member

Raph

Community Manager

in Events

les_matheson

Level 2