- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

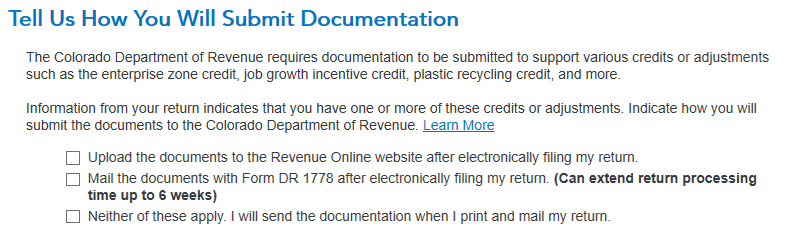

At the screen Tell Us How You Will Submit Documentation under the Colorado state income tax return, you see three options.

- You may upload the documents to the Colorado Department of Revenue website,

- You may mail the documents with Form DR 1778 after electronically filing the tax return, or

- You may attach the documents to your paper-filed tax return.

See here.

Colorado Department of Revenue Income 48: Charitable Contribution Subtraction states:

Documentation

Submit this documentation when you file your return using the E-Filer Attachment function of Revenue Online, or attach the documentation to your paper Colorado income tax return.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 12, 2023

8:30 AM