- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Check This Entry: TY22 CLCO Wksht Row B AMT

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

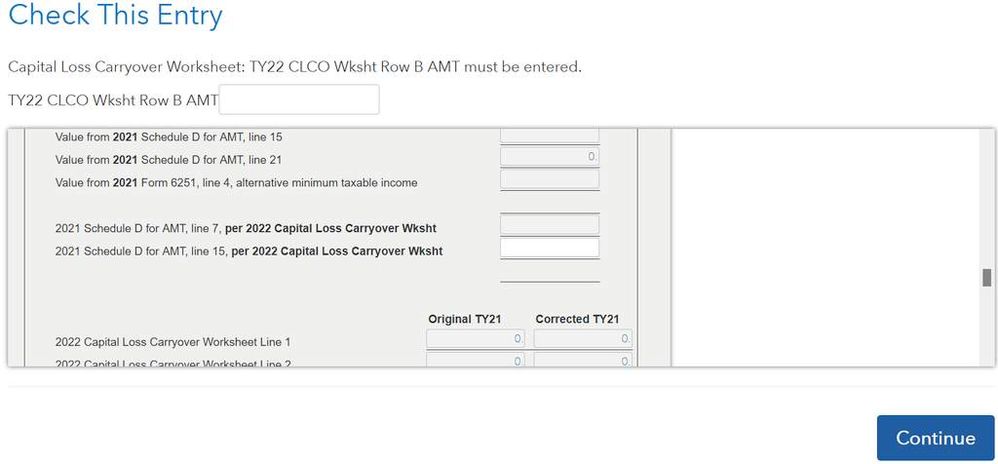

While trying to complete my taxes for last year using Turbo Tax Online, when it gets to the review portion, I'm getting to a screen that says:

Check This Entry

Capital Loss Carryover Worksheet: TY22 CLCO Wksht Row B AMT must be entered.

with a textbox to enter this "TY22 CLCO Wksht Row B AMT". The little window below with another textbox is labeled "2021 Schedule D for AMT, line 15, per 2022 Capital Loss Carryover Wksht".

What is it looking for here? (I have also gotten the same thing asking for "Row A AMT" once or twice, and it will go on to ask about the lines above that in the little window, too.) I have never had to pay the AMT, so ... ??

I found the pages to re-download my previous years' taxes and included all the forms ("Include government and TurboTax worksheets"). Looking through all that for my 2022 taxes, there are no forms in there labeled "Capital Loss Carryover Worksheet". I do see:

- Schedule D AMT: Capital Gains and Losses as Refigured for the Alternative Minimum Tax - this looks pretty much just like the regular Schedule D, with a couple numbers changed

- Capital Loss Carryforward Worksheet - this sounds similar, but there's no "Row B" or "Row" anything (and no line 15). There are columns for "Regular Tax" and "Alternative Minimum Tax".

- Federal Carryover Worksheet - this has a "Loss and Expense Carryovers" section, and the lines have "a" and "b" (i.e. there's a "12a", "12b", "13a", "13b", etc), so maybe something in here??

- Smart Worksheets - this has a couple tables, "Capital Gains (Losses) Smart Worksheet" and "Alternative Minimum Tax (AMT) Smart Worksheet", that do have rows labeled "A", "B", etc. But if one of these is the correct one, there are multiple columns with different numbers, and no column headers, so I'm still not sure which one would be the correct one

I saw some other questions like this (made a new one so I could add as much info as I could without hijacking someone else's), but no answers yet for what we're supposed to put in here. The "Help" link has nothing.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

Seeing the same thing here. What does it mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

Also seeing this for Row A. Any insight Intuit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

Same problem. I don't even care at this point and would gladly end all capital loss carryovers to just file and be done with it. But I don't even know how to do that. lol

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

Same issue, I found a related Reddit Thread but does not give a clear answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

I think "Row B AMT " is on the second page of the referenced worksheet. Thereafter I input all the requested items (line 7 and line 15 of schedule D, etc.)

No impact since I didnt have any CLCO from 2021 anyway.

Very confusing but hopefully inputs have no impact

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

This stuff really only applies to you if you trigger the Alternative Minimum Tax which it appears that you did not. Just enter the amounts from the respective lines of your schedule D from 2022 and the system will be able to calculate and it won't effect your taxes. Unless you trigger the AMT this year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

I am also a victim of this weird error message. It is not clear what the answer is, but it seems that TT is reacting on the fly. I started doing my taxes about two weeks ago and the error messages have changed during those two weeks. Also there is now a pop-up on one screen reading "Why asking for 2021 Schedule D AMT informaiton ". Note that the typo of "information" appears in the pop-up which, to me, is a flag that someone is working under pressure to address this glitch. Anyway, that pop-up in part reads "There was an (TT) issue fixed in early 2023 for AMT Capital Loss Carryover from 2021 to 2022. Some of the 2022 returns (filed before March 1, 2023) may have brought over inaccurate information...". For the record, I filed after March 1 and am getting these messages. My AMT carryover is clearly wrong and despite now even upgrading to the "Live Assisted" level, they are still wrong. I suspect TT is only now realizing the extent of their problem. So no solution here, but information not already in this post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

Ok, so what do I do, wait for a "fix"? I'm using the PC version of TT....

RobertB4444 said "Just enter the amounts from the respective lines of your schedule D from 2022", but no such Row A / Row B. Am I dense or just confused?

Also, is AMT short for Amount or is it referencing Alternative Minimum Tax?

Thx

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

I am also using the web version of Turbo tax 2023 and had this same issue. I was struggling to reprint the historical tax returns which consisted of the Governmental and TurboTax forms.

What I had to do was go to the Tax Home > Your tax returns & documents > click on 2021 > amend (change) 2021 return > amend using turbo tax oneline.

Now once you get into this page, it asks you why you are amending, ignore all that and click on the left side:

Click on tax tools > print center > print, save or preview this years return. Once in this next page you can print with all the more detailed forms.

Please note, I STILL couldn't find the worksheet, so I just went to the Schedule D AMT form with the header "Capital Gains and Losses as Refigured for the Alternative Minimum Tax". In this form I was able to find the fields the program was asking for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

Your answer is not specific enough. Which lines on Schedule D are you talking about?

I'm quite miffed at this. First of all Tax should be able to automatically retrieve these figures from past returns. I have been using TurboTax for years, and the returns and corresponding software remains on my computer.

Secondly, in the past, when the program asks for something like this there would be a question mark or other thing you could click labeled "where can I find this" or similar language. I strongly suspect Intuit has eliminated these help functions so as to get you to pay extra for "expert help". I paid more than $100 for the "Premiere" version. I'm not about to spend another penny for something that should be in the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

I also got this error and filed well after March 1st last year and did not trigger AMT. What I did was change the checkbox where it asked if I was impacted by the TY21>TY22 miscalculation from YES to NO. I ran the Federal check again and the error was gone.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

Regarding the question, "Is this return impacted by inaccurate TY21->TY22 conversion? (see help)"

What If I did not see that I could check 'no'? I started entering some numbers. Is it possible to go back and check 'no' and bypass all this nonsense? I was not affected by AMT (Alt Min Tax) last year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

To get to where you can change "Is this return impacted by Inaccurate TY21 > TY22 conversion" from YES to NO: Go into Forms View and pull up Capital Loss Carryover worksheet scroll down a bit and you will see the question. I had no CLCO from 2021 to 2022 so I don't see why it would have the YES checked.

I went to my 2023 return and changed the check to YES, and entered the requested TY21 values (except Form 6251 as I did not have one in TY21. Well.... the Original TY22 and Corrected TY22 columns had the exact same values. So as I suspected, this whole mess did not apply to my return. What a waste of time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check This Entry: TY22 CLCO Wksht Row B AMT

I'm in the same boat too. Although I've hit by AMT in TY21 and TY22, I don't have "2021 Schedule D for AMT".

I also looked for "2022 Capital Loss Carryover Worksheet", but I don't have it. What I have is "Federal Carryover Worksheet." I'm really confused.

What should I put in the "2021 Schedule D for AMT, line7, per 2022 Capital Loss Carryover Wksht"? To be clear, this year (TY23) I'm not on AMT .

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17708396698

Returning Member

wdahlen

Level 1

nmontagne

New Member

brockmar

Level 2

jaktax

New Member