- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

I am having the exact same problem. I answer the questions about the CARES distribution and the program does NOT account for the 1/3 income that should be added to this year's numbers.

Also, I assume that the FED TAX deducted from the distribution from last year was all applied to last year and that is not broken up into thirds, is it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

@777driver wrote:

I am having the exact same problem. I answer the questions about the CARES distribution and the program does NOT account for the 1/3 income that should be added to this year's numbers.

Also, I assume that the FED TAX deducted from the distribution from last year was all applied to last year and that is not broken up into thirds, is it?

No, the federal taxes withheld on the 2020 distribution was entered on the 2020 tax return. It is not spread out over 3 years.

In the Retirement income section make sure you entered the 1/3 of the distribution in both boxes.

If the 2020 distribution was from an account that was Not an IRA

2020 Form 8915E Line 9 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

If the 2020 distribution was from an IRA account

2020 Form 8915E Line 17 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

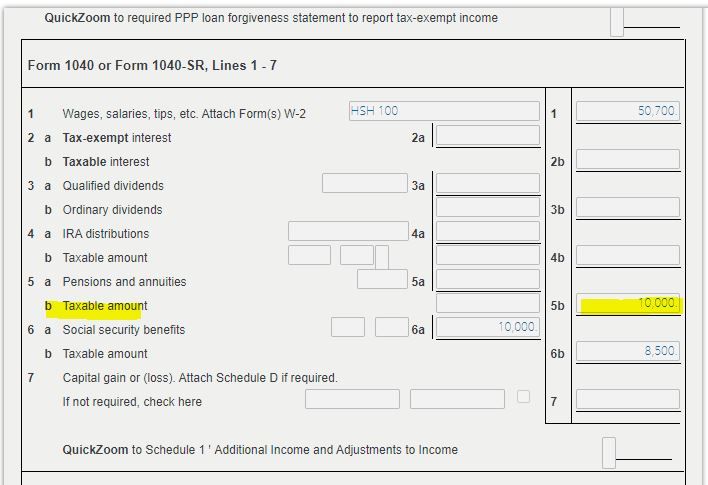

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

Thanks, that's what I figured.

Also, after opening the actual 1040 from in the program it does seem that the 1/3 distribution is on line 5b and is thus being accounted for properly.

I will report back if anything looks incorrect going forward.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

Same here. I went through the questions and the 1/3 is not reflected on 1040 5b (403b withdrawal so not line 4b). When I look at the forms I find the 8915-s(smartworksheet) not 8915-f.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

@sandyb3 wrote:

Same here. I went through the questions and the 1/3 is not reflected on 1040 5b (403b withdrawal so not line 4b). When I look at the forms I find the 8915-s(smartworksheet) not 8915-f.

The Form 8915-F was included in the TurboTax online editions in the early evening of 03/23

The Form 8915-F was included as a software update for All the TurboTax desktop editions on 03/24

If you are using the desktop editions, update your software. Click on Online at the top of the desktop program screen. Click on Check for Updates.

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R in 2022

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

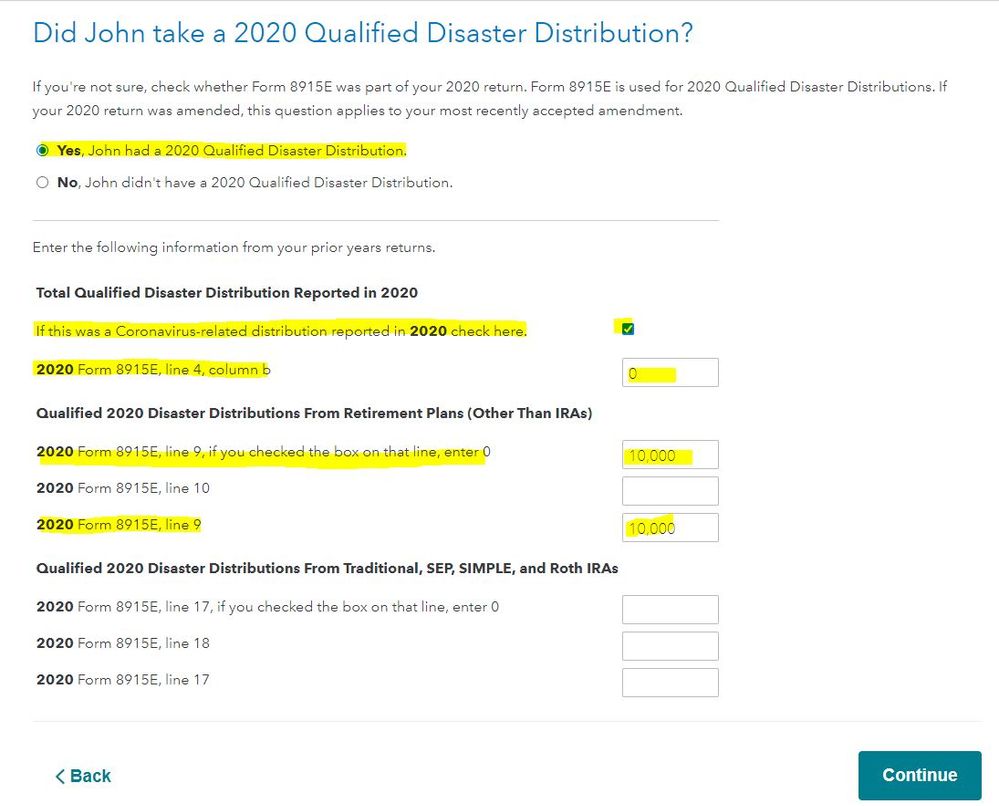

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Leave blank or enter a 0

This is not required on a Form 8915-F for a Coronavirus-related distribution

If the 2020 distribution was from an account that was Not an IRA

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

2020 Form 8915E, line 9, if you checked the box on that line, enter 0

2020 Form 8915E Line 9

If the 2020 distribution was from an IRA account

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

2020 Form 8915E, line 17, if you checked the box on that line, enter 0

2020 Form 8915E Line 17

Do not enter anything in the other boxes, leave them blank (empty) or enter a 0

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

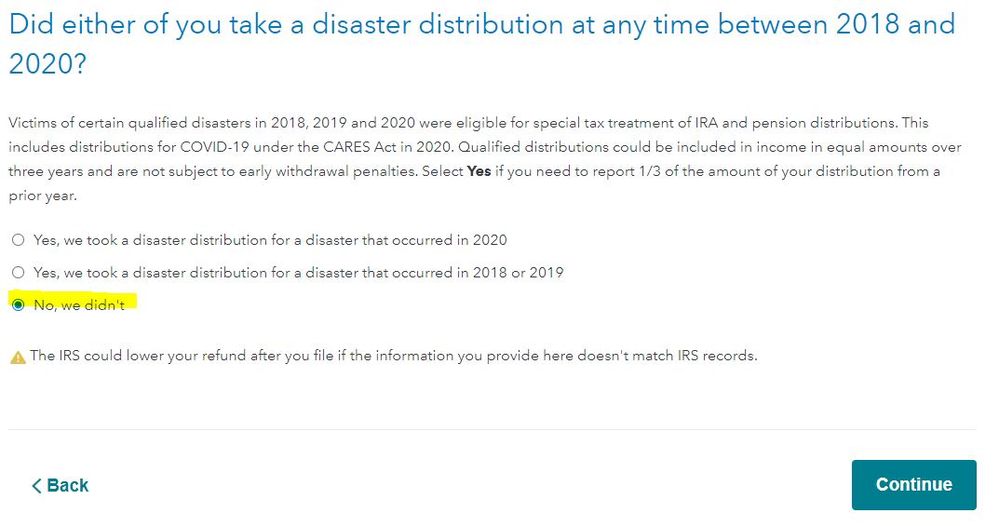

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

You should not receive the "Needs Review" in the Federal Review section if -

You Leave blank or enter a 0 in the box for 2020 Form 8915-E, line 4, column b

Screenshots from the online editions -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

Wondering if you ever were able to figure this out. We worked on this today but this does not change our estimated tax. Is there a way to see line by line before paying to file ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

I am not looking at the form right now, but on the first line where it asks if you checked the box, if no x in the box, then enter 1/3 of your distribution. Also enter that in I believe the third line. Should amend your return to account for that amount. You can then go into the “print or save returns “ and see your form 1040. The distribution will show on the first page.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

Yes, I solved it. When I put in my 1/3, Turbotax asks for the info from line 9 from last years (2020) 8915 in two spots. I had it only once. Mine is line 9 from the 8915 from 2020 due to being a 403b not an IRA. Turbotax immediately refigured my federal and state taxes. Hope you can solve your issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

Are you able to review the entries on the 2021 Federal 1040 tax return? You may view the distributions on the 2021 Federal 1040 tax return at Tax Tools / Tools / View Tax Summary / Preview my 1040.

You may view Form 8915-F at Tax Tools / Print Center / Print, save or preview this year's return / Include government and TurboTax worksheets.

Form 8915-F Part II distributions may be found on line 5b of the 2021 Federal 1040 tax return. The distribution is not reflected in box 5a.

See entries for Part II of Form 8915-F on lines 12, 13 and 15.

Form 8915-F Part III distributions may be found on line 4b of the 2021 Federal 1040 tax return. The distribution is not reflected in box 4a.

See entries for Part III of Form 8915-F on lines 23, 24 and 26.

I was able to report Qualified 2020 Disaster Distributions From Retirement Plans (Other than IRAs) in Part II and Part III from the 2020 8915-E.

I was able to generate an IRS Form 8915-F Qualified Disaster Retirement Plan Distributions and Repayments and report distributions.

- I did not repay any 2020 Qualified Disaster Distribution in 2021.

- I did not report a disaster distribution in 2017, 2018 or 2019.

- I reported No for the second question Did you take a disaster distribution at any time between 2018 and 2020? after the section Wages & Income and before the section Deductions & Credits.

@clowe22c

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

When I enter my 1/3 portion (second installment) for TY2021 I see my Federal and State tax liabilities go down. Should this be the case?

I am not seeing any info on my 2021 1040 line 5 a, 5b regarding the distribution or repayment.

Shouldn't I have to enter Distribution amounts from 2020? Where would this info go other than 1040 lines 5a, 5b? I don't seem to see any information passed from my 2020 return that I imported regarding the 1099-r and the 8915-E.

I followed the step by step as indicated.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

When I enter my 1/3 portion (second installment) for TY2021 I see my Federal and State tax liabilities go down. Should this be the case?

I would think the tax burden would go up or the refund would go down as you added the 1/3 of the disaster distribution to both tax returns.

I am not seeing any info on my 2021 1040 line 5 a, 5b regarding the distribution or repayment.

Form 8915-F Part II distributions may be found on line 5b of the 2021 Federal 1040 tax return. The distribution is not reflected in box 5a. See entries for Part II of Form 8915-F on lines 12, 13 and 15.

Shouldn't I have to enter Distribution amounts from 2020? Where would this info go other than 1040 lines 5a, 5b? I don't seem to see any information passed from my 2020 return that I imported regarding the 1099-r and the 8915-E.

I am seeing no reference to the original 1099-R distribution amount on the 1040, the 8915-F or the Qualified Disaster Distributions Worksheets.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

JamesG1, Thanks for getting back to me!

To clarify I am attempting to indicate the REPAYMENT of a Cares Act distribution ( the second 1/3 repayment). Tax liability in my eyes should stay the same. Not go up or down. If i wasn't REPAYING it then yes the taxes should increase. Why would the software make my taxes decrease when I'm only indicating to the IRS that I've continued on my repayment plan to avoid the increase in my income?

When I entered the info after the interview as indicated to fill out the 8915-F Turbo Tax increased my refund, or said another way it decreased my tax liability. Why would that be?

There is not entry on either line 5a or 5b on the 1040. Why is the software not entering it there? Is this the reason my refund was increased? How is the software not filling out my 1040 correctly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

Your tax liability will be INCREASING, decreasing your refund. If you deferred the tax on your Care Act distribution over 3 years, you will pay the taxes on that 1/3 this year and then again next year. If you deferred, you did not pay the full amount of tax when filing last year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

Yes, your tax liability should increase (reducing your refund or increasing the amount owed.)

Make sure you are entering 1/3 of your distribution in two separate boxes on the 8915 form. I am not looking at the form right now, but on the first line where it asks if you checked the box, if no x in the box, then enter 1/3 of your distribution. Also enter that in I believe the third line. Should amend your return to account for that amount. You can then go into the “print or save returns “ and see your form 1040. The distribution will show on the first page.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CARES Act retirement distribution in turbotax software - penalty-free and paying 1/3rd

If you enter the one third of the distribution the tax liability increases, then if you entered the repayment you will see the refund increase or the balance due decrease. You will not see an entry on the Form 1040. Instead you will see your entries on Form 8915-F.

The refund should not be adjusted due to this entry itself. It is income in and then out so the refund meter shouldn't change as a result of this type of entry. When I test this my refund is adjusted accordingly, repayment increases my refund.

Review your return again, to see if something else is causing the issue. My images are shown below for assistance.

@Wolfeman84

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

diitto

Level 2

BillyWoolfolk

Returning Member

CRAM5

Level 2

fpho16

New Member

manwithnoplan

Level 2