- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Capital gain

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gain

Did they increase Capital gain tax for 2023 for information on 1099-Div and 1099-Int. I have had the same accounts for few years sometimes I pay few hundreds and sometimes I get a refund of few hundreds. This year I am paying in thousands don't know if I information is calculated correctly how can I check? The forms are imported from bank accounts directly to Turbotax to avoid errors. I have never paid so much in taxes I have my withholding for Zero and I file single. Is there something wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gain

Very wrong. 8949 not linking correctly to Schedule D,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gain

The capital gains tax did not increase for the 2023 tax year. I recommend you compare your totals on your Forms1099 (INT, DIV, B) to the amounts that were imported. You can view the amounts on page 1 of your Form 1040 in TurboTax Online as follows:

Sign in to your TurboTax account.

- Open or continue your return.

- Select Tax Tools from the menu (if you don't see this, select the menu icon in the upper-left corner).

- With the Tax Tools menu open, you can then:

- Preview your entire return: Select Print Center and then Print, save or preview this year's return (you may be asked to register or pay first).

- View only your 1040 form: Select Tools. Next, select View Tax Summary in the pop-up, then Preview my 1040 in the left menu.

If you have individual stock/bond trades, you could have some with no or an incorrect cost basis that needs to be adjusted. You might need to delete the forms you imported and try again, or enter them manually.

If you want to review your entire return you will need to pay for TurboTax and then you will be able to print your entire return or specific forms/schedules prior to filing. You will still be able to make changes prior to filing. Follow these steps to print a preliminary copy of our return in TuboTax Online:

- While logged in and working on your return, click on Tax Tools

- From the drop down menu click on Print Center

- Click on Print, save or preview this year's return

- On the next screen click on "Pay Now"

- You may be prompted to "Go to My Info" if you need to add additional information

- Submit your payment information and you will be able to print your tax returns

Note, you must pay by credit card in order print or preview your preliminary return. You will not be able to pay using your federal tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gain

What is 8949 is it a form? What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gain

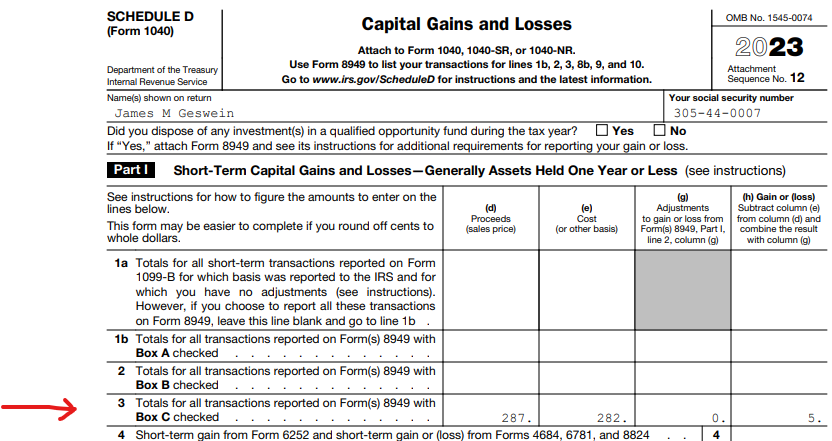

IRS Schedule D Capital Gains and Losses will report the summation by either long-term or short-term capital gains or losses. As an example, this Schedule D reports short-term capital gains with Box C checked.

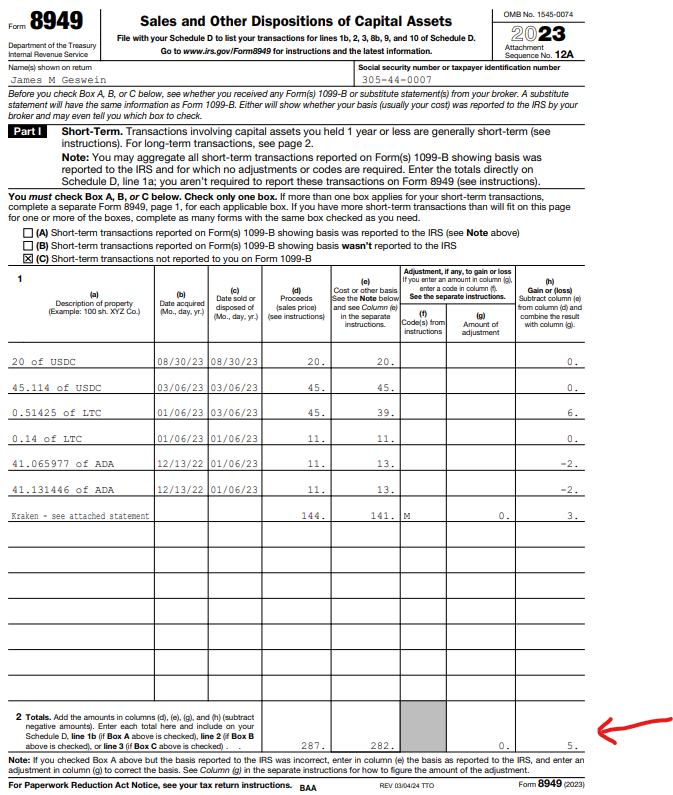

The detailed short-term transactions with Box C checked may be found on IRS form 8949 Sales and other dispositions of Capital Assets. See here.

In TurboTax Online, view and check the entries at Tax Tools / Print Center / Print, save or preview this year's return / Include government and TurboTax worksheets.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gain

nothing changed for 2023 in this regard. however, more income can push dividends that would have otherwise been taxed at lower rate into a higher beacket

There's a capital gain and qualified dividend worksheet where the tax computation is made. you may have to pay first to see it.

other possibilities are errors in entering your tax data or answering questions.

we have no access to your return so recheck everything.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gain

None of these boxes are checked. It seems I'm getting different questions to answer this year I thought Turbotax carries over from other years. There was a section I think in the dividend was asked for general, permitted and few others can't find it now in Turbotax. But Turbotax picked general so I left it. I have never been asked to answer these questions before.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

laberg23

New Member

Retiredgranddad

New Member

RamPDX

Level 1

brentharm

New Member

jxrangelshopi

New Member