- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

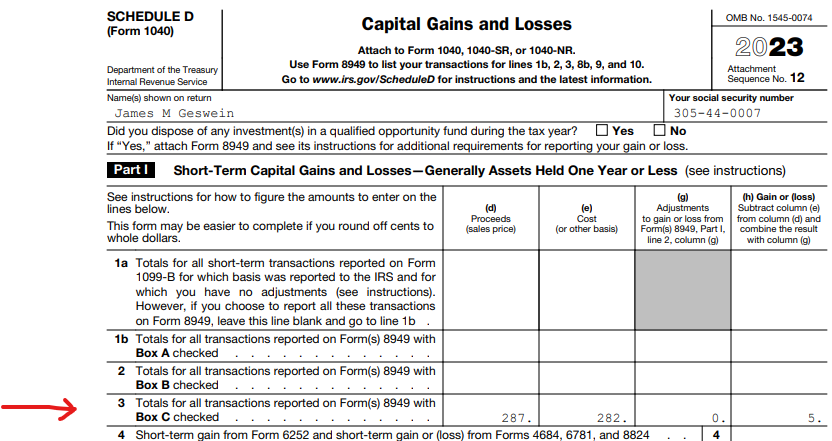

IRS Schedule D Capital Gains and Losses will report the summation by either long-term or short-term capital gains or losses. As an example, this Schedule D reports short-term capital gains with Box C checked.

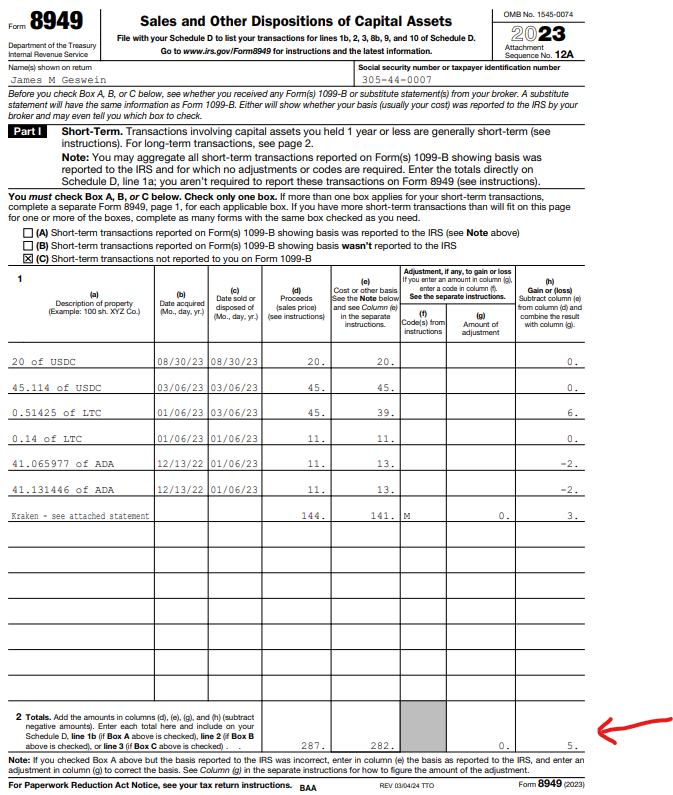

The detailed short-term transactions with Box C checked may be found on IRS form 8949 Sales and other dispositions of Capital Assets. See here.

In TurboTax Online, view and check the entries at Tax Tools / Print Center / Print, save or preview this year's return / Include government and TurboTax worksheets.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 7, 2024

1:49 PM