- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Bug on TurboTax or My Misunderstanding: I Bond interest taxed by state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug on TurboTax or My Misunderstanding: I Bond interest taxed by state?

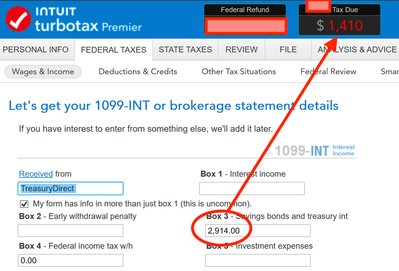

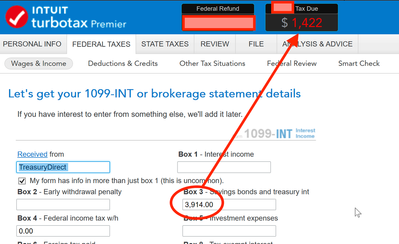

See screen shots - I bond interest should not be taxed by states. However, I am seeing $12 more tax if there is $1K more I-bond interest. The following screen shots are captured from TurboTax Premier. Is this an TurboTax bug? or is there extra tax that include Treasury bond interest for relatively high earners?

I bond interest $2,914 => Tax Due $1,410

I bond interest $3,914 => Tax Due $1,422

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug on TurboTax or My Misunderstanding: I Bond interest taxed by state?

Good eye. There is no state tax on I-Bond interest. Your entries look fine, but the state segment of TT hasn't yet recognized this as tax exempt. I would keep going and see if that changes. For my state there was a separate field asking for how much of my interest was from US Government obligations.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug on TurboTax or My Misunderstanding: I Bond interest taxed by state?

I've finished entering everything; actually I am ready to file my return barring this bizarre situation.

Below are more data points. seems TT is using a rate of 1% (0.6% - 1.5%).

- $914 => $1,399

- $1,914 => $1,404

- $2,914 => $1,410

- $3,914 => $1,422

- $4,914 => $1,427

- $5,914 => $1,439

Further observations

- TT does not calculate it as 'box 1 interest', as my State income margin rate is much higher than 1%

- The Fed tax is accurately changed based my Fed income margin rate while tweaking the numbers

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug on TurboTax or My Misunderstanding: I Bond interest taxed by state?

I would use the Forms view to see your actual state numbers. You might even need to save a PDF of your state return as it currently stands and look at the numbers there. If your state is like mine (Oregon), it takes your federal taxable income (AGI) and then subtracts certain income items. Look at what your state has listed for subtractions and what codes it gives for them on the accompanying state schedules. Is it subtracting the full amount of your I-Bond interest income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug on TurboTax or My Misunderstanding: I Bond interest taxed by state?

I am seeing the exact same problem. Editing Box 3 changes my MN Tax Due by 1% of the amount in box 3. How did you end up resolving this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug on TurboTax or My Misunderstanding: I Bond interest taxed by state?

The subtraction happens after additions and your deductions and exemptions. Look at your schedule M1M and verify line 14 shows your interest income. It is included on line 35 and goes to Form M1 line 7 to be subtracted. To see your forms:

- In desktop, switch to Forms Mode.

- For online:

- On the left side, select Tax Tools

- Select Print center

- Select Print, save or preview this year's return

- If you have not paid, select pay now.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug on TurboTax or My Misunderstanding: I Bond interest taxed by state?

And after you make any changes on your federal return you have to go through the state again for it to update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug on TurboTax or My Misunderstanding: I Bond interest taxed by state?

Thank you Amy, but I still think there is a problem. I can confirm that schedule M1M line 14 shows my U.S. Savings bond interest. I can also confirm that the total on line 35 of M1M shows up on Form M1 on line 7. In spite of this, I can see my MN Tax Due amount change when I edit the bond interest on the 1099-DIV. This shouldn't effect MN Tax Due, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug on TurboTax or My Misunderstanding: I Bond interest taxed by state?

Edits in the federal program and the refund meter are not good indicators since the state program isn't involved. You want your tax forms to be correct on the state side. As long as the actual refund is correct, you are good to file!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug on TurboTax or My Misunderstanding: I Bond interest taxed by state?

I figured out what was going on by comparing the state forms with and without the 1099-INT for the federal bonds. My higher income was resulting in a reduced MN standard deduction, and when the bond interest is added to the federal return, my income is a little higher, which made the MN standard deduction a little lower, which made my MN taxes a little higher... even though the full bond interest was being subtracted out.

So, I think it's not a TurboTax problem, it seems this is just how it works in MN. This seems wrong to me, since the bond interest is not supposed to be taxed by the state, but clearly MN is taxing me on it to some extent.

Also, the refund meters were working just fine all along and were updating correctly for both Federal and State any time I edited the 1099-INT fields.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug on TurboTax or My Misunderstanding: I Bond interest taxed by state?

I am receiving this exact same problem in CA. This for a child's tax return and I was trying to use TT online. I cannot get into the forms view (possibly my incompetence). The only 1099 form(s) are from this iBond sale and TT shows that the state tax is charging the same $12. Any idea?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug on TurboTax or My Misunderstanding: I Bond interest taxed by state?

Yes, TurboTax will automatically automatically identify the amount in Box 3 as an item to be subtracted from state income, when you enter interest from U.S. Treasury securities in Box 3 of Form 1099-INT. You may not see this immediately in the Refund Meter.

When you complete the state interview in TurboTax, you are asked a series of questions about any items that need to be treated differently or allocated among different states, and you will see the Box 3 amount listed as a subtraction from state income. You don't have to do anything unless you need to allocate the subtraction amount among different states.

Once you go through your state interviews, the savings bond interest should not appear in state taxable income.

For California returns, look at Schedule CA, Line 2, Taxable Interest, to find where the bond interest is subtracted.

Typically, interest from corporate bonds will be in Box 1, interest from U.S. Treasuries will be in Box 3, and tax-exempt interest from muni bonds will be in Box 8. Even if you don't have to pay income tax on the interest, you still need to include it on your Federal tax return.

- Box 1 of the 1099-INT reports all taxable interest you receive, such as your earnings from a savings account.

- Box 2 reports interest penalties you were charged for withdrawing money from an account before the maturity date.

- Box 3 reports interest earned on U.S. savings bonds or Treasury notes, bills or bonds. Some of this may be tax-exempt.

- Box 4 reports any federal tax withheld on your interest income by the payer.

- Box 8 reports tax-exempt interest and relates to interest-bearing investments you hold with state and local governments, such as municipal bonds.

See this TurboTax tips article for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug on TurboTax or My Misunderstanding: I Bond interest taxed by state?

Thanks for the detailed response and apologies for the reply delay. In this instance, the problem is in CA540. The i Bond interest is further complicated by the fact that this is a tax return for a minor. The tax is carried over from FTB3803. I can see this in CA540 b/c the tax appears on line 31, a direct carry over from FTB3803 (Turbo Tax checked the box indicating that it carried the tax over). However, when I look at FTB3803, this is parent's election to report child's interest and dividends, I can see that there are two lines for interest income: 1a is taxable interest income and 2b is tax-empt interest income. The instruction clearly states: "do not include [the 1b] amount in 1a." However, Turbo Tax, in copying over my child's w2, copied the *same* interest income into both 1a AND 1b. I do not know why TT does this, but given that my child _only_ has interest income from one source, the sale of US Treasury I Bonds, I do not believe that I have made any mistake about whether the interest is taxable at the State level or not. Yet, TT includes the amount line 1a and 1b in form 3803. Then, as expected, line 1b is ignored for purposes of computing State tax on dividend and interest income. The amount of tax computed on line 9 of FTB3803 is then carried over to CA540. This is particularly frustrating in that I cannot figure out how to edit forms directly in the online version of TT so I printed out the form(s) and scratched out the wrong numbers and hand wrote what I believe the correct numbers. This is doubly irritating b/c I did not carefully read the TT forum *before* starting my child's taxes. I should have purchased the disk, not the online version so that I could at least do my child's taxes on one copy. Instead, I paid for a separate online account for my child and had to edit and correct the work by hand myself. In this instance, I feel as if TT took my money for no value whatsoever. And the benefit of online filing was lost. B/c my child is a first time filer, I had to print and mail by hand regardless. Of course that is another problem w/ TT process flow. B/c State filing relies upon Federal filing, while CA State would allow a first time filer to pay electronically, the Federal does not. And if the Federal does not, the State cannot process. TT let me declare online filing and payment for the State even though the Federal required physical printing and mailing in a payment. Then TT created errors in my State filing so I had to go in and changing the filing and payment process was unintuitive. Again, a benefit of the disk over the online version. I think the lesson (for me, not necessarily for everyone) is to stick with the disk next year. This was actually my first year using online instead of the disk. And TT could not pull over my information from the prior year "disk". Sigh.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

4md

New Member

jjon12346

New Member

jstan78

New Member

mulleryi

Level 2

mulleryi

Level 2