- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Before I entered any information into my 1040, there showed a federal refund of $50,000.00. What is that for, or is this a TT glitch?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

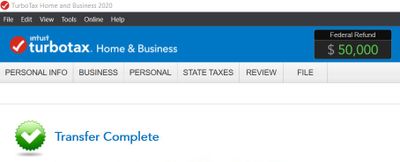

Before I entered any information into my 1040, there showed a federal refund of $50,000.00. What is that for, or is this a TT glitch?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Before I entered any information into my 1040, there showed a federal refund of $50,000.00. What is that for, or is this a TT glitch?

It is some weird browser or communication error. I have seen it both ways. Start out getting $50,000 or start out owing $50,000.

Use the Chrome browser. Clear cache, cookies, and browsing data using for all time option.

Then sign back into TurboTax and it should work correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Before I entered any information into my 1040, there showed a federal refund of $50,000.00. What is that for, or is this a TT glitch?

I am using the 2020 DESKTOP version of TT Home &Business. Before I entered any income or expenses, or even fill out the into my 1040, there showed a federal refund of $50,000.00. This refund appears the minute that the information is transferred from my 2019 :

Has anyone had this problem on the Desktop version? I was on the phone for 1 hour and 47 minutes with tech support and they had never seen this before, so they were no help. Thanks in advance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Before I entered any information into my 1040, there showed a federal refund of $50,000.00. What is that for, or is this a TT glitch?

Sometimes a carry-over credit can show up immediately on the next year's tax return.

BUT

Yes, 50,000 is a bit (waaaaaaay) too much for normal situations.

______________________

I have seen strange things like this though, for US folks working in an EU country. If the person filling in their tax return has their computer's regional settings set some EU country, the normal US monetary punctuation is reversed...and that leads to horrible number errors. A $500.00 carryover credit in US punctuation is 500comma00 in EU numerical punctuation, and the comma screws up the software and ends up as 50,000.00 US$$

$500?? A dependent tax credit? A home energy credit carrryover?

___________________________

Make sure your regional setting for your computer is set to the USA...no matter if you are now.

Or perhaps a really screwed up 2019 tax file....or the wrong one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Before I entered any information into my 1040, there showed a federal refund of $50,000.00. What is that for, or is this a TT glitch?

None of the suggestions apply to me. No children, haven’t been to Europe in 16 years and if there was a carry-over, it would not have been for any of the suggestions you made . I also save our return in 3 different places and used each of those 3 copies in attempts to make the refund go away. I really think it is a corrupted program, but at this point, I just am not sure.

The 1st comment I received from the community indicated that this had occurred in the online version ( he had seen both a refund of $50,000. and an amount due of $50,000.00) and this be corrected by closing and reopening in Chrome, which did not apply to me since I am not using the online version.

BTW, I had another programming error in my disk. None of my Asset entry worksheets transferred correctly (and this was on August 23.) This was eventually corrected by a TT update released on Sept. 3. I know this was a programming error by Intuit, so it stands to reason (my reasoning) that this is possibly another of their errors. And thanks for the attempt to correct my problem…

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ilian

New Member

jwallace19791123

New Member

in Education

cj5

Level 2

gavronm

New Member

veronicaalvarado155

New Member