- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Asset depreciation forms 4562 and 4792

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Asset depreciation forms 4562 and 4792

Due to lost tax records for my rental property acquired in 1981and sold in 2023, I am trying to recreate my list of assets depreciated. I made 12 line entries on the Asset Depreciation and Amortization report. Mainly appliances and flooring purchased in the 80s and 90s.

On form 4792, I only see 5 of the 12 entries. Also when looking at the Asset Entry Worksheet I see 3 'red' entries on 9 of the 12 entries; for "line 10, Prior year depreciation," " line 20, Date sold or given away," "line 50, recovery period." Also on 1 it is red for 'opt out of special depreciation 9h". The entry is 'no' and the 'yes box' is pink. I thought I made all the appliance and flooring entries the same. I neve saw any question regarding 'opt out of special depreciation'.

What am I doing wrong??

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Asset depreciation forms 4562 and 4792

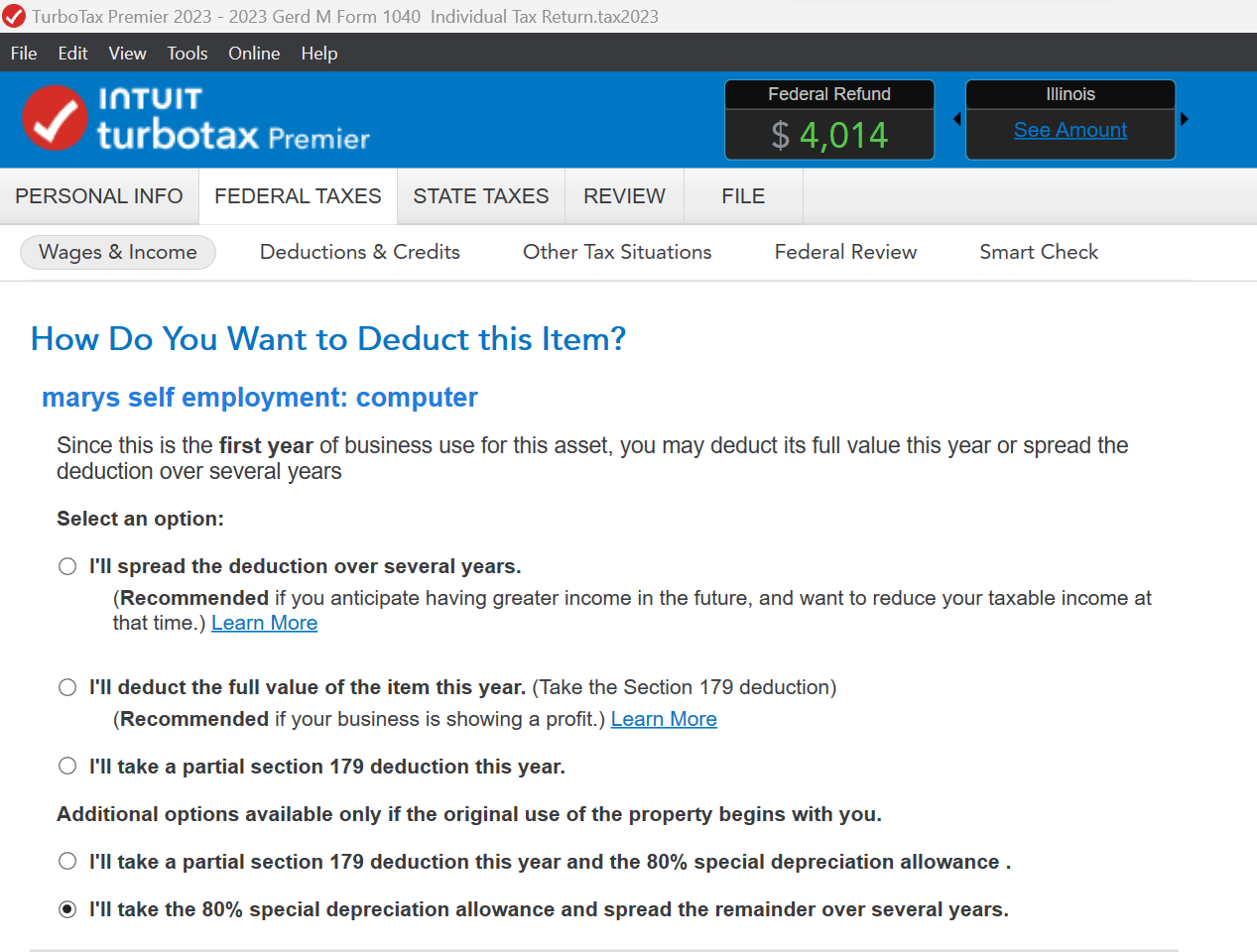

The question about 'opting out of special depreciation' appears when adding a new asset.

It could be that you elected a Section 179 deduction or a 100% Special Depreciation Allowance for the assets you are not seeing, or that they are now fully depreciated.

Here's more detailed info on How to Depreciate Property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

robert-king

New Member

user17709997215

Level 1

wbianna

New Member

jawabunga

Level 1

puls

Level 2