Yes. NJ Transition Renewable Energy Certificates (TRECs) payments are considered taxable income. The payments are taxable on your federal and state tax returns. Following @Irene2805's advice from this page, you'll enter this income using the following steps:

- Open your TurboTax account.

- "Take up where you left off."

- In the panel on the left, click Federal > Wage & Income.

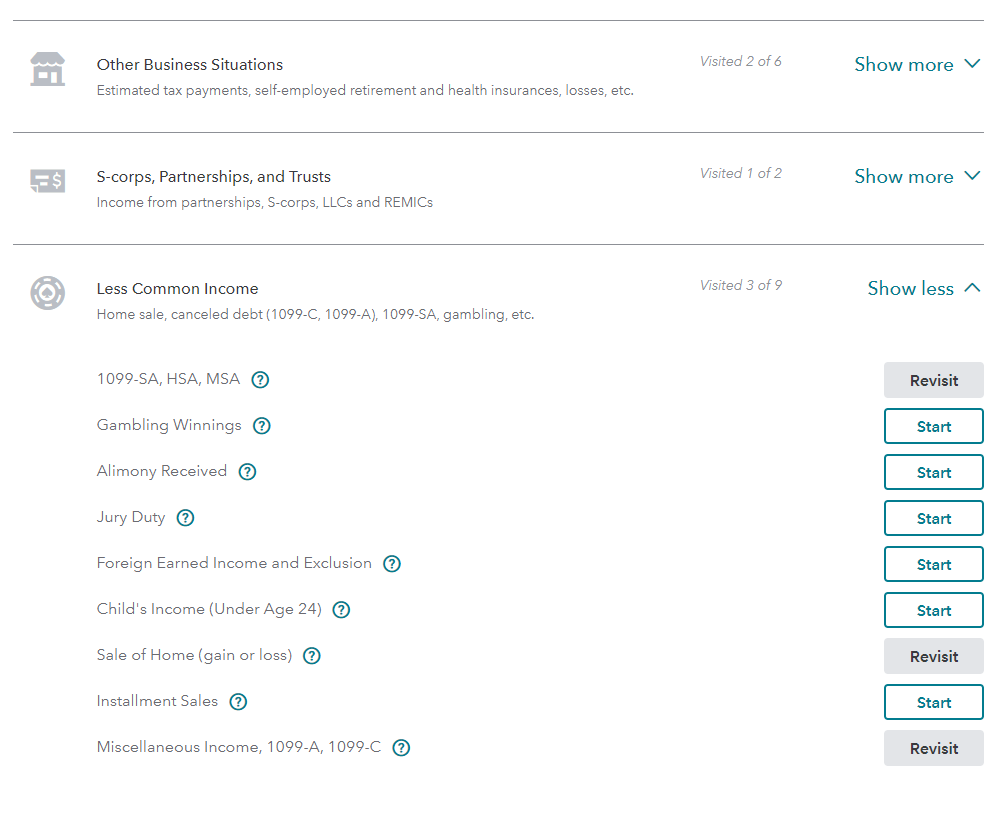

- Scroll down to "Less Common Income" > Miscellaneous Income > Start/Revisit.

5. "Other reportable income" > Start/Revisit.

6. On the screen, "Any Other Taxable Income," select "Yes" > Continue.

7. On the screen, "Other Taxable Income" enter the description and amount.

8. Continue > Done.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"