- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- AMT Special Depr Allow

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

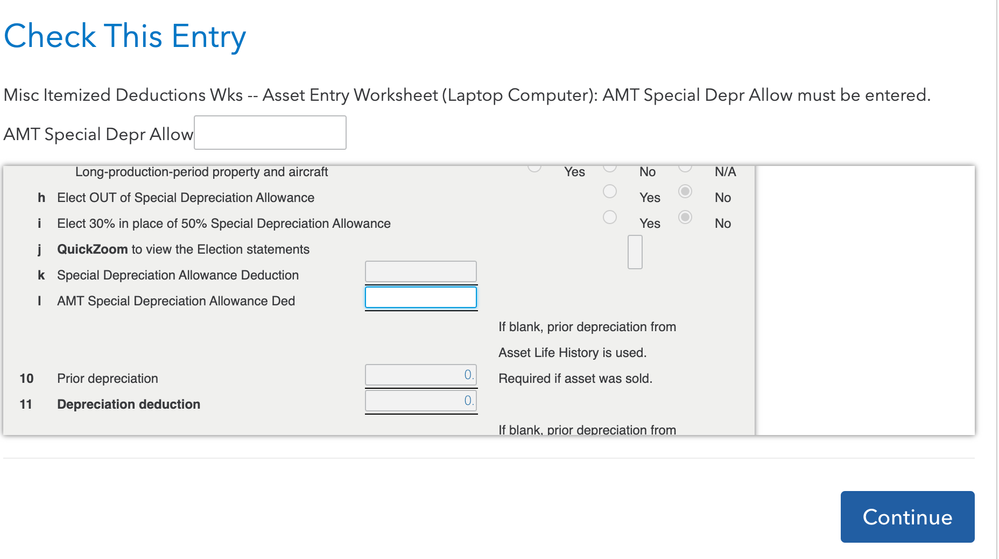

AMT Special Depr Allow

As I was finishing up my taxes I got hit with this banger. My best guess is that the value should be 80:

https://www.irs.gov/faqs/sale-or-trade-of-business-depreciation-rentals/depreciation-recapture/depre...

I bought a laptop in 2022. I remember adding it to my taxes last year. And I believe depreciation was setup over several years. This just popped up at the end of my tax submission in the review. It didn't ask me anything about the laptop this year. And I don't know where to find that info in TurboTax.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AMT Special Depr Allow

If you are using TurboTax Desktop, you can look at

AMT Report

in Forms

The last column has the AMT adjustments (if applicable) listed.

This form is not filed with your return, so if using TurboTax Online, you may need to pay in order to print the worksheets.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AMT Special Depr Allow

I printed out the tax forms. It includes worksheets for Federal Information, Personal, Spouse, Dependents. I don't see anything that references the laptop. I don't see anything that has "AMT" related to the laptop either. "AMT Report" has no results. "Special Depreciation" has no results. It is possible that is because this value is still showing as not valid in the review step. So maybe I need to put some made up value?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AMT Special Depr Allow

Is anyone able to assist? I would rather not pay $100 for expert assistance on top of the other fees just so someone can tell me why the software is not generating the specific worksheet in question as it should.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AMT Special Depr Allow

Can you look at your 2022 tax year return and see if you have Form 4562 with the Laptop listed or if the total amount of the laptop was expensed on Schedule C?

If this was added to your Schedule C for 2022, can you go to the business section of your TurboTax program and select Edit for the business. Scroll down to Business Assets and select START or UPDATE for Assets being Depreciated

Select "Yes, I want to go to my asset summary"

Is the Laptop listed?

AMT depreciation was most likely the same as regular, but I am not able to tell you what that was. You may have taken 80% special depreciation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

rodiy2k21

Returning Member

srobinet1

Returning Member

JR500

Level 3

Raph

Community Manager

in Events