- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Adjustment to Cost Basis on 1099-B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adjustment to Cost Basis on 1099-B

Hello, if one needs to adjust the cost basis from a 1099-B as gains are being reported on the W-2 as to not double count, what is the best way to do that in TurboTax? It seems the only way to adjust the cost basis is to select "Ill enter a summary for each sales category" which I see requires you to mail in your 1099-B to the IRS after e-filing. Is there another way to adjust the cost basis without having to mail in the 1099-B? Should one just select "Ill enter one sale at a time" and adjust the cost bases reported in Box 1e of the 1099-B? I believe doing this will not provide transparency on the adjustment being made so not sure what to do. Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adjustment to Cost Basis on 1099-B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adjustment to Cost Basis on 1099-B

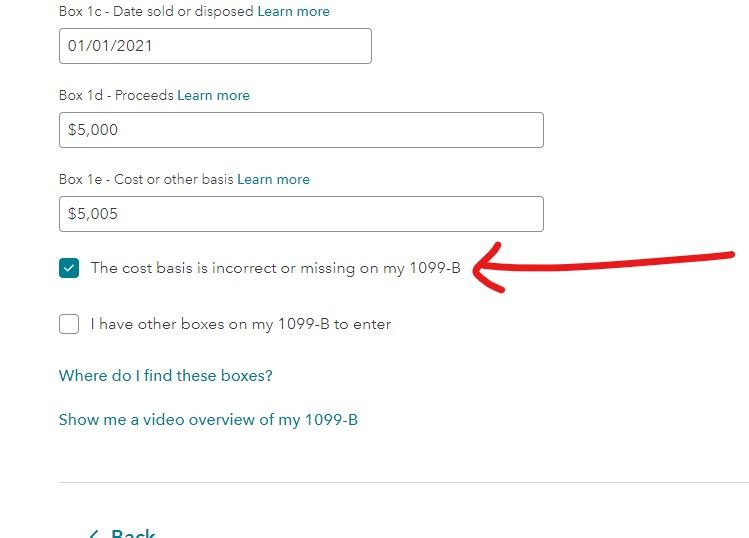

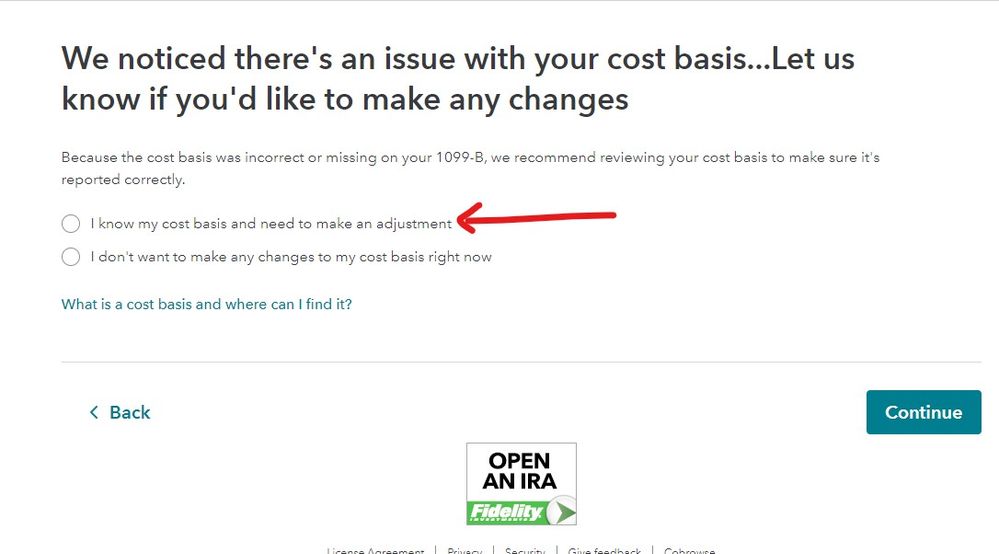

Should one just select "Ill enter one sale at a time" and adjust the cost bases reported in Box 1e of the 1099-B? CORRECT METHOD TO USE.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adjustment to Cost Basis on 1099-B

Thank you for the response Critter-3. If I do this, there is no place at put in an "adjustment" and associated "adjustment code" I read in other places you want to enter a "B" for adjustment code reason but if I use this method there is nowhere to enter this. I just want to ensure this is correct and won't result in additional issues. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adjustment to Cost Basis on 1099-B

Follow the screen instructions in the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adjustment to Cost Basis on 1099-B

Thanks you! I will try this out and let you know if I have additional questions. Appreciate the help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adjustment to Cost Basis on 1099-B

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Rudy_V

New Member

Sam979

New Member

gng795

New Member

Frenchy714

New Member

fireball11

New Member