- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Acquired date on 1099-B different than supplemental form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Acquired date on 1099-B different than supplemental form

I sold some RSU lots and 1099B seems to be reporting incorrect Acquired date for part of the sale.

Details:

- I sold a total of 576 shares,

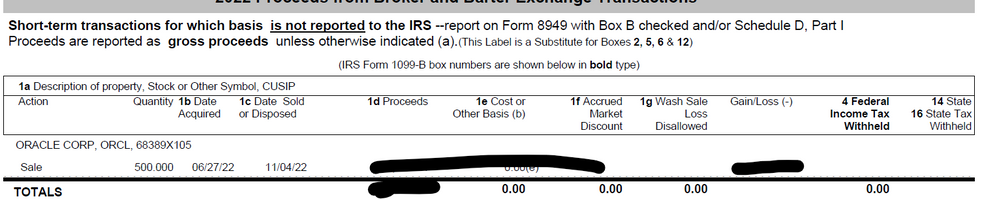

- 500 of those are reported under "Short term transactions for which basis is not reported to IRS"

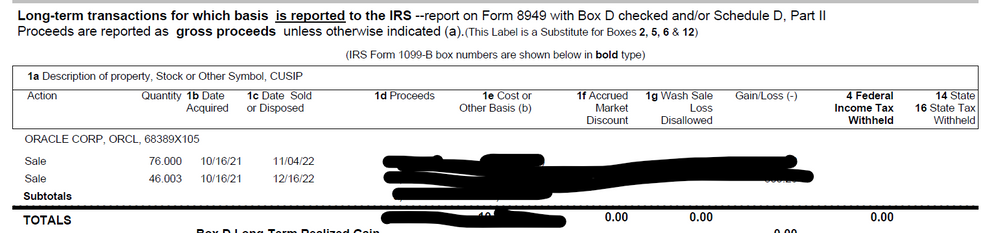

- 76 are reported under "Long term transactions for which basis is reported to IRS". This acquired date is likely incorrect.

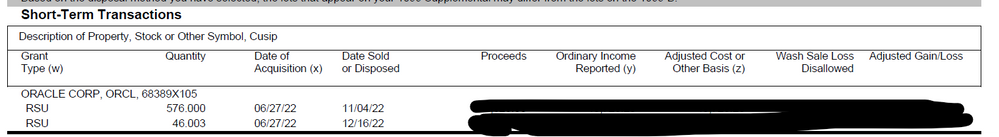

- The supplemental form has 1 entry for 576 shares listed under "Short term transactions.

I am not sure how to report these and where should they go on form 8949. Turbotax auto-import creates 1 entry with 576 shares.

1099 B short term

1099 B- long term

Supplemental section

I have the same issue with the sale of 46.003 shares. I am not sure how to report this correctly, as Fidelity reported the sale as long term but i need to change it to short term. Where should it go on 8949.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Acquired date on 1099-B different than supplemental form

I see RSU- which means you don't own the stock until it vests or you reached a milestone with the company. That date is your acquisition date and very likely your company did not tell the brokerage. Instead, the brokerage is going by what they can figure out.

When doing your taxes, use the correct dates and holding periods. Also, be sure to add the basis that was included on your w2 when the stock vested.

Since it is importing with information you need to correct, you can delete the import and enter the 500 as one transaction and the 76 as another. Continue entering correct dates and basis. Remember to include any transaction fees in the basis.

I want to urge you to create a financial notebook that is kept separate from your tax return. Keep it safe and each year, add your year-end statements from all your financial accounts plus a copy of your W2’s, your carryover information, and proof of your basis in your various investments. Digital or paper, you just need to keep the moving parts trackable.

Form 8949 page 1 is short term and page 2 is long term.

See:

- How do I enter Restricted Stock Units (RSU) sales in TurboTax Online?

- About Form 8949, Sales and Other Dispositions of Capital Assets

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Acquired date on 1099-B different than supplemental form

Thanks for your answer, @AmyC . I am still not clear on the holding period. Should I use the holding period fidelity reported to IRS so that the transactions show up the "correct" 8949 page, but then use the actual dates from supplemental form to ensure the tax value is correct.

As an example, for the 76 shares one. Should that be reported on long term section of 8949 because that is what Fidelity has reported to IRS, but I change the date Acquired to the correct one.

I hope that makes sense 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Acquired date on 1099-B different than supplemental form

The information on your Form 1099-B is reported to the IRS, but the Supplemental Information Form includes adjustments necessary to avoid overpaying taxes. You will want to use the information on the Supplemental Information Form to make any necessary adjustments to Form 8949.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Csherer

New Member

anonymouse1

Level 6

in Education

CG03

Level 1

tacopa

Level 2

Jmcauley54

Level 1