- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Acquired date on 1099-B different than supplemental form

I sold some RSU lots and 1099B seems to be reporting incorrect Acquired date for part of the sale.

Details:

- I sold a total of 576 shares,

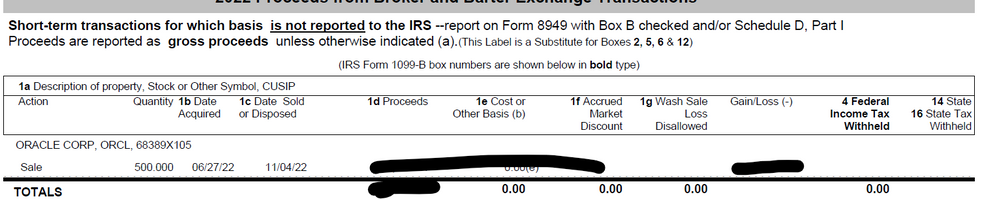

- 500 of those are reported under "Short term transactions for which basis is not reported to IRS"

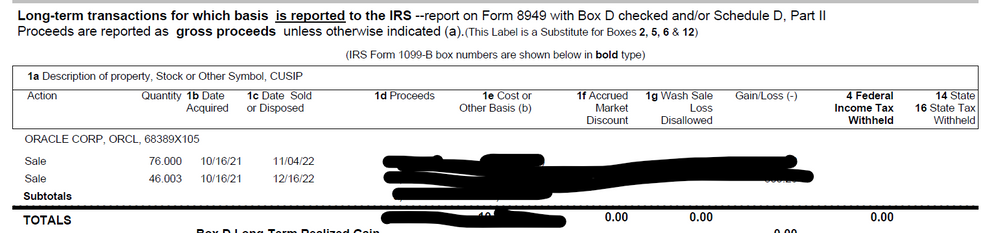

- 76 are reported under "Long term transactions for which basis is reported to IRS". This acquired date is likely incorrect.

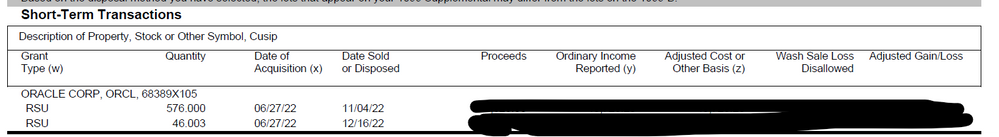

- The supplemental form has 1 entry for 576 shares listed under "Short term transactions.

I am not sure how to report these and where should they go on form 8949. Turbotax auto-import creates 1 entry with 576 shares.

1099 B short term

1099 B- long term

Supplemental section

I have the same issue with the sale of 46.003 shares. I am not sure how to report this correctly, as Fidelity reported the sale as long term but i need to change it to short term. Where should it go on 8949.

Topics:

February 27, 2023

11:23 AM