- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 529 Rollover to Roth IRA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 Rollover to Roth IRA

Although a rollover from a QTP/ 529 to a Roth IRA that meets the Federal criteria is exempt from Federal tax, some states do tax the distribution. In PA, the PA legislature passed a bill to exempt rollovers made after July 10, 2024. My son's rollover was made (unfortunately) earlier in 2024, so is taxable in PA. However, by not having the rollover reflected when inputing information to the Federal

form, it may not be correct on the relevant State return. We used the only approach we could discern to input the 1099-Q information correctly reflecting a Trustee- to-Trustee transfer, but not have it be categorized as a taxable distribution by answering the only related questions affirmatively, i.e., that it was a transfer to another QTP (as others have noted, TurboTax does not currently include an option to designate the Trustee-to-Trustee Transfer as from a QTP to a Roth IRA). Although this omits it as taxable income from the Federal return, this automatically characterizes it as exempt on the state return as well, which for some states (or situations as in the case of a rollover in 2024 made prior to July 10th for PA residents) will be incorrect. Any suggested strategy for reconciling these in TurboTax (am using the Premier version for my and my son's returns) to not have it reflected on the Federal return but added to the State return when appropriate?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 Rollover to Roth IRA

I am using Premier. I added a 109-Q as a trustee to trustee. I did these steps:

- Continue the PA return,

- Qualified Education Distributions showing the amount and stating that PA law differs from federal.

- Continue

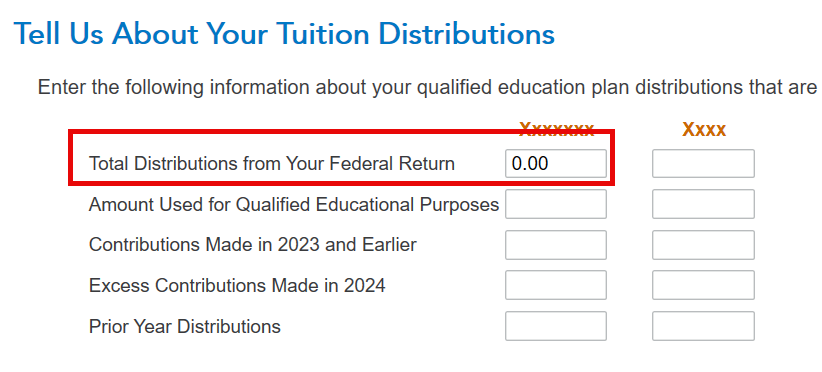

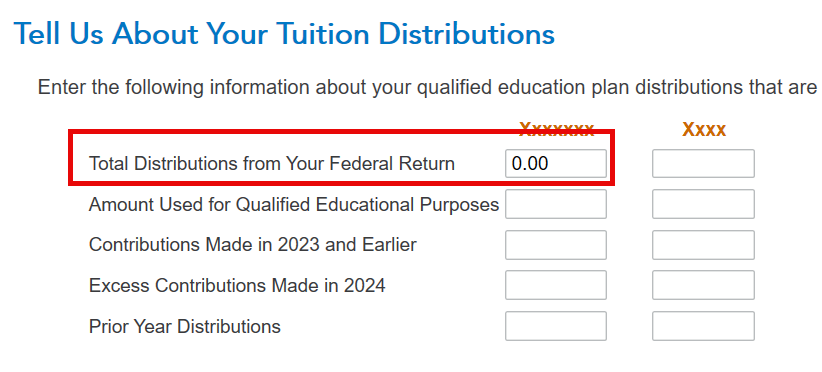

- Tell us about your distributions shows 0 so I change it to match the distribution

- I tried various numbers and found entries did not matter, so I left zeroes the rest of the way.

- The important part is the worksheet below that section.

- Since you are using premier, right click (for a MAC, command click) on the boxes f and g and enter the taxable amount.

- The tax bill goes up and you are done.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 Rollover to Roth IRA

I am using Premier. I added a 109-Q as a trustee to trustee. I did these steps:

- Continue the PA return,

- Qualified Education Distributions showing the amount and stating that PA law differs from federal.

- Continue

- Tell us about your distributions shows 0 so I change it to match the distribution

- I tried various numbers and found entries did not matter, so I left zeroes the rest of the way.

- The important part is the worksheet below that section.

- Since you are using premier, right click (for a MAC, command click) on the boxes f and g and enter the taxable amount.

- The tax bill goes up and you are done.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 Rollover to Roth IRA

How does the new law work? We submitted the 1099-Q INFORMATION but how do you offset it. Taxes simply went up?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 Rollover to Roth IRA

The new law:

- The federal is exempt so your tax did not go up there.

- PA you rolled before the new law so it is taxable. This increases your income and tax.

Different plans have different rules and PA 529 FAQ recommends checking with your plan for the taxable portion of your nonqualified PA 529 distribution.

Reference: PA 529 to Roth IRA Rollovers

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

vor17tex

Level 2

NMyers

Level 1

gomes_f

New Member

Brownshoes1992

Level 1

fpho16

New Member