No. Contributions can only be deducted when made by the account owner to one or more tuition savings account(s) established under the New York program.

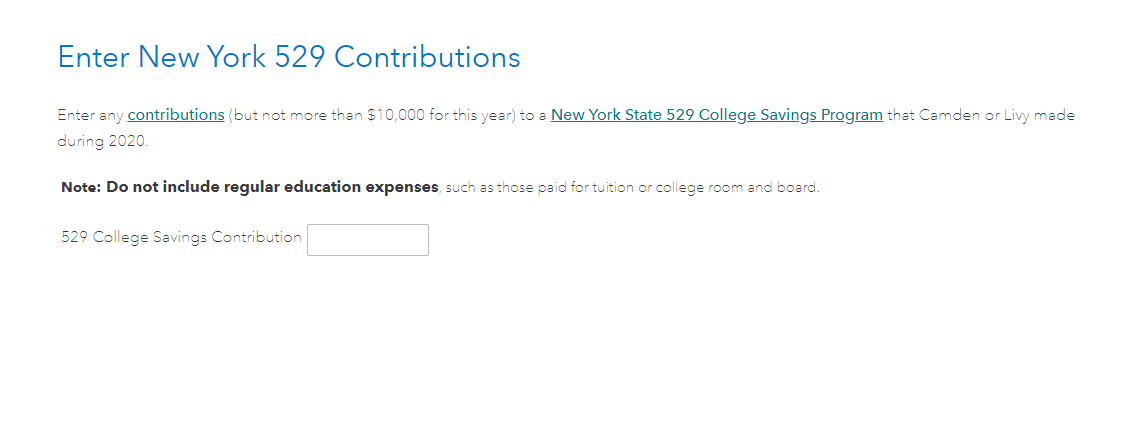

You can enter your 529 contributions on the page titled Enter New York 529 Contributions. You can access this section of your state return under Education Adjustments on the page Changes to Federal Income. I have attached a screenshot for additional guidance.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"